And also, what long term LRs are giving you if you are looking at (from what i see) swing highs/lows breakouts for determining trade direction?

Alex

Hello F,

i have some more questions for you, if you dont mind...

1. Which levels do YOU consider the most important when scalping? I mean levels from 1m, 5m, 15m etc

2. What do you consider to be the breakout of the level? Close of 1m bar above/below? Or all LRs should be above/below level to take the trade?

3. do you trade fades (false breakouts of larger time frame s/r zones)? Good example from today when you told that from some level youll be looking for short scalps, but price went a little lower, false breakout of support and moved higher? when ill be at my pc ill post a chart to show what i mean.

4. What are your signals to exit the position? Are you looking at LRs to tell you when or by price action?

5. You told that you are using s/l not greater than 5 pips - dou you just set sl to 5 pips or it depends on price action? Or maybe above/below fast LRs - if price will break them probably we are on the wrong side anyway...

thanks in advance

Alex

Hi Alex

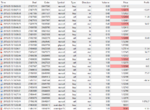

I will start with - the LRs I look at for a Price Structure bias on a 1 min chart - and then give you 2 examples later on via a 1 min and then 5 min chart. Main LR's for structure are based on LR setting over 200 - 300 and then 450 to 500.

The longest on my chart is marked in thicker red - with the other 2 in different dotted black.

These LRs give me structure - IE - If below price then price should rise. - if all 3 are above price then price should fall and in a bearish PS.

Don't forger the quickest 3 LRs from 9 to say 20 /25 are for quick scalps of 3 to 7 pips in either direction - whereas middle LRs - say 60 to 100 setting are for intraday swings of say 7 - 25 pips . If all 9+ LRs are all under or over price then thats a stronger move - normally you get them both sides of price.

OK

Q1 - For scalping I prefer a tick or 1 min chart. In fact if there was a tick chart on the market that could cover over a 15 -20 hr period on one screen - i would use a tick all the time.

All movements start from the first change of price and the tick is the most accurate to catch scalps and all moves that happen quickly and last say 3 to 20 mins anything from say 3 pips to 25 pips.

I do use other time charts such as 4 or 5 min and 10 and 30 min for the bigger picture - ie over last 2 or 3 days - but only because I cannot see it all off a 1 min chart.

I also use the weekly and monthly for seeing the bigger picture if I have a scalp thats gone to swing and as been going over say 3 days and is already up 150 -200+ pips - then I need to see the weekly and monthly view etc

Q2 - A breakout all depends on so many circumstances - not just a 2 or 3 pip move over or under a support or TL

It depends on PS and time of day and of course time itself along with volatility and the last 30 mins movements.

Thats why trading FX for me is not simple or easy - it's' really complex with so many things needing to line up and agree as clues.

Sometimes I enter 5 -10 pips before an important level and place stop in profit and just wait to see if it goes my way - othertimes I let the B0 happen and then enter on a pullback - all depending on the clues - every occasion can be different there is no simple black or white answer

I dont need all LRs under or over for scalps - just ideally 2 quick ones

Q3 - I trade every movement ideally above 7 pips - what ever the conditions or structure - but only when all my clues give me enough confidence to say its not a 50 /50 trade - i want ideally 80% + probability on my side - I know I can never be 100% correct on 1000's of trades anything from 65 to 85% is enough .

Q4 - I am different to 90%+ of all traders - my entries are far more important to me than my exits. I want a perfect entry and happy with just an average / good or Vgood exit - based yet again on LRs - PS - PA and time again.

I would prefer a 30 pip scalp than getting out early with just 7 pips - BUT - if I think it as more legs - I leave part stake on with stop in a small amount of profit and then move it up as it goes more my way

EG - this afternoon on the EU - I left a part stake on from 1317 and so happy to exit that one with around 50 pips - because even on part stakes - it like a 15 pip good scalp on 100% stakes with a RR of 3 +

I add by pyramiding and peeling on intraday trades and as long as i don't have stops out of any profits I am happy . Trading is never perfect - i have had a relatively good day - but missed out on many more green pips and money today - simply because of my own mistakes and not being around at certain KT's

Q5 - No - do not set hard stops at 5 pips - I babysit every scalp until I exit or am happy with a stop in profit.

I can have a hard emergency stop say 20 -25 pips away from action - but when I enter a scalp on one click - if it just goes 2 or 3 pips against me - i will pull it

Ideally I want to be in a profit within a minute or two maximum - sometimes I can be in profit within 15 -20 seconds of entering if I get my timing correct

I don't mind price pulling back on me by 4 or 7 pips etc - if i am up in profit - but not from entry.

Babysitting takes anything from 3 to 20 mins - but once I have a stop in profit - the pressure is off - ie cannot lose then .

On part stake 30% trades - with stops in profit I can have 3 or even 6 on at the same time - with no real pressure if all have stops in some profits - and also no excess exposure on your Capital.

Hope all that helps

Its easier if you are already or have been a scalper for 3 or 6 months - but as Major Magnun proved - he was no scalper before he copied my method but after about 6 months - he was well up to speed and could really read PA at what I call the "coalface" or noise - most periods of the day

Regards

F