Tim my man

My daily target is not a fixed amount,, In fact if you correctly adjust your postions size the target must be a function of the equity curve, In another word if the equity curve rises then the target increases and visa versa.

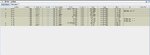

I expect an average of .75% to 1% return daily . This sum is between $1750- $2000

There is a Monthly threshold in my equity curve ceiling ( I take profit when the threshhold is reached pushing the curve back to 20 period back ) ,, The Profit is then transferred to my LONG TERM PORTFOLIO for LONG TERM INVESTMENTS) ,,

The reason for taking profit every month is

1) I am a fundamentalist more than a technician hence going for long term buy /hold

2) it is mathematically possibe( but only mathematically ) a day trading account to out perform a BUY /Hold Account,, This is not an easy task and most traders fail to do so .

Today I only made $604 before cost. AN incredibly difficult day for me ,,

GREY1 ALSO SHORTED LRCX .. THIS IS AN OVER NIGHT TRADE .

PS:-- by the way TIM u have been on this BB since years and years ago . You must be doing some thing right to have survived the market ,, Keep up the good work and always say MUCHAS GRACIAS when you win .. LEE says it I say it lets all say it lol