You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

kraven GTF you w@nk@

Sobe

Junior member

- Messages

- 43

- Likes

- 1

kraven GTF you w@nk@

I just want to state my intent to be on T2W. While I am never one to shy away from a respectful debate, there's really no place for this here. There is no blame, I just want a genuine thread where people of any level of "expertise" of the markets can join and share. But, first and foremost it has to be done in a civil manner.

I felt as though, in my trading career, I have gotten to the point where I can offer something to other traders, an understanding of how I view the currency markets using technical and fundamental analysis. With the retail forex market still in its neophyte stages, and rife with scams, providing insightful, sound, FREE trading advice is invaluable. Before anybody says anything, I am certainly not claiming a "holy grail" here. I take losses just like everybody else. However, my belief is the difference between winners and losers is a better understanding of risk, and certainly was the defining moment in my trading career. 👍

Sobe

Junior member

- Messages

- 43

- Likes

- 1

Yesterday's post on the EUR/USD

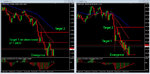

Here is the chart from yesterday on the EUR/USD where I discussed a reversal coming:

I was looking at the 1.2230 level as noted on the chart, however, it extended down to a low of 1.2177. As you can see today we've had a 200+ pip reversal on the EUR/USD. Great trading opportunity!!

This brings me to an important point:

View support and resistance as a range not a hardened line, or exact pip. Especially when dealing with volatile pairs (i.e. gbp/jpy).

As previously mentioned, I do not prefer counter-trend trades, however it doesn't mean I don't take them. I simply use a different risk model than trend trades. You just have to expect a "choppier" ride.

Here is the chart from yesterday on the EUR/USD where I discussed a reversal coming:

I was looking at the 1.2230 level as noted on the chart, however, it extended down to a low of 1.2177. As you can see today we've had a 200+ pip reversal on the EUR/USD. Great trading opportunity!!

This brings me to an important point:

View support and resistance as a range not a hardened line, or exact pip. Especially when dealing with volatile pairs (i.e. gbp/jpy).

As previously mentioned, I do not prefer counter-trend trades, however it doesn't mean I don't take them. I simply use a different risk model than trend trades. You just have to expect a "choppier" ride.

Sobe

Junior member

- Messages

- 43

- Likes

- 1

Sobe can you take a look at this crude set-up and advise please.

when it says "enter buy at the close of this bar" it means an imaginary bar where the green line is

Yes, is the answer to the imaginary green bar you have on your chart. You've got the idea!! Although, I would say the first entry was missed in the 0.8530/40 area the last time the M30 crossed the Zero Line and H1 and H4 were heading up.

I don't trade this pair, and I never have, so I don't feel like I totally understand the flow, but here is how I would look at it using my toolbox. Also, if you take a look at H4 and you Fib the recent move down there's not much room to the upside, and 21 and 55 ema's are there too. 0.8600/10-40 area would look the be resistance.

In response to going short with the M30 and H1 going down, sure. Run a tighter stop and look to take some quick profits would be my thought on that one.

Attachments

Sobe

Junior member

- Messages

- 43

- Likes

- 1

Thanks Sobe

Why do you use 21 and 55 ema's as opposed to others?

Can you check your PM's mate.

Personal preference is the best answer. They are also Fibonacci sequence numbers. My feeling on MAs is anybody can use any length and get results. I do not believe one is better than the other. The most important thing is they fit into your style of trading. For example, if you are looking for 10-20 pip trades, you might not want to use a 200 SMA. Something along the lines of 13 ema might be better.

There isn't much difference between a 50 and 55 if you plot them both you'll see. 200, 100, 50 are probably the most common MAs used by any trader in every equity market. These are certainly going to cause points of S/R and there's going to be lots of action in these areas. The 21 gives me an idea of how strong of a trend we are in. If the 21 and 55 are angled steeply I know momentum is strong and will likely continue.

Being that I'm a day/swing trader, I have found these length MAs to be perfect for me and my goals. I'm not looking for 10 pip moves. I'm looking for 50-150+.

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

Personal preference is the best answer. They are also Fibonacci sequence numbers.

here's your starter for ten:

how many trading days, on average over a year, are there per month ? 😴 😴

this thread is like the blind leading the moronic

Sobe

Junior member

- Messages

- 43

- Likes

- 1

here's your starter for ten:

how many trading days, on average over a year, are there per month ? 😴 😴

this thread is like the blind leading the moronic

Hi rathcoole_exile,

Thanks again for the comments. However, I'm not sure of the intentions? If you don't want to trade my methods then you don't have to. Clearly, it must have your interest, otherwise you wouldn't keep reading this thread.

It's kind of funny in a way. The first eight years of my career were spent in large corporations in the managerial and consultant capacity. Inevitably, there's always people like you in every company and apparently forum. The least favorite class I took during my MBA program was Organizational Leadership. However, it is probably the one I have used most.

So, if you are trying to anger me, you won't. In fact, it's important to have a contrarian point of view in the group, it is almost necessary. So, thank you!! :cheesy:

Sobe

Junior member

- Messages

- 43

- Likes

- 1

OsMA MTF with Alert

I added an alert to the OsMA MTF indicator. The first bar to close when crossing the Zero Line will send an alert.

However, the alert will always say the TF of the chart it is on. So if you are on an M30 chart and you have the H1 and H4 OsMA on the chart, it will alert when either one crosses the Zero Line, but it says M30 on the alert, because the indicators are on the M30 chart.

I added an alert to the OsMA MTF indicator. The first bar to close when crossing the Zero Line will send an alert.

However, the alert will always say the TF of the chart it is on. So if you are on an M30 chart and you have the H1 and H4 OsMA on the chart, it will alert when either one crosses the Zero Line, but it says M30 on the alert, because the indicators are on the M30 chart.

Attachments

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

Hi rathcoole_exile,

Thanks again for the comments. However, I'm not sure of the intentions? If you don't want to trade my methods then you don't have to. Clearly, it must have your interest, otherwise you wouldn't keep reading this thread.

It's kind of funny in a way. The first eight years of my career were spent in large corporations in the managerial and consultant capacity. Inevitably, there's always people like you in every company and apparently forum. The least favorite class I took during my MBA program was Organizational Leadership. However, it is probably the one I have used most.

So, if you are trying to anger me, you won't. In fact, it's important to have a contrarian point of view in the group, it is almost necessary. So, thank you!! :cheesy:

no mate, not trying to anger you and sorry to disrupt your thread.

it's just knobheads like kraven i don't like

Sobe

Junior member

- Messages

- 43

- Likes

- 1

A good day to think about Fundamentals

Well, we've had a strong day in the Euro today, clearly fundamentally driven:

Bloomberg Articles

Up until today, I have had a tough time buying the Euro, and have not been convinced of the Euro's debt issues and the ECB's ability to handle it. Despite every person I see on TV backing the Euro, to me it has just been rhetoric. I'm not sure why, maybe traders instinct I think finally we may have a significant move in the Euro.

Of course, today's move was on China's rhetoric of backing the Euro, but we already knew that, do you think they're going to sabotage their own investments. Let's not forget, how ridden with debt the US is, we can't ever forget that. It's just goes to show you how powerful and connected the US government is to big business, and its ability to keep to US debt out of mainstream media. I had a laugh the other day, it seems every day I do my news gathering I see the exact same headline, "EURO CRISIS." For those of you who have seen the movie Groundhog Day, you'll know what I'm talking about.

Here's an image of what I'm watching for tomorrow and maybe even next week, but as of right now there's only one thing for sure, things are volatile:

Well, we've had a strong day in the Euro today, clearly fundamentally driven:

Bloomberg Articles

Up until today, I have had a tough time buying the Euro, and have not been convinced of the Euro's debt issues and the ECB's ability to handle it. Despite every person I see on TV backing the Euro, to me it has just been rhetoric. I'm not sure why, maybe traders instinct I think finally we may have a significant move in the Euro.

Of course, today's move was on China's rhetoric of backing the Euro, but we already knew that, do you think they're going to sabotage their own investments. Let's not forget, how ridden with debt the US is, we can't ever forget that. It's just goes to show you how powerful and connected the US government is to big business, and its ability to keep to US debt out of mainstream media. I had a laugh the other day, it seems every day I do my news gathering I see the exact same headline, "EURO CRISIS." For those of you who have seen the movie Groundhog Day, you'll know what I'm talking about.

Here's an image of what I'm watching for tomorrow and maybe even next week, but as of right now there's only one thing for sure, things are volatile:

Attachments

Sobe

Junior member

- Messages

- 43

- Likes

- 1

How convenient!?!?!?!?!

In yesterday's post, I expressed my feeling of annoyance with the continued "EURO CRISIS" headlines, particularly centered around Greece. I think traders were starting to think the Euro could handle its crisis, and potentially have a little bit of a correction in its currency.

BUT, how convenient, as the title of this posts says, look at this article:

Spain loses AAA rating

Now, let me say upfront, I'm not much into the whole conspiracy theory thing, but doesn't it seem like somebody is just sitting with an economic destruction button somewhere. We already know the ratings agencies have a little "stench" to them from the collapse of the housing market and the ratings of mortgage-backed securities. And, it is no secret big business, bankers, and politicians are in bed together....do you see where I'm going there?

If the Dollar starts to decline, we all know what the Fed will be forced to do to interest rates, and that would really put a damper on this credit-fueled recovery...

They got a good 6 months out of Greece and its "DEBT" headlines. Now, one quick phone call over to Fitch on a Friday afternoon, right before leaving early for happy hour, BOOOOOOM, there goes Spain.

Like I said, sometimes it's just fun to think about things, but WOW, this would be a juicy one, wouldn't it??

In yesterday's post, I expressed my feeling of annoyance with the continued "EURO CRISIS" headlines, particularly centered around Greece. I think traders were starting to think the Euro could handle its crisis, and potentially have a little bit of a correction in its currency.

BUT, how convenient, as the title of this posts says, look at this article:

Spain loses AAA rating

Now, let me say upfront, I'm not much into the whole conspiracy theory thing, but doesn't it seem like somebody is just sitting with an economic destruction button somewhere. We already know the ratings agencies have a little "stench" to them from the collapse of the housing market and the ratings of mortgage-backed securities. And, it is no secret big business, bankers, and politicians are in bed together....do you see where I'm going there?

If the Dollar starts to decline, we all know what the Fed will be forced to do to interest rates, and that would really put a damper on this credit-fueled recovery...

They got a good 6 months out of Greece and its "DEBT" headlines. Now, one quick phone call over to Fitch on a Friday afternoon, right before leaving early for happy hour, BOOOOOOM, there goes Spain.

Like I said, sometimes it's just fun to think about things, but WOW, this would be a juicy one, wouldn't it??

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

how delightful, what a splendid way to introduce yourself to a new forum.

quite quite charming !

quite quite charming !

Ambrose Ackroyd

Senior member

- Messages

- 2,879

- Likes

- 287

Every time I see this thread, all I can think of is "Trading the Osama "

Sobe

Junior member

- Messages

- 43

- Likes

- 1

Every time I see this thread, all I can think of is "Trading the Osama "

The "terrorism" trade. Lol...

It's kind of interesting if you think about it. At least in the long term.

The United States defense and military budget, primarily used in the "War on Terror" has the potential to bankrupt the US. Sooner than later too.

I think the only question left is, what to buy?

Similar threads

- Replies

- 1

- Views

- 2K

- Replies

- 11

- Views

- 6K

- Replies

- 2

- Views

- 2K