You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

one more thing on the run.........if you notice all my Charts are based on taking the USDGBP core chart....then hiding it completely and enlarging the Indicator tothe exclusion of all else !

I do this to ensure the feed is consistent verses potentially the "slower" feed pairs? (eg CHFJPY)

If I need a Chart I bring it in seperately alongside the core Indicator Charts

we need a metatrader Guru to say if this is necessary.....also you may see that my charts are an hour behind verses GMT (no idea why ??) - also when I publish the Forex vs Gold/Crude/Equities Indicators this timezone/Feed stuff becomes even more critical as they are not the same Trading open/close periods to Forex

but then nothings perfect !

Neil

I do this to ensure the feed is consistent verses potentially the "slower" feed pairs? (eg CHFJPY)

If I need a Chart I bring it in seperately alongside the core Indicator Charts

we need a metatrader Guru to say if this is necessary.....also you may see that my charts are an hour behind verses GMT (no idea why ??) - also when I publish the Forex vs Gold/Crude/Equities Indicators this timezone/Feed stuff becomes even more critical as they are not the same Trading open/close periods to Forex

but then nothings perfect !

Neil

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

think I can see where you are !

Hi Ivan

before I disapear again trying to keep this going.....

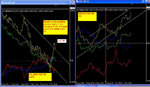

heres my 200Ma/Delta 1 chart that I think is 5min like yours......the red vert line is about where you were I think (??).....I tend to pack a lot of bars into my charts for more overview/analysis etc etc

Thoughts.......I have added the +/- 0.00010 ob and os lines in again to illustrate a point here - we probably would have made a few dinaros on a fast trade here (selling yen or Dollar and buying Euro or GBP) but I would be unhappy to trade as they are all kinda in no mans land and I want at least 1 currency to have moved above/near the Dotted lines and then top be falling/rising back towards the zero before I am comfortable with trying a retrace trade

plenty more to come and I am really enjoying pouring this out now as I had got rusty on loads of this - never having created a journal or document before !

Neil

Hi Ivan

before I disapear again trying to keep this going.....

heres my 200Ma/Delta 1 chart that I think is 5min like yours......the red vert line is about where you were I think (??).....I tend to pack a lot of bars into my charts for more overview/analysis etc etc

Thoughts.......I have added the +/- 0.00010 ob and os lines in again to illustrate a point here - we probably would have made a few dinaros on a fast trade here (selling yen or Dollar and buying Euro or GBP) but I would be unhappy to trade as they are all kinda in no mans land and I want at least 1 currency to have moved above/near the Dotted lines and then top be falling/rising back towards the zero before I am comfortable with trying a retrace trade

plenty more to come and I am really enjoying pouring this out now as I had got rusty on loads of this - never having created a journal or document before !

Neil

Attachments

Ingot54

Well-known member

- Messages

- 403

- Likes

- 62

"Settings"

On the 5 min chart which I posted above I used Delta settings of 3. I "removed" all the other lines which had no bearing. So far I have not experimented with the 200MA setting. Will keep that for another day

The way I entered the trade was to select the pair to trade using your correlation method, with a 5.3.3 stochastic added in to fine tune entry. Once the GBP line and the JPY line reached full deviation on 5 min TF, the stochastic was already straining at the lead to reverse.

At that point I entered LONG the EURJPY and SHORT the EURGBP.

The pair made about 120 pips between them at the peak. Not bad for 40 minutes "work".

Love it!

But one of the problems traders have - at least it is one of mine - is to know when to exit the trades. Here again the Stochastic can be a good indicator, though I would prefer we keep the method as free as possible without adding indies. There is no rule that says we have to vacuum up every pip that falls into our pip-basket ... just most of them! There is always another trade.

I think it is far preferable to miss out on a few pips by taking an early shower, than it is to give back pips that you already had in your rucksak! You do feel better about it for some reason.

I'm done for the night - it's almost 1am here on the Aussie east coast. I've had a ball - listening to Bee Gees on Youtube while I play the markets. I have just finished listening to El Condor Pasa, The Boxer, Sound of Silence and right now: "I am a Rock" all from Simon and Garfunkel. I grew up with the halcyon music of the 60's and 70's in my well-spent youth.

YouTube - Simon and Garfunkel-I Am a Rock

YouTube - Bee Gees - Message To You (1973) Live!

Maybe tomorrow night it will be ABBA and The Beach Boys.

Aaahhh! Didn't we have just the best music?

I hope you didn't mistake the 5.3.3 stochastic for a couple of the FxCorrelator pairs!Hey Ivan

what are your settings ?

meanwhile I promise to get down more detail on how the indicators "moves" next

Neil

On the 5 min chart which I posted above I used Delta settings of 3. I "removed" all the other lines which had no bearing. So far I have not experimented with the 200MA setting. Will keep that for another day

The way I entered the trade was to select the pair to trade using your correlation method, with a 5.3.3 stochastic added in to fine tune entry. Once the GBP line and the JPY line reached full deviation on 5 min TF, the stochastic was already straining at the lead to reverse.

At that point I entered LONG the EURJPY and SHORT the EURGBP.

The pair made about 120 pips between them at the peak. Not bad for 40 minutes "work".

Love it!

But one of the problems traders have - at least it is one of mine - is to know when to exit the trades. Here again the Stochastic can be a good indicator, though I would prefer we keep the method as free as possible without adding indies. There is no rule that says we have to vacuum up every pip that falls into our pip-basket ... just most of them! There is always another trade.

I think it is far preferable to miss out on a few pips by taking an early shower, than it is to give back pips that you already had in your rucksak! You do feel better about it for some reason.

I'm done for the night - it's almost 1am here on the Aussie east coast. I've had a ball - listening to Bee Gees on Youtube while I play the markets. I have just finished listening to El Condor Pasa, The Boxer, Sound of Silence and right now: "I am a Rock" all from Simon and Garfunkel. I grew up with the halcyon music of the 60's and 70's in my well-spent youth.

YouTube - Simon and Garfunkel-I Am a Rock

YouTube - Bee Gees - Message To You (1973) Live!

Maybe tomorrow night it will be ABBA and The Beach Boys.

Aaahhh! Didn't we have just the best music?

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

all the same .............can people now see why I call the USD Yen currencies a tag team ?

These guys are the Global "Risk" barometer currencies and I want to compare them to the Vix later on in this thread to see how close they are for potential use in trading....

Neil

These guys are the Global "Risk" barometer currencies and I want to compare them to the Vix later on in this thread to see how close they are for potential use in trading....

Neil

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

I hope you didn't mistake the 5.3.3 stochastic for a couple of the FxCorrelator pairs!

On the 5 min chart which I posted above I used Delta settings of 3. I "removed" all the other lines which had no bearing. So far I have not experimented with the 200MA setting. Will keep that for another day

The way I entered the trade was to select the pair to trade using your correlation method, with a 5.3.3 stochastic added in to fine tune entry. Once the GBP line and the JPY line reached full deviation on 5 min TF, the stochastic was already straining at the lead to reverse.

At that point I entered LONG the EURJPY and SHORT the EURGBP.

The pair made about 120 pips between them at the peak. Not bad for 40 minutes "work".

Love it!

But one of the problems traders have - at least it is one of mine - is to know when to exit the trades. Here again the Stochastic can be a good indicator, though I would prefer we keep the method as free as possible without adding indies. There is no rule that says we have to vacuum up every pip that falls into our pip-basket ... just most of them! There is always another trade.

I think it is far preferable to miss out on a few pips by taking an early shower, than it is to give back pips that you already had in your rucksak! You do feel better about it for some reason.

I'm done for the night - it's almost 1am here on the Aussie east coast. I've had a ball - listening to Bee Gees on Youtube while I play the markets. I have just finished listening to El Condor Pasa, The Boxer, Sound of Silence and right now: "I am a Rock" all from Simon and Garfunkel. I grew up with the halcyon music of the 60's and 70's in my well-spent youth.

YouTube - Simon and Garfunkel-I Am a Rock

YouTube - Bee Gees - Message To You (1973) Live!

Maybe tomorrow night it will be ABBA and The Beach Boys.

Aaahhh! Didn't we have just the best music?

when I was a spotty adolencence disco had just happened (mid/late 70's)......luckily my parents had introduced me to the quality stuff in the 60's so I had something decent to fall back on when my white suit was in the Cleaners !

Neil

Ingot54

Well-known member

- Messages

- 403

- Likes

- 62

I think the reason your charts are 1H behind could be something to do with the broker whose MT4 you are using. I use FXLite - which is geared for the New York Close. If that is not it, then maybe either your computer or your broker is set on daylight-saving time? Apart from those 2 thoughts, I have no clue.Hi Ivan

before I disapear again trying to keep this going.....

heres my 200Ma/Delta 1 chart that I think is 5min like yours......the red vert line is about where you were I think (??).....I tend to pack a lot of bars into my charts for more overview/analysis etc etc

Thoughts.......I have added the +/- 0.00010 ob and os lines in again to illustrate a point here - we probably would have made a few dinaros on a fast trade here (selling yen or Dollar and buying Euro or GBP) but I would be unhappy to trade as they are all kinda in no mans land and I want at least 1 currency to have moved above/near the Dotted lines and then top be falling/rising back towards the zero before I am comfortable with trying a retrace trade

plenty more to come and I am really enjoying pouring this out now as I had got rusty on loads of this - never having created a journal or document before !

Neil

Yes - I think you are correct - that was the point I chose to make my trade. I do not understand though, what you meant by: " ... all my Charts are based on taking the USDGBP core chart... " but I am sure it is a simple thing.

I would like to nail down what you class as a good trade or at least a good point to enter - after that we don't know what the market will give us. Maybe we should be taking a peek at the 15 min and maybe 30 min TF as well, before deciding to take a trade - 5 min trades are by nature more scalping-types. I was lucky to get those pips, I do concede - rarely can one pick a breakout without luck!

I will experiment more with those Delta settings - I think this is a fantastic package of yours Neil - congratulations on an excellent piece of work. Chat again tomorrow mate.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

I hope you didn't mistake the 5.3.3 stochastic for a couple of the FxCorrelator pairs!

On the 5 min chart which I posted above I used Delta settings of 3. I "removed" all the other lines which had no bearing. So far I have not experimented with the 200MA setting. Will keep that for another day

The way I entered the trade was to select the pair to trade using your correlation method, with a 5.3.3 stochastic added in to fine tune entry. Once the GBP line and the JPY line reached full deviation on 5 min TF, the stochastic was already straining at the lead to reverse.

At that point I entered LONG the EURJPY and SHORT the EURGBP.

The pair made about 120 pips between them at the peak. Not bad for 40 minutes "work".

Love it!

But one of the problems traders have - at least it is one of mine - is to know when to exit the trades. Here again the Stochastic can be a good indicator, though I would prefer we keep the method as free as possible without adding indies. There is no rule that says we have to vacuum up every pip that falls into our pip-basket ... just most of them! There is always another trade.

I think it is far preferable to miss out on a few pips by taking an early shower, than it is to give back pips that you already had in your rucksak! You do feel better about it for some reason.

WOW !!!!! - nice going Ivan !

thats why I posted this baby in the end - to get proper Traders involved so we all can make money and learn

Despite a gambling orientated upbringing (long story) and other distractions in the past I confess here that i am not an experienced trader....just someone who messes around a lot with charts / indicators and Trading ideas for future use in this Great business!

The Indicator will provide an Edge.........I dont believe it can be a pure system in itself and will need help of which there are multitudes of ways !

Neil

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

apologies......

sorry Ivan / all

work has been nuts today and will be tomorrow (still here !)....i'll try to get some posts in during the fun tomorrow..........given his rapid learning curve I give ingot54 (Ivan) another week of practice and we will both be responding to any questions on the Indicator / Thread !

more followers contributors needed please to join the Army - we wont bite !

Neil

sorry Ivan / all

work has been nuts today and will be tomorrow (still here !)....i'll try to get some posts in during the fun tomorrow..........given his rapid learning curve I give ingot54 (Ivan) another week of practice and we will both be responding to any questions on the Indicator / Thread !

more followers contributors needed please to join the Army - we wont bite !

Neil

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

more stuff on the indicator

Hi ingot54 / all

ok some thoughts on the FXCorrelator before I go to work....I will miss lots of detail (writing detailed "how to" books will never be my job) but hats what forums are for

this is what I do........

I use a free metatrader package courtesy of ODL.....they offer free feeds and have never given me grief for still not having set up a live account with them

When I do play a little (not much in last month or so) its a virtual with Worldspreads...I was introduced to them by a chap called John Bartlett who coaches Trading in the Uk (cheque please JB !).and offers some decent inexpensive courses mainly for Newbies with some robust trading systems.

Set-up

bring up a new GPBUSD Chart in Metatrader

make the chart options line chart , remove grids and hide line by colours

load in the FXCorrelator and expand the window to remove the pair chart

play with the MA/delta settings based on your tastes/needs for this chart

hide certain currency pairs by clicking the colour to none

play with lines also if you want (bold, dotted etc etc) - cancels if TF changes (doh !)

then create as many as I need

I use 1 currency pair chart for all my Indicator charts...why ? because I read somewhere that you need a popular feed pair to ensure the indicator updates as fast as possible expecially for 1 min charts (??).....probably C**p actually !

Next are the settings...(whats the time here ?..ok i got a little more time)

Neil

Hi ingot54 / all

ok some thoughts on the FXCorrelator before I go to work....I will miss lots of detail (writing detailed "how to" books will never be my job) but hats what forums are for

this is what I do........

I use a free metatrader package courtesy of ODL.....they offer free feeds and have never given me grief for still not having set up a live account with them

When I do play a little (not much in last month or so) its a virtual with Worldspreads...I was introduced to them by a chap called John Bartlett who coaches Trading in the Uk (cheque please JB !).and offers some decent inexpensive courses mainly for Newbies with some robust trading systems.

Set-up

bring up a new GPBUSD Chart in Metatrader

make the chart options line chart , remove grids and hide line by colours

load in the FXCorrelator and expand the window to remove the pair chart

play with the MA/delta settings based on your tastes/needs for this chart

hide certain currency pairs by clicking the colour to none

play with lines also if you want (bold, dotted etc etc) - cancels if TF changes (doh !)

then create as many as I need

I use 1 currency pair chart for all my Indicator charts...why ? because I read somewhere that you need a popular feed pair to ensure the indicator updates as fast as possible expecially for 1 min charts (??).....probably C**p actually !

Next are the settings...(whats the time here ?..ok i got a little more time)

Neil

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

the Settings.....

Right....

the FXcorrelator is deceptively simple regarding formulas etc etc but very powerful in what it portrays......

its almost like using a Macd with just the 2 lines or perhaps 2 MA's on a chart or 2 RSI's overlaid on a normal pair....................except one of the pairs (the second currency)

is not UASD or CHF or whatever.......its all other Currencies (apart from the lead pair) together...

so the USDollar (mr Green) in the charts is pretty close to the USDollar index as offered on some trading platforms, GBP is pretty Close to the Sterling Index which I have no idea is offered at all.....and so on !

the MA dictates the Baseline for how the Currencies will move......a longer MA (200-500) means you get a nicer and more realistic platform to guage distances from the Delta setting you add......however this will naturaly be slower regarding crossovers etc etc as yuo are looking at 200 Crossovers vs say a MA setting of 55 or 21 which will be crossing over much much faster and more frequently (actually these levels do my brain in !).......Try it and play......

the Delta will smooth th eline as required......1 = real bar pricing so on a MA200, Delta 1

setting you are viewing how the price of a currency is performing on a 200MA verses everything else and any crossovers will be (95% accurate) at when on the pairs chart the MA1 crosses the MA200

ease back on the Delta throttle and it smooooooths things just like increasing a second MA line on any chart......hence a 200/13 FX correlator is much smoother than a 200/1 setting..........nice to look at but remember you are now well off the pace if you are

trying to trade it

Everything the FXCorrelator does is aligned to the Dynamics of Moving average techniques and Trading systems.........plenty of benefits but notoriously lagging !

I would add charts but brain hurts and havnt had a coffee yet

Neil

umm next is trading ideas but got to get ready now........

Right....

the FXcorrelator is deceptively simple regarding formulas etc etc but very powerful in what it portrays......

its almost like using a Macd with just the 2 lines or perhaps 2 MA's on a chart or 2 RSI's overlaid on a normal pair....................except one of the pairs (the second currency)

is not UASD or CHF or whatever.......its all other Currencies (apart from the lead pair) together...

so the USDollar (mr Green) in the charts is pretty close to the USDollar index as offered on some trading platforms, GBP is pretty Close to the Sterling Index which I have no idea is offered at all.....and so on !

the MA dictates the Baseline for how the Currencies will move......a longer MA (200-500) means you get a nicer and more realistic platform to guage distances from the Delta setting you add......however this will naturaly be slower regarding crossovers etc etc as yuo are looking at 200 Crossovers vs say a MA setting of 55 or 21 which will be crossing over much much faster and more frequently (actually these levels do my brain in !).......Try it and play......

the Delta will smooth th eline as required......1 = real bar pricing so on a MA200, Delta 1

setting you are viewing how the price of a currency is performing on a 200MA verses everything else and any crossovers will be (95% accurate) at when on the pairs chart the MA1 crosses the MA200

ease back on the Delta throttle and it smooooooths things just like increasing a second MA line on any chart......hence a 200/13 FX correlator is much smoother than a 200/1 setting..........nice to look at but remember you are now well off the pace if you are

trying to trade it

Everything the FXCorrelator does is aligned to the Dynamics of Moving average techniques and Trading systems.........plenty of benefits but notoriously lagging !

I would add charts but brain hurts and havnt had a coffee yet

Neil

umm next is trading ideas but got to get ready now........

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Trading Idea 1

Hi all

simplest is best so heres first one

since the FXCorrelator isolates each currency as a single entity you finally get to see how the varmits move !

and yes there they are...... cycling backwards/ forward up and down, everything people drone on about is true ! (Eliot waves, cycling, HH/HL. LLLL HHH (?) blah blah blah)

so heres the first and very simple trading methodology.......

set up 2 or 3 charts with the indicator on 3 TF's (1,5,30 or 5,1h,4h ) whatever you want !

have the same setting (200 on a Delta 2 or 3 is nice.....1 is a little jerky)

Remove some currencies that you are not interested in to make it simpler to watch

(put on the Tag team (Yen,USD) + GBP and Euro as minimum...although thats just me)

then watch the flow !!!!...........thats it

think about it..if you see something moving upwards (2 steps forward/1 step back - or HH,HL / LL,LH) on the Higher TF's you have a "trend"

Wait for it to be falling back a little in its main trend thrust..........

then drop down to lower TF (which naturally will be opposite trend of Higher TF) and wait for the lower TF to start moving back in same direction as higher TF

add any indicators you need on the actual Pair chart you chose to trade for support and comfort blankets............ !

me - i used to "just do it" as the actual Pair chart sometimes will be screaming not to do the trade as it is totally focused on the 1 pair and not the whole picture that FXcorrelator is showing you.........

sorry - no coffee - no attachments........i'll add later !

Aaaah - Coffee........ Attachment now added

Attachment now added

Neil

Hi all

simplest is best so heres first one

since the FXCorrelator isolates each currency as a single entity you finally get to see how the varmits move !

and yes there they are...... cycling backwards/ forward up and down, everything people drone on about is true ! (Eliot waves, cycling, HH/HL. LLLL HHH (?) blah blah blah)

so heres the first and very simple trading methodology.......

set up 2 or 3 charts with the indicator on 3 TF's (1,5,30 or 5,1h,4h ) whatever you want !

have the same setting (200 on a Delta 2 or 3 is nice.....1 is a little jerky)

Remove some currencies that you are not interested in to make it simpler to watch

(put on the Tag team (Yen,USD) + GBP and Euro as minimum...although thats just me)

then watch the flow !!!!...........thats it

think about it..if you see something moving upwards (2 steps forward/1 step back - or HH,HL / LL,LH) on the Higher TF's you have a "trend"

Wait for it to be falling back a little in its main trend thrust..........

then drop down to lower TF (which naturally will be opposite trend of Higher TF) and wait for the lower TF to start moving back in same direction as higher TF

add any indicators you need on the actual Pair chart you chose to trade for support and comfort blankets............ !

me - i used to "just do it" as the actual Pair chart sometimes will be screaming not to do the trade as it is totally focused on the 1 pair and not the whole picture that FXcorrelator is showing you.........

sorry - no coffee - no attachments........i'll add later !

Aaaah - Coffee........ Attachment now added

Attachment now added

Neil

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Danarm and his thread....Correlation ?

aaahhh..........this guy uses correlation in some of his strategies/calls.....excellent thread and I have been following it for a while now

its mentioned here.....then i'm sure theres a template of how to trade later in the thread talking about correlations + I know that something called art of Pimpology that is also linked somewhere as a more Newbie thread (oops that may be on another Wedsite/forum)

anyway - another sucessful respecter of the Corry !

http://www.trade2win.com/boards/trading-journals/38994-its-all-about-pips-6.html

Neil

aaahhh..........this guy uses correlation in some of his strategies/calls.....excellent thread and I have been following it for a while now

its mentioned here.....then i'm sure theres a template of how to trade later in the thread talking about correlations + I know that something called art of Pimpology that is also linked somewhere as a more Newbie thread (oops that may be on another Wedsite/forum)

anyway - another sucessful respecter of the Corry !

http://www.trade2win.com/boards/trading-journals/38994-its-all-about-pips-6.html

Neil

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

ingot54 is on fire !

hi everyone and I see we have had over 5,000 visits to the Thread already....so thankyou !

dont be afraid to pop in and discuss.......Ingot54 is already crashtesting the FXcorrelator for all its worth and I have asked him to bring this action to the thread more now as we have been sharing a lot of cosy PM chats up to this point.......

Ivan dont break it !!!!!!!!!! (ha ha)

Neil

hi everyone and I see we have had over 5,000 visits to the Thread already....so thankyou !

dont be afraid to pop in and discuss.......Ingot54 is already crashtesting the FXcorrelator for all its worth and I have asked him to bring this action to the thread more now as we have been sharing a lot of cosy PM chats up to this point.......

Ivan dont break it !!!!!!!!!! (ha ha)

Neil

hi everyone and I see we have had over 5,000 visits to the Thread already....so thankyou !

dont be afraid to pop in and discuss.......Ingot54 is already crashtesting the FXcorrelator for all its worth and I have asked him to bring this action to the thread more now as we have been sharing a lot of cosy PM chats up to this point.......

Ivan dont break it !!!!!!!!!! (ha ha)

Neil

Some would say and I would ofcourse never be one of them - that if Ivan is doing this in Aus ... then he might be doing things upside down ?

ho ho ho

(Sorry, late night - couldn't resist)

Ingot54

Well-known member

- Messages

- 403

- Likes

- 62

Amazing stuff!

At first I found two pairs to trade that captured both the buy and sell directions. I looked for a currency that was near parallel to the zero axis, and that happened to be easy to couple with both the GBP and the JPY. I now know I could have used one of the "Tag Team" - USD or JPY to couple with ... but hey! it worked with the EUR this time, so all good!

So the pairs I traded were the EURGBP and the EURJPY. I was long one of them and short the other. What I learned is that the acton is fast and furious with this pair - and if you want action, here's your beast! You really must be in your trading trousers to manage a pair like the GBPJPY - you don't take pit stops or coffee breaks while this bloke is on your trading radar! You roll up your sleeves and spit on your hands!

Now a few hours ago I was again delving into the GBPJPY. By setting up a "pure correlation" template as you described in Post # 70 I found that I could experiment with the settings.

For my eyes, I found that the Delta of 3 was most useful for the faster TF like 5 and 15 minutes, and the Delta of 5 was smoother and more appropriate for the 1H TF.

Also I found that by eliminating the other colours (currencies) that were uninteresting to me :

NZD - light blue

CAD - Brown

CHF - Grey

that the chart became uncluttered and much easier to read.

It was then that I discovered that I was complicating things too much by trying to select 2 pairs to trade to correlation between any two currencies. The FXCorrelator will select the exact pair to trade purely by the direction of the coloured lines.

Simple eh! But the beauty of this FXCorrelator is that you can choose your weapons!

So if you keep an eye on the JPY (yellow) and the GBP (red) you merely watch for convergence/divergence and trade accordingly.

But don't forget you also have a brain - you still need to check other TF to see where the longer term trend is.

As Neil said in his Post # 72:

More in a moment ...

Crikey Neil - this has been a wild ride over the past 10 days! I have been focusing mainly on the GBPJPY action.hi everyone and I see we have had over 5,000 visits to the Thread already....so thankyou !

dont be afraid to pop in and discuss.......Ingot54 is already crashtesting the FXcorrelator for all its worth and I have asked him to bring this action to the thread more now as we have been sharing a lot of cosy PM chats up to this point.......

Ivan dont break it !!!!!!!!!! (ha ha)

Neil

At first I found two pairs to trade that captured both the buy and sell directions. I looked for a currency that was near parallel to the zero axis, and that happened to be easy to couple with both the GBP and the JPY. I now know I could have used one of the "Tag Team" - USD or JPY to couple with ... but hey! it worked with the EUR this time, so all good!

So the pairs I traded were the EURGBP and the EURJPY. I was long one of them and short the other. What I learned is that the acton is fast and furious with this pair - and if you want action, here's your beast! You really must be in your trading trousers to manage a pair like the GBPJPY - you don't take pit stops or coffee breaks while this bloke is on your trading radar! You roll up your sleeves and spit on your hands!

Now a few hours ago I was again delving into the GBPJPY. By setting up a "pure correlation" template as you described in Post # 70 I found that I could experiment with the settings.

For my eyes, I found that the Delta of 3 was most useful for the faster TF like 5 and 15 minutes, and the Delta of 5 was smoother and more appropriate for the 1H TF.

Also I found that by eliminating the other colours (currencies) that were uninteresting to me :

NZD - light blue

CAD - Brown

CHF - Grey

that the chart became uncluttered and much easier to read.

It was then that I discovered that I was complicating things too much by trying to select 2 pairs to trade to correlation between any two currencies. The FXCorrelator will select the exact pair to trade purely by the direction of the coloured lines.

Simple eh! But the beauty of this FXCorrelator is that you can choose your weapons!

So if you keep an eye on the JPY (yellow) and the GBP (red) you merely watch for convergence/divergence and trade accordingly.

But don't forget you also have a brain - you still need to check other TF to see where the longer term trend is.

As Neil said in his Post # 72:

NVP; said:Set up 2 or 3 charts with the indicator on 3 TF's (1,5,30 or 5,1h,4h ) whatever you want !

have the same setting (200 on a Delta 2 or 3 is nice.....1 is a little jerky)

Remove some currencies that you are not interested in to make it simpler to watch

(put on the Tag team (Yen,USD) + GBP and Euro as minimum...although thats just me)

then watch the flow !!!!...........thats it

think about it..if you see something moving upwards (2 steps forward/1 step back - or HH,HL / LL,LH) on the Higher TF's you have a "trend"

Wait for it to be falling back a little in its main trend thrust..........

then drop down to lower TF (which naturally will be opposite trend of Higher TF) and wait for the lower TF to start moving back in same direction as higher TF

add any indicators you need on the actual Pair chart you chose to trade for support and comfort blankets............ !

More in a moment ...

Ingot54

Well-known member

- Messages

- 403

- Likes

- 62

Vegemite sandwich anyone?

But in an ironic sort of way, you are correct - I was approaching the indicator from the sticky end of the brush! I had been nutting this through without the guidance of NVP over the weekend, and Monday - and ended up working out a profitable trade 24 hours ago or so - see Post #64 on page 8 of this thread.

Since then I have discovered it is a bit of beginner's luck - I had no idea how ruthless this beastie can be. I will make it my life's work to tame this GBPJPY animal - even if it kills me! No ... wait ... !

But I was dreaming of a new Ferrari (shiny midnight blue) and when I looked again at the screen, the little beggar had reversed on me. I had forgotten to take profits!

So tonight I just followed the action.

More in a moment.

Yeah, right Jansher21!Some would say and I would ofcourse never be one of them - that if Ivan is doing this in Aus ... then he might be doing things upside down ?

ho ho ho

(Sorry, late night - couldn't resist)

But in an ironic sort of way, you are correct - I was approaching the indicator from the sticky end of the brush! I had been nutting this through without the guidance of NVP over the weekend, and Monday - and ended up working out a profitable trade 24 hours ago or so - see Post #64 on page 8 of this thread.

Since then I have discovered it is a bit of beginner's luck - I had no idea how ruthless this beastie can be. I will make it my life's work to tame this GBPJPY animal - even if it kills me! No ... wait ... !

But I was dreaming of a new Ferrari (shiny midnight blue) and when I looked again at the screen, the little beggar had reversed on me. I had forgotten to take profits!

So tonight I just followed the action.

More in a moment.

Attachments

Ingot54

Well-known member

- Messages

- 403

- Likes

- 62

Some of the PM content between Ingot54 and NVP

YouTube - Münchener Freiheit: Keeping The Dream Alive

Here are a couple of the messages I sent to Neil this evening (Oz time) with Neil's blessings:

The 5 minute chart has been amazing tonight - up 50 pips, then down 65 ... retrace 34 ... down 40 ... up 25 ... and now down 100 pips from the peak nearly an hour ago!

Ride 'em cowboy! Would take a good trader to handle the action on it tonight.

Of course, you could have taken the up-tick in the JPY on the 30 min chart, accompanied by the 5.3.3 stochastic crossing down at that time. Just those signal alone would have yielded 75 pips to date.There's that huge spinning top - and all-engulfing bearish doji which was just a shake-out. I looked at the FF Calendar - nothing to see here folks ... move along!

Why would the JPY react so strongly to the USD employment figures? Is this just relativity / correlations at work? I don't think so in this bit of news, because the USD and the JPY are perfectly positively correlated tonight. On the 30 min chart, I can see the GBP is parallel with the zero axis, and the JPY is climbing at 45 degrees. That is quite a divergance, and one which I wish I'd spotted an hour ago.

But it was still developing, and I did the correct thing by watching the smaller TF as well.

I have found that for my eyes, the best setting is between 3 and 5 for the Delta. Depends on the TF - 5 for the very short ones, and 3 for the 30 min and higher TF because it smoorthes the "noise".

On the 5 min TF we are actually watching the noise, so a period of 3 Delta smooths out a few bumps without giving us false security.

YouTube - Abba - I Have A Dream

I was telling my wife about you and your FXCorrelator, Neil, and after I showed he how it works she is amazed! She has decided to throw her weight behind me in trading now, after a few years of being irritated by my involvement in trading. I did lose a lot of money ($*k) over the past 5 years, but recently have not traded live.

It is so good to have her support - she is a natural disciplinarian, and I am the visionary!

I am about to set up a template as you recommend. Although I have done one successful trade, I am keen to simplify my setup, to speed it all up.

For example, when the Correlator shows JPY heading up strongly, as it has done this afternoon and the GBP heading down (just as they did last night), then I look for 2 other pairs to trade that will take advantage of the inevitable reversion.

Last night I chose the EUR to pair them with, because of the low spread, and relative stability of the EUR. The EURGBP and EURJPY was the resulting two pairs to trade.

I will probably ask the question on the forum, but this is something I would like to know: Is it possible to make a list of each of the 8 currencies, and beside them on the list, place the 2 most optimal pairs to trade every time? This would be so much faster for me. eg if I see the USD rising and the CAD falling, I would consult my list and see that the AUDUSD and the AUDCAD is the optimal pair to trade the setup. Or it could be the EURUSD and the EURCAD. You will understand what I am getting at, I am sure. As long as there is a common denominator to pair with the divergant/convergant pair, and good to trade.

The way I see it so far, is that it is unlikely that the same common denominator could be used consistently, because at some stage, even these would be showing +ve or-ve correlation with one of the pairs, and thus would not be suitable at that time.

Finally here is a link to an ADX indicator. It is useful for showing trend over all TF in whatever pair it is applied to. I am sure you will find it helpful:

http://www.forexfactory.com/showthre...t=46667&page=1

The indicator is in the Post #1.

NOTE: I have actually attached that indicator below. Just right click it and save to desktop. Then add it to your MT4 experts/indicators files as usual. Let me know if you do not know how to do that, and I will be happy to post the method clearly for anyone.

Well those two messages say a lot - much has already been answered ... such as the bit about finding suitable currencies to pair the currencies we find on the FXCorrelator - Neil has already mentioned the use of the "tag team" - the USD or the JPY.

If you are interested in trying this method and joining the fun, just download the FXCorrelator from Post # 2 at the beginning of this thread. This is not only refreshng - it works! And for people like myself who have struggled over a few years, that breathes life and hope into me again.

Thank you Neil for your generosity and unselfishness in sharing this indicator.

Yes mate ... and still keeping the dream alive!Hey Jansher21,

welcome again..........now now dont goad him....hes the only one ive got playing with the indicator !!!

Neil

YouTube - Münchener Freiheit: Keeping The Dream Alive

Here are a couple of the messages I sent to Neil this evening (Oz time) with Neil's blessings:

The 5 minute chart has been amazing tonight - up 50 pips, then down 65 ... retrace 34 ... down 40 ... up 25 ... and now down 100 pips from the peak nearly an hour ago!

Ride 'em cowboy! Would take a good trader to handle the action on it tonight.

Of course, you could have taken the up-tick in the JPY on the 30 min chart, accompanied by the 5.3.3 stochastic crossing down at that time. Just those signal alone would have yielded 75 pips to date.There's that huge spinning top - and all-engulfing bearish doji which was just a shake-out. I looked at the FF Calendar - nothing to see here folks ... move along!

Why would the JPY react so strongly to the USD employment figures? Is this just relativity / correlations at work? I don't think so in this bit of news, because the USD and the JPY are perfectly positively correlated tonight. On the 30 min chart, I can see the GBP is parallel with the zero axis, and the JPY is climbing at 45 degrees. That is quite a divergance, and one which I wish I'd spotted an hour ago.

But it was still developing, and I did the correct thing by watching the smaller TF as well.

I have found that for my eyes, the best setting is between 3 and 5 for the Delta. Depends on the TF - 5 for the very short ones, and 3 for the 30 min and higher TF because it smoorthes the "noise".

On the 5 min TF we are actually watching the noise, so a period of 3 Delta smooths out a few bumps without giving us false security.

YouTube - Abba - I Have A Dream

I was telling my wife about you and your FXCorrelator, Neil, and after I showed he how it works she is amazed! She has decided to throw her weight behind me in trading now, after a few years of being irritated by my involvement in trading. I did lose a lot of money ($*k) over the past 5 years, but recently have not traded live.

It is so good to have her support - she is a natural disciplinarian, and I am the visionary!

I am about to set up a template as you recommend. Although I have done one successful trade, I am keen to simplify my setup, to speed it all up.

For example, when the Correlator shows JPY heading up strongly, as it has done this afternoon and the GBP heading down (just as they did last night), then I look for 2 other pairs to trade that will take advantage of the inevitable reversion.

Last night I chose the EUR to pair them with, because of the low spread, and relative stability of the EUR. The EURGBP and EURJPY was the resulting two pairs to trade.

I will probably ask the question on the forum, but this is something I would like to know: Is it possible to make a list of each of the 8 currencies, and beside them on the list, place the 2 most optimal pairs to trade every time? This would be so much faster for me. eg if I see the USD rising and the CAD falling, I would consult my list and see that the AUDUSD and the AUDCAD is the optimal pair to trade the setup. Or it could be the EURUSD and the EURCAD. You will understand what I am getting at, I am sure. As long as there is a common denominator to pair with the divergant/convergant pair, and good to trade.

The way I see it so far, is that it is unlikely that the same common denominator could be used consistently, because at some stage, even these would be showing +ve or-ve correlation with one of the pairs, and thus would not be suitable at that time.

Finally here is a link to an ADX indicator. It is useful for showing trend over all TF in whatever pair it is applied to. I am sure you will find it helpful:

http://www.forexfactory.com/showthre...t=46667&page=1

The indicator is in the Post #1.

NOTE: I have actually attached that indicator below. Just right click it and save to desktop. Then add it to your MT4 experts/indicators files as usual. Let me know if you do not know how to do that, and I will be happy to post the method clearly for anyone.

Well those two messages say a lot - much has already been answered ... such as the bit about finding suitable currencies to pair the currencies we find on the FXCorrelator - Neil has already mentioned the use of the "tag team" - the USD or the JPY.

If you are interested in trying this method and joining the fun, just download the FXCorrelator from Post # 2 at the beginning of this thread. This is not only refreshng - it works! And for people like myself who have struggled over a few years, that breathes life and hope into me again.

Thank you Neil for your generosity and unselfishness in sharing this indicator.

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Calm down dear !!!!

Ingot54.......you wont understand this comment

its a famous one from a UK insurance commercial uttered by the colourful producer Michael Winner ! ..a kind of catch phrase !

GBPJPY

anyway I can 100% confirm you will need plenty of Vegemite flavoured Valium if you sit on this gunpowder pair......always remember you can calm it a little by going

Yen/Euro

or

GBP/USD

to introduce a lower Volatility currency to the trade (Yen/Euro is nice as I like the Yen more than any other Currency in the Family and it will slice through the Euro on its retrace without the whipsaw you may will get on GBP/Yen combo)

as for faster MA's...........ai yi yi !

Great Stuff and thanks for believing......!

Neil

Ingot54.......you wont understand this comment

its a famous one from a UK insurance commercial uttered by the colourful producer Michael Winner ! ..a kind of catch phrase !

GBPJPY

anyway I can 100% confirm you will need plenty of Vegemite flavoured Valium if you sit on this gunpowder pair......always remember you can calm it a little by going

Yen/Euro

or

GBP/USD

to introduce a lower Volatility currency to the trade (Yen/Euro is nice as I like the Yen more than any other Currency in the Family and it will slice through the Euro on its retrace without the whipsaw you may will get on GBP/Yen combo)

as for faster MA's...........ai yi yi !

Great Stuff and thanks for believing......!

Neil

Last edited:

Similar threads

- Replies

- 0

- Views

- 3K