You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold 2011/12

- Thread starter dan1986ccfc

- Start date

- Watchers 30

Atilla

Legendary member

- Messages

- 21,035

- Likes

- 4,207

This week gold is likely to be kept down as US T-bonds are being auctioned. When this is over gold is going to continue up. The last week of December is treacherous.

Wishful thinking imo... Only place gold is going is down under...

I reckon Gold will finish 2013 below 1500

As for 2012 end it will try and push above 1800 if it can but beware of the bull trap.

Some people think it is still money... 😱

Just another commodity disposable to squeaky bubbles. Talk it up as much as one chooses to. Soro's sold at 1400s and now supposedly bought some. What joy. He obviously knows what his doing 😆

Past performance is no guarantee of future gains!

Beware:!:

Last edited:

YouAreNotFree

Experienced member

- Messages

- 1,295

- Likes

- 225

Plenty of acceptance above 1700 and at 1730ish level. The look below 1700 didn't last very long at all. Odds favour a move higher in the near future.

View attachment 150144

Broke out the same day, which has now failed.

The first warning signal to todays move was the break of Monday's balancing day to the downside after failing to close the gap just above Fridays high. I don't trade Gold, I daytrade Silver and banned myself from longs yesterday and today because of this action. The structure of Silver was a little more uncertain. Once we gapped down and opened below the point of last weeks breakout the conditions were primed for todays liquidation.

YouAreNotFree

Experienced member

- Messages

- 1,295

- Likes

- 225

This week gold is likely to be kept down as US T-bonds are being auctioned. When this is over gold is going to continue up. The last week of December is treacherous.

There's a whole load of US deposits which will no longer be gov guaranteed come Jan next year. Plenty of that is going to be bankrolling Uncle Sam. Watch those rates.

I bet virtually none of it goes into Gold though.

YouAreNotFree

Experienced member

- Messages

- 1,295

- Likes

- 225

The structure of Silver was a little more uncertain.

Look at Silver compared to Gold this last few days. Very interesting.

We know Silver is a much smaller market so maybe it's those shorter term, leveraged traders accounting for the difference. This is what I meant when I said Silver was looking more uncertain. It didn't look (to me) anywhere near as weak as Gold.

Last edited:

YouAreNotFree

Experienced member

- Messages

- 1,295

- Likes

- 225

We have tested below the 1700 level overnight.

For you Gold bulls, what you don't want to see is it spending very much time around here. The push down ON broke the 3 day balance following the Wednesday liquidation. Ideally for a bullish outlook it would be able to re-enter that balance and close unchanged or higher. The more time we spend at 1700 the more bearish the outlook becomes.

For you Gold bulls, what you don't want to see is it spending very much time around here. The push down ON broke the 3 day balance following the Wednesday liquidation. Ideally for a bullish outlook it would be able to re-enter that balance and close unchanged or higher. The more time we spend at 1700 the more bearish the outlook becomes.

Atilla

Legendary member

- Messages

- 21,035

- Likes

- 4,207

We have tested below the 1700 level overnight.

For you Gold bulls, what you don't want to see is it spending very much time around here. The push down ON broke the 3 day balance following the Wednesday liquidation. Ideally for a bullish outlook it would be able to re-enter that balance and close unchanged or higher. The more time we spend at 1700 the more bearish the outlook becomes.

1700 1800 are the battle lines. 1800 rejected and I suspect it will have another show at taking it out but fail yet again.

Waiting for the US trading 'cliff' Richard???? Where do these people come up with these names 🙂

Either way, imo with the recovery of US and EU markets gold will head down.

goldluvr

Junior member

- Messages

- 27

- Likes

- 2

Seasonally norms are for gold December to test yearly lows. I am not at all surprised nor will I be when it bounces off the 200 day ma.

Expect Indexes could see a significant 20% drop from these levels alos.

I have said before "be patient for prices below 200 day ma and sell your positions when we rise above.

Expect Indexes could see a significant 20% drop from these levels alos.

I have said before "be patient for prices below 200 day ma and sell your positions when we rise above.

YouAreNotFree

Experienced member

- Messages

- 1,295

- Likes

- 225

We have tested below the 1700 level overnight.

Ideally for a bullish outlook it would be able to re-enter that balance and close unchanged or higher.

Guess where the top intraday swing high was? Yep, the bottom of that 3-day balance. Had a little peak in which was swiftly rejected.

More importantly looking forward, there has been plenty of acceptance at 1700 in todays trading. Same goes for Silver at its support level of 32.93.

1700 1800 are the battle lines. 1800 rejected and I suspect it will have another show at taking it out but fail yet again.

Waiting for the US trading 'cliff' Richard???? Where do these people come up with these names 🙂

Either way, imo with the recovery of US and EU markets gold will head down.

See now you have me singing 'Gee whiz its you' and 'On the beach' ffs.

For me, the best scenario looking towards the downside would be a failed b/o above 1800 (ie out of this trading range.) That would likely cause plenty of long unwinding and new selling. I would expect significant shorting if we break below the current trading range, with the same for Silver.

Last edited:

Atilla

Legendary member

- Messages

- 21,035

- Likes

- 4,207

Guess where the top intraday swing high was? Yep, the bottom of that 3-day balance. Had a little peak in which was swiftly rejected.

More importantly looking forward, there has been plenty of acceptance at 1700 in todays trading. Same goes for Silver at its support level of 32.93.

See now you have me singing 'Gee whiz its you' and 'On the beach' ffs.

For me, the best scenario looking towards the downside would be a failed b/o above 1800 (ie out of this trading range.) That would likely cause plenty of long unwinding and new selling. I would expect significant shorting if we break below the current trading range, with the same for Silver.

Ahhh 'On The Beach' - another one of my favourites, but I think that's Chris Rae you thinking of there :idea:

I do agree with your analysis. In the absence of a break out from 1800 it's not going to be pretty for gold.

Right now I'm looking at a lower high on the charts at 1760 and overall if we finish below 1800 for the year I don't see what will drive this squaky bubble higher next.

Strategy to short the rises still in play for me. 👎

YouAreNotFree

Experienced member

- Messages

- 1,295

- Likes

- 225

Ahhh 'On The Beach' - another one of my favourites, but I think that's Chris Rae you thinking of there :idea:

Cliff Richard | On The Beach | - YouTube

Oh hell, im in my 20's and posting Cliff Richard videos. Even most most coffin dodgers think he's uncool. It's my Dad's fault, he's a fan and a result I grew up listening to him as a kid. I knew the words to nearly every song. Admittedly I like his and the Shadow's stuff, but I like just about anything really.

YouAreNotFree

Experienced member

- Messages

- 1,295

- Likes

- 225

It was certainly interesting watching them bitch over the 1700 level last week.

Briefly. 4 day balance. Prev daily high taken last two days. Peaked below the prev 3 day range on Friday and rejected. Closed above 1700 and at high end of 4 day balance. We couldn't sell-off on better than expected Friday jobs numbers either.

Look for it to move out of balance one way or another. We then want to see it hold above or below. Imo, it will most likely to be to the upside. Ideally I would want to see it gap higher tomorrow, fail to close, then push higher. If we open within balance we may well just have another rotational day, passing time until the Fed news.

Another promising scenario would be a breakout to the upside which fails (note the last failed b/o I posted about a few pages ago), especially as a result of FOMC 'dissapointment' on Wednesday.

Briefly. 4 day balance. Prev daily high taken last two days. Peaked below the prev 3 day range on Friday and rejected. Closed above 1700 and at high end of 4 day balance. We couldn't sell-off on better than expected Friday jobs numbers either.

Look for it to move out of balance one way or another. We then want to see it hold above or below. Imo, it will most likely to be to the upside. Ideally I would want to see it gap higher tomorrow, fail to close, then push higher. If we open within balance we may well just have another rotational day, passing time until the Fed news.

Another promising scenario would be a breakout to the upside which fails (note the last failed b/o I posted about a few pages ago), especially as a result of FOMC 'dissapointment' on Wednesday.

Last edited:

Blaiserboy

Well-known member

- Messages

- 391

- Likes

- 24

Atilla

Legendary member

- Messages

- 21,035

- Likes

- 4,207

It was certainly interesting watching them bitch over the 1700 level last week.

Briefly. 4 day balance. Prev daily high taken last two days. Peaked below the prev 3 day range on Friday and rejected. Closed above 1700 and at high end of 4 day balance. We couldn't sell-off on better than expected Friday jobs numbers either.

Look for it to move out of balance one way or another. We then want to see it hold above or below. Imo, it will most likely to be to the upside. Ideally I would want to see it gap higher tomorrow, fail to close, then push higher. If we open within balance we may well just have another rotational day, passing time until the Fed news.

Another promising scenario would be a breakout to the upside which fails (note the last failed b/o I posted about a few pages ago), especially as a result of FOMC 'dissapointment' on Wednesday.

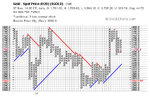

View attachment 150968

That last candle-stick looks like the bulls want to have another go - but size lacks conviction to me. Upward move pencilled in along with my limit orders to short at 1740, 1780 and another at 1820 with 100 SL for each.

Will be interesting to see how it turns out... 🙄

YouAreNotFree

Experienced member

- Messages

- 1,295

- Likes

- 225

Most likely scenario played out.

I'm guessing as nobody was trading today, they won't be tomorrow either. Volume was terrible, it is likely institutional money likely was shying away ahead of the Fed news on Wednesday.

The most important references are the 4 day balance/ 1700 level. Will the b/o hold up or not?

I'm guessing as nobody was trading today, they won't be tomorrow either. Volume was terrible, it is likely institutional money likely was shying away ahead of the Fed news on Wednesday.

The most important references are the 4 day balance/ 1700 level. Will the b/o hold up or not?

YouAreNotFree

Experienced member

- Messages

- 1,295

- Likes

- 225

Atilla

Legendary member

- Messages

- 21,035

- Likes

- 4,207

Fed Statement: Bernanke Speaks:

This has got to be bullish for gold...

It is questionable even if the Fed is buying $40 billion of mortgage backed securities? I've heard some reports suggesting it may be more like $25 bn. Yet I've also read it to be $80bn. Do people really know. $80 bn includes $40 bn TBills.

Compared to $4 Tn of debt it really is small fry - especially in light of improvement in the housing market and the economy.

People very desperate to talk gold up. Look at the charts and attempts at 1800 look like distant thunder claps. Can you smell the rain in the still air. Calm before the storm before gold sinks imo.

Been months since the ECB announced their Bond buying program and who's in the queue?

Niemand! :whistling

QE ain't what it used to be.

Too true..

Is there anything left to trade ... ?

YouAreNotFree

Experienced member

- Messages

- 1,295

- Likes

- 225

Can you smell the rain in the still air. Calm before the storm before gold sinks imo.

Speaking of moisture, Peter Schiff was close to tears on his radio show today😆

He embarked on a lengthy diatribe about the failure of Gold and Silver to rally following the Fed details.

'Dumb 'this, 'stupid' that, 'hyperinflation' the other. He even mentioned for the first time ever (that I have heard- he always dismisses this conspiracy theory) that it could well be manipulation. Oh the stench of desperation😆

Bore off Peter mate, I'm not listening to your show anymore. It's the same old crap over and over.

Last edited:

Similar threads

- Replies

- 4

- Views

- 4K

- Replies

- 1

- Views

- 839