Hi vegas,

A suggestion:

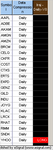

Core trading stocks need to have some parameters, and I think Grey1 has provided them. This is what I use to narrow down my core watch list for trading:

· Daily ATR(14) > $1.50

· Stock Price > $20, < $80 (there are exceptions, like RIMM until I get burnt LOL), lower priced stocks have limited upside (RMBS & MRVL have been recently removed from my list. Stay away from MSFT, INTC, CSCO, & EBAY & YHOO have narrow ranges also.

· Stocks with spreads > $ 0.05, I’d take out NVEC & RMBS imo. I actually like stocks with a spread of < $ 0.02 or 0.03, this is very important.

· I watched “PD” yesterday for a trade, and in my LVII, the prices levels (on the bid side) were apart by $ 0.30. This kind of LISTED stock scare the Chitt out of me. There probably are a lot of hidden bids, but with all of the tricks being played, I like to see bid support (going long), there are plenty of other stocks. After a glance at these wide levels, I quickly eliminated this from my list. So just become familiar with your stocks.

· Keep stocks that are being “buy outs” off your radar, they usually trade in a very tight range, like consolidation.

Don't know if anyone else does this, but in my LVII, I only have ECN's shown, no MM's, & no specialists, you can't ID them anymore. Also, with our trading style, we only care about Market's direction & O/B-S, & stocks' prices & volume.

FWIW, I also do a scan EOD, where I obtain the 40 greatest range stocks for the day (+ & - ) and pare them down to the constraints listed above to see if there are any new stocks to add to my list. Another add would be the gappers from the day’s open (quality stocks, they still need the daily ATR). Some gapping stocks are still active the next day. But by adding a few, one must continue to cut some out.

Nas