Neil,

if you concentrated on this full time, how many trades do you think you would make in the average day? Say for theory's sake you could keep your eye on it all and would see all the opportunities as they arose, and actually took all the opportunities that pan out into trades?

Ouch !!! - thats a

very good question

😏

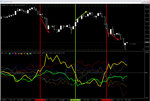

if we stuck to the letter of the scalper rules I would look for opportunities to trade everytime the yen and Dollar crossed the zero on same side on the 1min and 5 min corries

I figure an average day (8am to say 4pm) thats about 6-8 pure (above and below Zero) signals on the 5 min charts from which to then use the 1m charts to confirm

(see the attachment for about 1 an hour below today)

then of course you can sometimes ride multiple scalps on the 1 minute TF from the same signal on the 5 min (actually the best signals are second or even third time around as the 1 min lines cross back again into same side of zero as the continuing 5min signal)

and then of course you will get 2-3 or more currencies all giving the same trade signal when the tag team really diverges away from the Zero on a big risk play in the markets

so the answer is plenty of signals if I took them all - and thats just using the basic scalp rules

😱

(naturally after more than a year of playing we now have many many variations on MA/Delta settings and entry values)

you can fine tune a little by introducing the DJ as an (inverse) confirmation of the Tag move....ive explained this a lot on the thread I think now....

and you can again fine tune when you look at the pair signalled by only trading if decent Price Action is being seen/confirmed and using common sence regarding entry points...

but it doesnt stop there........

I like the USDJPY trade a lot and would certainly add that to the mix (commented on a few months back on thread)

and in truth i'm a sucker for a big move on either CAD or the GBP

regardless of what the Tag team are doing - as their mega volatilities (assuming they follow through) will always generate pippage even if the USD moves in their same direction

this is before we discuss higher Timeframes - which I (we) could trade on the scalper settings still using 2 timeframes (eg a 4h and 1h for confirmation).

😴😴

Yes folks - I wish i could, but i just cant get comfortable with higher Timeframes.....I want pips and I want them

NOW

gut feel tells me 3-5 decent scalps an hour targeting an average of 5 net pips a trade (some will be better if I get a decent legup/run and some will be culled rapidly on small losses).......so averaging 20+ pips an hour (net) would be just grand for me (based on naturally allocating a fairly decent $ per pip stake) - but it would also be very hard work as a lot of concentration is needed and hesitation is not tolerated.....and I would need to get some experience under my belt again before seriously hitting the pedal and trading with real money.

but we have the core system/rules here - we just have to follow it and become totally at one and effortless with using it - like a fighter pilot is with his plane.

Remember in trading its not the pips you make....its how much you bet per pip that pays the bills

theres people out there boasting hundreds of pips a trade , but thats relatively easy if you gear up to the 4h charts and above with big big stop losses in place ....and of course ease back your $ per pip to peanuts (as any realistic trader must do as % of pot)

why a wait a day (and all the incredible events than can happen in 24 hours) for the same

$ return you could deliver in a good hours focused scalping ?

Is that ok Adamus......ive forgotten the question ? hahahaha :

😛

N