Hello Forexmospherian. first of all thanks for this thread, interesting information here 👍.

Now i have some questions:

1. how do you determine your entry based on LRs? (i'm not talking here TL breakouts, HL, LH etc etc) do you wait for LR 9 to cross LR 14 (i don't know if you have used exactly those LR settings, but from the chart this is what i see)? Or just waiting for price to be above/below those 2 LRs?

2. You mentioned that first 3 LRs are used for scalping decisions, and the rest - for overall market view, so why you told that at 8.17 -21 am "in theory was the scalp buy again"? What was the reason for that assumption? I can see that price lost it's momentum, and was above 2 first LR's.

Thanks in advance

Alex

Hi Alex

I will relate your points to the EJ as that was the pair mentioned in my comment

Ok

1. Determining entries . - They are based on what I call a multitude of "clues" - not just one clue off time or LR's - but in fact off at least 4 or 5 clues - can be easily 5+ many times on a really nice AAA+++ scalp set up.

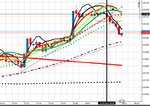

I need my quick 2 or 3 Lrs ( from LR 9 to 15 ) go either under or over price to show a change in direction commencing

If this is in a TW and near a KT - even better

I then look at the price structure of the session - based on my LR 1 min chart over last say 4 -8 hrs - ie I open my chart out to see the past.. With 9 or 10 Lrs the more under price the more likely price rises - and opposite the more over price

I will have interim levels - both dynamic of TL's and static off pivots or horizontal levels marked - they also need to line up with LRs and time etc

If I see the price structure of the session is changing ie like on EJ - from 4 30 am to 8 09 am UK time it was bullish - but after 8 09 am it became bearish and still is now under 134 00 - i will not always take every scalp

So that scalp buy opportunity from 8 17 to 8 21 am onwards - I ignored - as I still thought we would drop lower than a t 8 17 am

I could have taken it and made say 5 -7 pips - but I still favoured lower

Similarly at 8 31 and 8 51 am more scalp buy opportunities - both would have made 10 pips in fact the 8 51 am and 9 00 am ones worth over 20 pips -

BUT really after 8 09 am we have turned bearish - shown by the continuing LH's and LL's

If i was desperate for pips - and had not had a good first 90 mins of the morning from 6 30 am to 8 00 am - i would be scalping both ways - but for now I have prefered to stay with the EJ 30% sell under the 8 09 am price and its now over 40 pips lower

2

Yes my first 2 / 3 quick LRs said scalp buy at a KT and PA also said buy - and yes i could have made easily 5 -7 pips . In fact if it had carried on higher then I would have kicked myself - but actually at 8 17 am I still had a 30% buy stake on - so I was covered really.

Every trade entry I take - whether its a pure scalp for 5 -7 pips or ends up making 200 pips of a 30% stake left on with stop in profit is all based on my quick LRs lining up with interim levels and time and PA etc,

The trouble is I will never really know in advance on many scalps whether they will end up as just 5 pips or whether they could turn into 50 or 500 pips over say 3 days

Thats why I am no longer a pure scalper - but instead a short term intraday trader that is prepared to leave part stakes on many scalps with stops in profit and relax knowing what ever happens - i will either end up then with just a few pips win - or a nice larger win - that makes me a lot more money than the 70% part I exited as a pure scalp .

Hope that makes sense and will post a couple of EJ charts to show more next on PS - ( price structure ) and levels and KT's etc etc

That's why timing and entries are so important for me - I just dont want to get an entry wrong with a 15 -20 pip stop - and lose that amount - even if it goes 3 pips against me at entry - I want out ASAP

Good Trading to you

Regards

F