isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

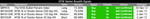

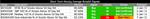

Attached is the updated major NYSE Bullish Percent and Moving Average Breadth charts plus the data table. It's still fairly green across the board this week, except for the short term moving average chart for the DOW which reversed back to a column of Os on the 7th. All of the Moving Average Breadth charts are still near the tops of their normal ranges and so risk continues to increase.

Attachments

-

$BPNYA_11-1-13.png18.3 KB · Views: 285

$BPNYA_11-1-13.png18.3 KB · Views: 285 -

NYA200R_11-1-13.png19.1 KB · Views: 261

NYA200R_11-1-13.png19.1 KB · Views: 261 -

NYA150R_11-1-13.png17.9 KB · Views: 253

NYA150R_11-1-13.png17.9 KB · Views: 253 -

NYA50R_11-1-13.png16.8 KB · Views: 281

NYA50R_11-1-13.png16.8 KB · Views: 281 -

market-breadth-table_11-1-13.png10.2 KB · Views: 853

market-breadth-table_11-1-13.png10.2 KB · Views: 853 -

NYA50R_line_11-1-13.png35.1 KB · Views: 850

NYA50R_line_11-1-13.png35.1 KB · Views: 850 -

NYA150R_line_11-1-13.png40.6 KB · Views: 300

NYA150R_line_11-1-13.png40.6 KB · Views: 300 -

NYA200R_line_11-1-13.png37.4 KB · Views: 245

NYA200R_line_11-1-13.png37.4 KB · Views: 245 -

ST_MA-breadth-table_11-1-13.png12.1 KB · Views: 856

ST_MA-breadth-table_11-1-13.png12.1 KB · Views: 856