You're trading it on the CME future but measuring it on the Forex. And that's the first problem. The second problem is: what if you don't have the right forex data for some reason (even timeframe alone affects it)? I mean, if you just move the close by one hour you're going to get totally different pivots. I think your best bet is download data from the very data provider you'll be using to trade the system, which is IB. Then you should just pretend you'll trade the forex and forget about getting the signals from one chart and executing them on another. But when you'll execute it live, you will still need to get the pivots from the forex rather than from the future.

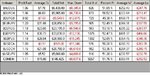

One more problem is getting the formula right. I am bad with formulas I know. And this may be a small problem for anyone else. But I don't even know what formula IB uses to calculate them. What I do know is that they seem to work on their chart (forex data). Let me show you the last 2 weeks for example (no hindsight, because I still haven't even looked at them):

I marked with red circles where they seem to have worked.

If you can get past these problems, I am pretty sure you can get them to give you an edge, regardless of how small it is. You see, i think that pivots are best when automated because patience is the most important requirement to trade them.

Maybe it's time for me to get involved in this before you get too far. I would like to be there when our share of profits materializes. Would you like to work on this together? On msn or skype?

Steps:

1) Download the last 2 weeks of data from IB and devise a formula to draw pivots on them, so that it matches completely the lines drawn by IB on the chart. The data we need is on a 5 minute timeframe. See example below:

2) Once we have a pivot formula that matches the chart, we can start the back-testing process and find a profitable formula (always all on forex data).

3) Once we have a profitable formula we download another 2 weeks from IB and see if it works on them. Then we start the process of automating the system, which will vary depending what platform we use.

4) Once we start making the money, we start the wiring process. You wire it to me, and I wire it to Gladiator. He then wires it to whoever told him that pivots work. In case of losses, we both sue Gladiator.

Ok, I am starting by downloading the data, since you're not replying.