Hi guys,

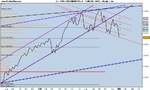

Here is my take on the charts for this week. You probably recognise it's my road map to the galaxies during 2008. :cheesy: So far so good. We are on target.

I've added couple of more down trending lines and according to MACD and RSI the selling pressure isn't off yet. I make 12,722 one of my 38% Fib retrace levels. I think we may have some more falls before support kicks in as MACD and RSI is yet to turn up.

Also, the H&S formation is clearly visible now. This has been in development since last year and now it's so clear and it is one of the most reliable text book charts that plays out to perfection.

Hence, a breach of 12800 in it's down trend followed by a bounce to 13000 that fails would be H&S playing out to it's conclusion imo. I would then see support at 12570 and 12170 on the bigger picture.

In summary I think 13000 has been breached so this week the previous lows likely to be tested again.

On a Fundamental level the big question is we all know US is heading for a recession (elections or not). Will the Asian rise in disposable incomes spur US and European exports? US exports yes as the dollar has fallen but European ones I don't think so.

Even if there is revival in the US economy it will be at the expense of inflation as Europe is not playing the same game. Hence, the US is in a very tight spot. In fact it is a dead end road. Who ever wins the elections is jumping out of the frying pan and into the fire.

Sooner or later even China once it's obligatory expenditure is completed will face inflationary pressures and a long over due correction. Thus my view is global growth will slow down possibly stall. I hope it will not be negative as that will have a disasterous domino effect making the recession deeper and more prolonged.

Good trading everyone... 👍