This is why I don't like "day trading". I don't like watching charts all day long. I only make trading decisions on the DOW at the end of the day after it has closed to confirm a signal. I prefer higher time frames. I can't get on with "minute" charts. My indicators seem to work better on the daily time frame.

I have a complete aversion to losing money so day trading is the only way that I can trade.

If the fundamental signs/sentiment were linked up to the technical indicators then what an easy job it would be!

Losses are inevitable but even after 25 years of trading I hate losses - as I believe that they are almost always avoidable.

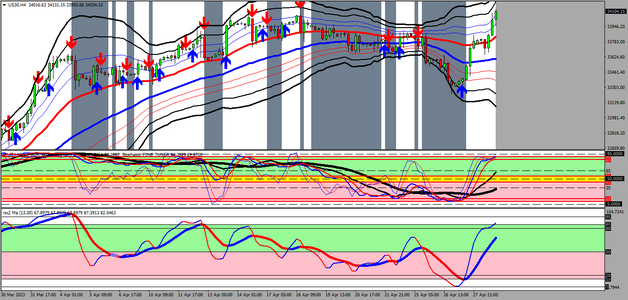

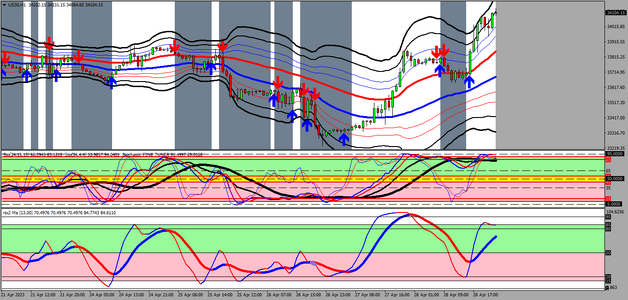

I have attached the 4hr (my signal entry chart) with the 15m chart (the chart I use when I have the time - but the 1m chart is used when I have little time).

The under chart indicators are multiple stochs on the top (longer term in black, shorter term in red/blue) and multiple RSI on the bottom (they give me divergence as well as entry exits when in the white areas).

On chart BBands using smma's (not sma's) and stochastic cross signals (arrows) - the background is when the CCI-13 crosses zero.

Each trader to their own system and NEVER change what works for you. The grass is NEVER greener on the other side of the trading field!

I do appreciate what you are sharing.

TEAMTRADER

PS - I have added the 1hr chart to show divergence so it is likely there is not much left for me in the move upwards on the Dow.