PitBull

Established member

- Messages

- 620

- Likes

- 59

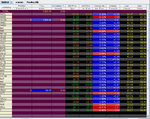

Sector Moves

I always like to study the sectors as this gives clues as to where institutional money is flowing. Now the 1st quarter window dressing is done, fund managers will be looking to make use of assets or not for the coming quarters. Even though the old maxim "sell in may and go away" applies there are two sectors that could be setting up.

First is the $SOX. As I said earlier on the board it broke a critical level a week back and tested the breakout level yesterday, running the stops and then closing right on the breakout level, making a nice hammer.

Stocks in the SMH ETF are:

ADI, ALTR, AMAT, AMD,AMKR,ATML,BRCM,INTC,KLAC,LLTC,LSI,MU,MXIM,NSM,NVLS,SNDK,TER,TXN,XLNX

Second is the BBH (Biotech's): Just breaking out of consolidation.

Notable stocks in the BBH ETF are:

AFFX, ALKS, AMGN,AMLN, BIIB, CEGE, CELG, CEPH, CVTX, DNDN, GENZ, GILD, ILMN, IMCL, ISPH, IVGN, MEDI, NUVO,TEVA, VRTX, XNPT

So it could be worthwhile tracking some of the bigger names to day trade or swing trade.

Good trading

I always like to study the sectors as this gives clues as to where institutional money is flowing. Now the 1st quarter window dressing is done, fund managers will be looking to make use of assets or not for the coming quarters. Even though the old maxim "sell in may and go away" applies there are two sectors that could be setting up.

First is the $SOX. As I said earlier on the board it broke a critical level a week back and tested the breakout level yesterday, running the stops and then closing right on the breakout level, making a nice hammer.

Stocks in the SMH ETF are:

ADI, ALTR, AMAT, AMD,AMKR,ATML,BRCM,INTC,KLAC,LLTC,LSI,MU,MXIM,NSM,NVLS,SNDK,TER,TXN,XLNX

Second is the BBH (Biotech's): Just breaking out of consolidation.

Notable stocks in the BBH ETF are:

AFFX, ALKS, AMGN,AMLN, BIIB, CEGE, CELG, CEPH, CVTX, DNDN, GENZ, GILD, ILMN, IMCL, ISPH, IVGN, MEDI, NUVO,TEVA, VRTX, XNPT

So it could be worthwhile tracking some of the bigger names to day trade or swing trade.

Good trading