Playing the FTSE Single From Friday

The following data uses May Ftse levels since as an option trader these are most relevant to me. Just add or subtract the basis if trading cash, or the difference between the May and June basis if trading June FTSE.

e.g Cash: 4117

May: 4095

June: 4075

=> Add 22 if trading cash

Subtract 20 if trading June

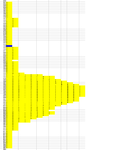

As the FTSE trades from 8.00 am 'til 4:30, it is most amenable to the standard 30-minute Market Profile charts.

The profile shows 2 distinct Value Areas on Friday - indicating a trend day.

As discussed with the 240-minute analysis for ES, these days leave behind fadeable scalping levels.

There are 2 from Friday in May Ftse: 4070 and 4061.

Today's opening range has found a low at the 4070 single, also forming a Pin off this level. In my opinion, these are best played with limit orders and tight stops as they are initially countertrend trades.

Trade management wise, I would take off the bulk as a scalp and then use a trailing technique until close with the remainder.

The following data uses May Ftse levels since as an option trader these are most relevant to me. Just add or subtract the basis if trading cash, or the difference between the May and June basis if trading June FTSE.

e.g Cash: 4117

May: 4095

June: 4075

=> Add 22 if trading cash

Subtract 20 if trading June

As the FTSE trades from 8.00 am 'til 4:30, it is most amenable to the standard 30-minute Market Profile charts.

The profile shows 2 distinct Value Areas on Friday - indicating a trend day.

As discussed with the 240-minute analysis for ES, these days leave behind fadeable scalping levels.

There are 2 from Friday in May Ftse: 4070 and 4061.

Today's opening range has found a low at the 4070 single, also forming a Pin off this level. In my opinion, these are best played with limit orders and tight stops as they are initially countertrend trades.

Trade management wise, I would take off the bulk as a scalp and then use a trailing technique until close with the remainder.