Darktone examples are based on hindsight and we all know hindsight is 20/20 . Lets give a real live example for trading cars :

Trader X bought a car at 20K waiting to sell it at a profit , however the market price is diving 19K 18K didnt sell yet , 17K 16K and finally sold at 15K .

Yes in hindsight thats sound stupid he should have sold at 19K , even better he shouldn't have bought the car at 20k in the first place , but no one can trade in hindsight , current market price is 15K , and the future is unknown , price may reverse back to 20K or keep plummeting . Same when he first bought the car the market value was 20K and the future was unknown .

I repeat car value may reverse to 18K but no one knows , the market can do anything and car value may keep plummeting to 10K and never reverse . Criticizing the car trader after the event doesnt sound right .

Was his name? nero??

😆

I got a better one for you:

Dealer X bought the car at 20K hoping to sell at his marked price o 25K.

Idjiot Dealer walks in and says "thats nice, i give you 17K fo it".

"Fark off, i paid 20K you scumbag, im looking for 25K" says Dealer X

"Ok, if you get stuck I give you 18 fo it" says Idjiot

In walks the first customer

"Oooo just what if been looking for, but i think its worth 23K"

"Sorry, the price is 25K, no deal" says Dealer "

And so it goes on with the customers offers.

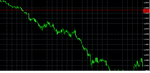

24K - 20K - 23K - 21K - 19K - 22K - 19K - 21K - 17K

😛 - 19K

Dealer X has been sitting on this car a while and the phones gone quiet, starting to sweat a bit cos its christmas and his son wants the yada yada with the kungfu grip.

He phones Idjiot Dealer.

"Hey bud, you know that car you said you liked 6 months ago" says Dealer X

"The pink one with the furry gear lever?" says Idjiot

"Yep, its yours for 18K mate" says Dealer X

"I give yo 15K fo it" says Idjiot "Things are o bit slippy round here atm" :cheesy:

Dealer X sells for 15K and pats himself on the back for doing a good job :smart:

👍