Hi TRO

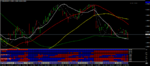

This is a EJ 30 min semi naked chart for the 5 trading days of last week

I use both horizontal of fixed levels as well as dynamic interim intraday levels not based on any particular traditional formula

When a dynamic level matches up with a previous days horizontal level - that will be a stronger S or R

The EJ fell approx 230 pips last week and in those 5 trading days - I had approx 14 levels of which 9 held more importance.

As an approximate that's a level every 12 -14 pips - with normally a minimum distance of 5 -7 pips and maximum 23 - 27 pips

That fits in perfectly with my scalp targets - ie quick non direction scalps - 5 -7 pips and then SSS -sweet spot scalping in time windows with targets of 10 -25 pips.

I have marked the stronger S or R areas were dynamic match horizontal with yellow circles.

In a normal week on the EJ - I would expect to average 5 scalps a day from just that pair - ie 25 scalps in the week - but with the market being dynamic - this is never set in stone - ie I might take 12 scalps on the EJ in one day if the pair moves 130 -150 pips

Even though the EJ was in a down trend over the 5 trading days - there would still be at least 8 - good buy scalps that would add up to over 150 pips - even though the net drop was approx 230 pips.

That's what many swing traders find difficult to understand - ie taking contra trades against the daily or weekly trend - but for me as a scalper as I have said before - a trend to me is any move that goes over 3 pips. That does not mean I chase just 3 - 5 pip trades - but the scalp buy that started late Thursday lasted over 7 hrs and moved up approx 80 pips - and excellent contra trade.

I will wait for any questions before I move on - but a key price level for me on Friday on the EJ was 138 30 -32

On all levels I allow 1- 5 pips - some can be within just 1 or 2 pips - whereas on major Monthly / weekly pivot levels you might have to allow 10 -15+ pips to know whether they are properly breached

Have not got a clue what the FIB or Murrey levels were on the EJ last week - and really I should have as knowledge is power - the more info I have the better - i am definitely into more information overload rather than keep it simple brigade - but that's just me - so I do respect the other view - and really its what you are happy with and what works for you as a trader

OK fire away with the questions - and hopefully I can answer them

Regards

F