You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

cointegration Trading....

Hi Shatztrader

just had a quick look this morning at Carol alexanders work and this is indeed very interesting........also brings home to me a little that trying to generate a lot of interest in this whole subject could be like pushing certain substances uphill

the thing is (as Ingot54 alluded to in an earlier Post)........understanding correlations and the methods of measuring/reproducing these graphically in a meaningful way is a key weapon in sucessful Trading - ignore it at your peril

I recognise my postings have been a little folksy to date and some people are probably thinking I am not showing enough respect to established Statistical/Scientifc methods in this area................but the truth is I am not a statisician and I would love to bring a balance here to this thread between the Science of correlation techniques verses the brutal practicalities of sucessful Trading

people on this site want profitable/workable trading sIdeas and systems and I want to bring some to the table !

c'mon all - please bring some thoughts to the table.......even if its denegrating my efforts to date and my (flawed?) indicator

Neil

Hi Shatztrader

just had a quick look this morning at Carol alexanders work and this is indeed very interesting........also brings home to me a little that trying to generate a lot of interest in this whole subject could be like pushing certain substances uphill

the thing is (as Ingot54 alluded to in an earlier Post)........understanding correlations and the methods of measuring/reproducing these graphically in a meaningful way is a key weapon in sucessful Trading - ignore it at your peril

I recognise my postings have been a little folksy to date and some people are probably thinking I am not showing enough respect to established Statistical/Scientifc methods in this area................but the truth is I am not a statisician and I would love to bring a balance here to this thread between the Science of correlation techniques verses the brutal practicalities of sucessful Trading

people on this site want profitable/workable trading sIdeas and systems and I want to bring some to the table !

c'mon all - please bring some thoughts to the table.......even if its denegrating my efforts to date and my (flawed?) indicator

Neil

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

trial the indicator....?

Hi (damn late for work now!)

It would be great if someone started using the indicator attached in earlier threads and fedback comments thoughts through this thread..........after about a year of playing with this I still have only achieved 25% of what this baby can do

c'mon you Metatrader fans !

Neil

Hi (damn late for work now!)

It would be great if someone started using the indicator attached in earlier threads and fedback comments thoughts through this thread..........after about a year of playing with this I still have only achieved 25% of what this baby can do

c'mon you Metatrader fans !

Neil

Ingot54

Well-known member

- Messages

- 403

- Likes

- 62

Correlation and Arbitrage

Hi Neil - I have followed every post.

I know about correlation, but apart from knowing not to trade against other positions, or in the same direction as other positions already open, I was wondering what else Correlation could be useful for.

I had a look at the pair that I posted (USDCHF and EURUSD) and I noticed something really interesting. At first I thought that the 2 pairs mirrored each other exactly. Mostly they do ... but there are times when there is a delay between when one pair makes a move, and the other moves in the opposite way.

It seems to me that this almost a licence to print money.

If you are quick enough, you can get SHORT the EURUSD if it has not moved when the USDCHF has suddenly gone LONG. Historically the pairs mirror each other, but this arbitrage occurs from time to time, and if you did little else than wait for it, you could do well I think.

I am certain there are people trading this already - there would probably be people who have already posted a method for it. If so, could someone please provide links. It's interesting.

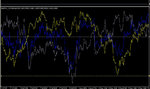

In the chart(s) below, I have shown some subtle differences in the WEEKLY charts.

I think when looking at these divergances on the 1H TF, the opportunity must surely pop out at you n'est ce pas?

Hi (damn late for work now!)

It would be great if someone started using the indicator attached in earlier threads and fedback comments thoughts through this thread..........after about a year of playing with this I still have only achieved 25% of what this baby can do

c'mon you Metatrader fans !

Neil

Hi Neil - I have followed every post.

I know about correlation, but apart from knowing not to trade against other positions, or in the same direction as other positions already open, I was wondering what else Correlation could be useful for.

I had a look at the pair that I posted (USDCHF and EURUSD) and I noticed something really interesting. At first I thought that the 2 pairs mirrored each other exactly. Mostly they do ... but there are times when there is a delay between when one pair makes a move, and the other moves in the opposite way.

It seems to me that this almost a licence to print money.

If you are quick enough, you can get SHORT the EURUSD if it has not moved when the USDCHF has suddenly gone LONG. Historically the pairs mirror each other, but this arbitrage occurs from time to time, and if you did little else than wait for it, you could do well I think.

I am certain there are people trading this already - there would probably be people who have already posted a method for it. If so, could someone please provide links. It's interesting.

In the chart(s) below, I have shown some subtle differences in the WEEKLY charts.

I think when looking at these divergances on the 1H TF, the opportunity must surely pop out at you n'est ce pas?

Attachments

Ingot54

Well-known member

- Messages

- 403

- Likes

- 62

Hedging

One of the problems with such a hedging strategy, would be that big losses could run up if the method began to diverge against the trader. Nothing correlates 100%.

So in order to scalp the divergances, why not have the pair hedged on demo, waiting for a large loss to occur. This would be the SETUP for putting on LIVE trades.

The TRIGGER would be when the losses start to reduce, as correlation resumed.

The method would need very tight stops, and always have a Take Profit in pace in case of large profit spikes.

But how would you enter a Stop Loss for a hedged trade?

Would it be practical to be simultaneously LONG one pair and SHORT the other?It seems to me that this almost a licence to print money.

I am certain there are people trading this already - there would probably be people who have already posted a method for it. If so, could someone please provide links. It's interesting.

One of the problems with such a hedging strategy, would be that big losses could run up if the method began to diverge against the trader. Nothing correlates 100%.

So in order to scalp the divergances, why not have the pair hedged on demo, waiting for a large loss to occur. This would be the SETUP for putting on LIVE trades.

The TRIGGER would be when the losses start to reduce, as correlation resumed.

The method would need very tight stops, and always have a Take Profit in pace in case of large profit spikes.

But how would you enter a Stop Loss for a hedged trade?

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Euro/Swissie Ideas

Hey Ingot54 !

thanks for your kind attention and very interesting comments

The close corrlations seen on the Euro and Swissie together with relatively low volatilities most of the time does indeed generate some trading ideas - particularly

when their relationship is perceived to be "stretched" on overbought / oversold positions

I have a Version of the FXcorrelator somewhere that isolates the two pairs for this purpose and also adds a "difference in value" line to highight when we see the big o/B or O/S position.......in truth its not perfect as it carries the usual health warnings when one tries to call the turning point between 2 pairs (but risk can be reduced by introducing standard price analysis principles on the EURCHF chart)....also theres the spreads if you are trading real short TF's

i'm at work but will access my home files remotely and try to find it....just need to hide from the Boss (ha ha )

i'll have a look at other post as well..........

Neil

Hey Ingot54 !

thanks for your kind attention and very interesting comments

The close corrlations seen on the Euro and Swissie together with relatively low volatilities most of the time does indeed generate some trading ideas - particularly

when their relationship is perceived to be "stretched" on overbought / oversold positions

I have a Version of the FXcorrelator somewhere that isolates the two pairs for this purpose and also adds a "difference in value" line to highight when we see the big o/B or O/S position.......in truth its not perfect as it carries the usual health warnings when one tries to call the turning point between 2 pairs (but risk can be reduced by introducing standard price analysis principles on the EURCHF chart)....also theres the spreads if you are trading real short TF's

i'm at work but will access my home files remotely and try to find it....just need to hide from the Boss (ha ha )

i'll have a look at other post as well..........

Neil

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Stops or Correlation

Good point !

some (most?) correlation trading systems and strategies require multiple trades to implement the plan and exploit the correlation anticipated

trouble is (and ive seen this discussed in a lot of sites) you have no capability to create stop losses, as in each individual trade being made they are all part of a greater dynamic group of trades (ive heard them called clusters ?) sooooo its a real problemo and without manual monitoring if it goes wrong you are really in the dodo...and even manually you could go down real fast on short TF's before you hit the "abort" buttons

let me have a think and also we may get some more comments as well !

love the Long/short idea !.............regardless of Correlation I have always thought that since all Financial Instruments display Fractal Behaviour across different timeframes one could be long in the 5min whilst being Short in the 1h on the same Currency Pair otr indice etc etc .........if you introduce standardised Money management principles (as you've already mentioned) of say 1-2% per trade then actually they are totally different trades in risk/return terms and could superboost your Capital base over time........assuming you are calling it correctly !

so is this a new form of correlation Trading strategy using the same instrument ?..........

very interesting !

Neil

Would it be practical to be simultaneously LONG one pair and SHORT the other?

One of the problems with such a hedging strategy, would be that big losses could run up if the method began to diverge against the trader. Nothing correlates 100%.

But how would you enter a Stop Loss for a hedged trade?

Good point !

some (most?) correlation trading systems and strategies require multiple trades to implement the plan and exploit the correlation anticipated

trouble is (and ive seen this discussed in a lot of sites) you have no capability to create stop losses, as in each individual trade being made they are all part of a greater dynamic group of trades (ive heard them called clusters ?) sooooo its a real problemo and without manual monitoring if it goes wrong you are really in the dodo...and even manually you could go down real fast on short TF's before you hit the "abort" buttons

let me have a think and also we may get some more comments as well !

love the Long/short idea !.............regardless of Correlation I have always thought that since all Financial Instruments display Fractal Behaviour across different timeframes one could be long in the 5min whilst being Short in the 1h on the same Currency Pair otr indice etc etc .........if you introduce standardised Money management principles (as you've already mentioned) of say 1-2% per trade then actually they are totally different trades in risk/return terms and could superboost your Capital base over time........assuming you are calling it correctly !

so is this a new form of correlation Trading strategy using the same instrument ?..........

very interesting !

Neil

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

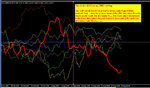

Eurchf_fxcorrelator

Hi Ingot54

aaaaaahhh..found it , just tidied it up a little and shes good to go !

I will post this in next post.....heres background

Ma200/Delta 3 .........a fairly standard setting i use

I've removed the other 6 currencies to isolate our Pair

Blue Euro , Grey Swissie

I've added a difference line (yellow) between the 2 currencies

The Zero horizontal line now becomes important to measure the variance to

the yellow line

to estimate o/b or o/s areas you will need to add two further horizontal lines (ive put them in yellow dotted).....then position these to where you feel that point is on particular TF being used (ie eyeball them in !)

in example below I have the lower line (oversold) showing (upper line is not showing) as that is where the pair have been considered to be oversold in the past based on my own judgement ......this i not a fix you see where the yellow line turned to impress you all - as it is based on historical information not on the picture

hey everyone try it out and give me feedback !

comment

confession - in actuality this is not a million miles away from looking at the pair in normal mode and introducing standard o/b o/s methodologies........however a normal pairs chart will not show you the slopes/relativity of the 2 Currencies in question or their relationships with the other Currecies at the points of o/b or o/soldness.....this is where we could create the edge to enhancing its success....!

Neil

Hi Ingot54

aaaaaahhh..found it , just tidied it up a little and shes good to go !

I will post this in next post.....heres background

Ma200/Delta 3 .........a fairly standard setting i use

I've removed the other 6 currencies to isolate our Pair

Blue Euro , Grey Swissie

I've added a difference line (yellow) between the 2 currencies

The Zero horizontal line now becomes important to measure the variance to

the yellow line

to estimate o/b or o/s areas you will need to add two further horizontal lines (ive put them in yellow dotted).....then position these to where you feel that point is on particular TF being used (ie eyeball them in !)

in example below I have the lower line (oversold) showing (upper line is not showing) as that is where the pair have been considered to be oversold in the past based on my own judgement ......this i not a fix you see where the yellow line turned to impress you all - as it is based on historical information not on the picture

hey everyone try it out and give me feedback !

comment

confession - in actuality this is not a million miles away from looking at the pair in normal mode and introducing standard o/b o/s methodologies........however a normal pairs chart will not show you the slopes/relativity of the 2 Currencies in question or their relationships with the other Currecies at the points of o/b or o/soldness.....this is where we could create the edge to enhancing its success....!

Neil

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

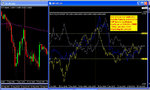

Eurchf_fxcorrelator file

here she is...........dontcha love remote access technology !

please get questions in today ....i'm away from internet access for 3 days from tonight as I have promised my wife we would go away for the long Bank holiday weekend.....

Neil

here she is...........dontcha love remote access technology !

please get questions in today ....i'm away from internet access for 3 days from tonight as I have promised my wife we would go away for the long Bank holiday weekend.....

Neil

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Ingot54

Well-known member

- Messages

- 403

- Likes

- 62

Hi NVP ... (still wondering what "NVP" stands for!)

I don't understand the benefit ... I mean, I don't understand how the correlation charts work, or what they do. Could you please give an example of how it works?

I am off to work shortly, and will also be chilling out on the weekend.

But I'm looking forward to further discussion on this early in the new week.

Thanks for all your work here - good stuff.

Chers and best wishes

Ivan

I don't understand the benefit ... I mean, I don't understand how the correlation charts work, or what they do. Could you please give an example of how it works?

I am off to work shortly, and will also be chilling out on the weekend.

But I'm looking forward to further discussion on this early in the new week.

Thanks for all your work here - good stuff.

Chers and best wishes

Ivan

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

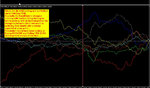

the Weekly EUR CHF 14th Dec 2008

In the chart(s) below, I have shown some subtle differences in the WEEKLY charts.

I think when looking at these divergances on the 1H TF, the opportunity must surely pop out at you n'est ce pas?[/QUOTE]

Hi Ingot54........its lunchtime so time for some posting !

I have had a look at your post and weekly chart and just some thoughts / observations as I would have read it.........(see the attached below)...unfortunately I do not tend to extend to weekly charts on my indicator as with a 200Ma standard setting the 4h's are quite long enough for my taste

looks like these Bars were around Mid Dec 2008 so i have commented on this period of time.........

Chart 1 attached is my standard 200/3 on the 4h so we can see what was happening

Boy the Euro(Blue) was doing well ! (I remember that time as we went on holiday to Europe and it cost me a fortune in sterling tems )...I would have been recommending a strong buy against (Guess) the USD/Yen until such times as it looked overbought.....sorry not sure if it was at the time....the EURCHF things was interesting (See Below) but not on my radar until Euro started Falling (as it is more volatile than the CHF)

Chart 2 now gets closer to your weekly chart and observation of the Bar movements....

the 14th Dec 2008 week was actually when the CHF started fighting back against the Euro and bounced off its 200ma into a nice nice move downwards (left hand chart)

EDIT ENTRY !

SPOTTED MISTAKE ON CHART 2 - SHOULD READ EURO OVERBOUGHT to CHF (DOH!) - sorry

on the right hand side this was "spotted" on the shorter TF 4h's as the Euro was showing as potentially overbought against the CHF and a reversal/Correction may be imminent

Buy CHF Sell Euro as the yellow line started falling back downwards.......to be honest in Chart 1 there was plenty of signals out there re buying these guys whilst selling USD or Yen so i might have ignored this opportunity.....interestingly the big money got made on the EUR/CHF play when they both reveresed in Strength vs the USD/YEN (this is common as the stronger currency driving the divergence suddenly folds against everyone, not just the targeted Currency in Question)

Now in truth its not this easy......MA's can make everything look simple and in reality the opportunity has gone before the trading signal has materialised......but i'm just using this as Demo only to comment on the Charts you posted

Thats the beauty of Trading ...you can make money a lot of ways (and lose it of course)

Neil

In the chart(s) below, I have shown some subtle differences in the WEEKLY charts.

I think when looking at these divergances on the 1H TF, the opportunity must surely pop out at you n'est ce pas?[/QUOTE]

Hi Ingot54........its lunchtime so time for some posting !

I have had a look at your post and weekly chart and just some thoughts / observations as I would have read it.........(see the attached below)...unfortunately I do not tend to extend to weekly charts on my indicator as with a 200Ma standard setting the 4h's are quite long enough for my taste

looks like these Bars were around Mid Dec 2008 so i have commented on this period of time.........

Chart 1 attached is my standard 200/3 on the 4h so we can see what was happening

Boy the Euro(Blue) was doing well ! (I remember that time as we went on holiday to Europe and it cost me a fortune in sterling tems )...I would have been recommending a strong buy against (Guess) the USD/Yen until such times as it looked overbought.....sorry not sure if it was at the time....the EURCHF things was interesting (See Below) but not on my radar until Euro started Falling (as it is more volatile than the CHF)

Chart 2 now gets closer to your weekly chart and observation of the Bar movements....

the 14th Dec 2008 week was actually when the CHF started fighting back against the Euro and bounced off its 200ma into a nice nice move downwards (left hand chart)

EDIT ENTRY !

SPOTTED MISTAKE ON CHART 2 - SHOULD READ EURO OVERBOUGHT to CHF (DOH!) - sorry

on the right hand side this was "spotted" on the shorter TF 4h's as the Euro was showing as potentially overbought against the CHF and a reversal/Correction may be imminent

Buy CHF Sell Euro as the yellow line started falling back downwards.......to be honest in Chart 1 there was plenty of signals out there re buying these guys whilst selling USD or Yen so i might have ignored this opportunity.....interestingly the big money got made on the EUR/CHF play when they both reveresed in Strength vs the USD/YEN (this is common as the stronger currency driving the divergence suddenly folds against everyone, not just the targeted Currency in Question)

Now in truth its not this easy......MA's can make everything look simple and in reality the opportunity has gone before the trading signal has materialised......but i'm just using this as Demo only to comment on the Charts you posted

Thats the beauty of Trading ...you can make money a lot of ways (and lose it of course)

Neil

Attachments

Technically Fundamental

Senior member

- Messages

- 2,810

- Likes

- 178

I thought that correlation and inter-market analysis factored only in decision making decision making... :-/ If you're making trades based on correlation shouldn't you just pick the ones that offers the highest return for the least risk and size accordingly otherwise you're just paying twice the commission.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Nvp ?.......

Hi Ivan

using Dynamic and innnovative thinking...........its my initials (!!!)

if only my trading plans were that logical

Without going through all your posts I have to ask the obvious....is that you and if so do you work on Fishing Trawlers ? (and there we were getting on so well)

Neil

PS the Avatar is the earliest example of Correlation Charts by a chap called

Jackson Pollock.....unfortunately he tried to corrolate 80 Global currencies on one chart and it looked like this.............Still got about $40m for it at last auction I believe, so hope for us all !

Hi Ivan

using Dynamic and innnovative thinking...........its my initials (!!!)

if only my trading plans were that logical

Without going through all your posts I have to ask the obvious....is that you and if so do you work on Fishing Trawlers ? (and there we were getting on so well)

Neil

PS the Avatar is the earliest example of Correlation Charts by a chap called

Jackson Pollock.....unfortunately he tried to corrolate 80 Global currencies on one chart and it looked like this.............Still got about $40m for it at last auction I believe, so hope for us all !

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

More info.........

Hi TF and welcome !

Please could you elaborate a little here......I can then show my lack of knowledge in so many areas of this subject and call for help !

Neil

I thought that correlation and inter-market analysis factored only in decision making decision making... :-/ If you're making trades based on correlation shouldn't you just pick the ones that offers the highest return for the least risk and size accordingly otherwise you're just paying twice the commission.

Hi TF and welcome !

Please could you elaborate a little here......I can then show my lack of knowledge in so many areas of this subject and call for help !

Neil

Technically Fundamental

Senior member

- Messages

- 2,810

- Likes

- 178

I don't know much about it myself mate, I'm just learning like you.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

http://www.trade2win.com/boards/forex-strategies-systems/25774-correlation-strategy.html

sorry this has been posted twice !!!!

sorry this has been posted twice !!!!

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Gone Fishing.....

hmmm - This looks interesting...and some Heavy dudes involved in the Discussions

http://www.trade2win.com/boards/forex-strategies-systems/25774-correlation-strategy.html

seems to have gone flat though Despite some superb (non) comments from me at the time

Neil

hmmm - This looks interesting...and some Heavy dudes involved in the Discussions

http://www.trade2win.com/boards/forex-strategies-systems/25774-correlation-strategy.html

seems to have gone flat though Despite some superb (non) comments from me at the time

Neil

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

checkout Post #23 in above

Hoorah - thanks Anna at last an explanation for this pitiful Thread......

correlation currencies currency trading pairs correlate euro dollar dollar swiss positive negative

this outlines the Grid references earlier in thread and the +/- percentages that most people associate with correlations.....and theres a Breadmaking page !

I will show you how these apply to my FXCORRELATOR chart Next

more hunting, hunting...........

Neil

Hoorah - thanks Anna at last an explanation for this pitiful Thread......

correlation currencies currency trading pairs correlate euro dollar dollar swiss positive negative

this outlines the Grid references earlier in thread and the +/- percentages that most people associate with correlations.....and theres a Breadmaking page !

I will show you how these apply to my FXCORRELATOR chart Next

more hunting, hunting...........

Neil

Similar threads

- Replies

- 0

- Views

- 3K