You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

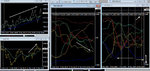

Thanks to Neil, I've made a few settings adjustments on Corrie. He's, also, got me thinking more about trading off a shorter tf.

I'm going to try and upload a GBP/JPY trade set up from today. One is my 1 min trading chart, with all the bells and whistles, and the other is a 1 min dual Corrie. You will see where the entry point was on both of them. I didn't take this trade as I was being ultra careful with the new set up.

It's been a while since I uploaded charts and have forgotten how to do it so, if nothing appears, it's down to my PC incompetence.

wow !........looks interestng mate ......keep it running here as and when you can - sharing what you are lookng for.....my only worry is the combination of words scalping and GPBJPY ! 😛

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

mornin all.....😴

dj30 was up in the night alongside the nikkei not shown )

tag been falling of course......so lets see what happens next

on the 1hr chart (right side).....Euro continues to trail along the bottom vs that huge low of last week .....so lets see if its a dramatic rise now or it falls off the cliff

CAD (brown )doing well this week.....sue oils doing well but it hasnt really spiked so far this week though so its all economics

later👍

N

dj30 was up in the night alongside the nikkei not shown )

tag been falling of course......so lets see what happens next

on the 1hr chart (right side).....Euro continues to trail along the bottom vs that huge low of last week .....so lets see if its a dramatic rise now or it falls off the cliff

CAD (brown )doing well this week.....sue oils doing well but it hasnt really spiked so far this week though so its all economics

later👍

N

Attachments

alan5616

Established member

- Messages

- 934

- Likes

- 200

wow !........looks interestng mate ......keep it running here as and when you can - sharing what you are lookng for.....my only worry is the combination of words scalping and GPBJPY ! 😛

N

Might be better to substitute USD for JPY in that case. Less brown trouser moments😀

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Might be better to substitute USD for JPY in that case. Less brown trouser moments😀

Hi mate

for me its all about getting the right volatility blend at the right time

heres my take on the average G8 volatility levels....clearly if news comes

out on a currency thats going to influence its activity dramatically

TAG TRIBE (Green) , Eurotribe (Blue), Commdolls (gold)

highest to Lowest :-

GBP,YEN

CAD,NZD

AUD,EUR,USD

CHF

open up the FXCorrelator based on the 20ma delta 1 , and watch the higher and lower levels achieved by the currencies as they interact ..

This will show how I have based the ratings (excluding extraordinary news events) ....for example to prove that the CHF (grey on the corrie) is the lowest try to find examples when that little dude is either scoring the highest or the lowest strength rating......and dont hold your breath !

likewise its very very rare to see a situation when theres not a GBP(red) and/or a Yen (yellow) commanding the top or bottom half....thats why they are the volatility kings !

in my opinion therefore the GBPJPY is Brilliant for matching 2 traditionally negatively correlated currencies BUT the uber-volatility (as they share the top spot above) means the whipsaws will kill you, so its a boom or bust trade every time...

so from above the reason people like the following pairs is that they blend well as regards different volatilities and are in opposing tribes.

This is pretty obvious if you are a corrie follower as it makes observations/trades based on the unique personality of currencies and their dynamic interactions :smart:

GBPUSD

JPYEUR*

so mix up your volatilities and tribes to make money !

N

** actually I ignore this pair to much......note to me to explore that avenue a little more !

Last edited:

Thanks to Neil, I've made a few settings adjustments on Corrie. He's, also, got me thinking more about trading off a shorter tf.

I'm going to try and upload a GBP/JPY trade set up from today. One is my 1 min trading chart, with all the bells and whistles, and the other is a 1 min dual Corrie. You will see where the entry point was on both of them. I didn't take this trade as I was being ultra careful with the new set up.

It's been a while since I uploaded charts and have forgotten how to do it so, if nothing appears, it's down to my PC incompetence.

Interesting stuff Alan. How & where would you have exited here, and which timezone are your charts on?

- Gavin

alan5616

Established member

- Messages

- 934

- Likes

- 200

Interesting stuff Alan. How & where would you have exited here, and which timezone are your charts on?

- Gavin

Hi Gavin,

I'm on Alpari time zone (CET). The exit point would have been once the green MAs start to cross into the purple ones. Sticking to the strict rules of the system, this trade would have made 100 pips

alan5616

Established member

- Messages

- 934

- Likes

- 200

I've zoomed in on this one so, that you can see the chart, itself, more clearly.

You'll notice that the entry signal is all green MAs below maroon and below the 50ema. Stoch histogram is red, both QQEs are going down and the shorter tf QQE has crossed the 50 line. RSI sidewinder is red.

In fact, to be honest, the entry is a couple of mins late. However it would have been good for about 20 pips (incl spread). As I write, it's had another drop but, too late!!

You'll notice that the entry signal is all green MAs below maroon and below the 50ema. Stoch histogram is red, both QQEs are going down and the shorter tf QQE has crossed the 50 line. RSI sidewinder is red.

In fact, to be honest, the entry is a couple of mins late. However it would have been good for about 20 pips (incl spread). As I write, it's had another drop but, too late!!

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

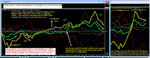

heres the scalper action this morning...have a read of the chart to help understand what we are looking for...yes you can trade blindly selling and buying currencies if both are on same sides of the zero (on 1min and 5min Timeframes) ...but some finess in needed to understand the 1m chart and only trade when divergence is being seen as well

same principles as Stochastics/macd's if you use them...you are looking for divergence confirmation on the 1min

most best scalps have been on the G/U so far (trading both sides of the buy and Sell)

N

same principles as Stochastics/macd's if you use them...you are looking for divergence confirmation on the 1min

most best scalps have been on the G/U so far (trading both sides of the buy and Sell)

N

Attachments

I've zoomed in on this one so, that you can see the chart, itself, more clearly.

You'll notice that the entry signal is all green MAs below maroon and below the 50ema. Stoch histogram is red, both QQEs are going down and the shorter tf QQE has crossed the 50 line. RSI sidewinder is red.

In fact, to be honest, the entry is a couple of mins late. However it would have been good for about 20 pips (incl spread). As I write, it's had another drop but, too late!!

Where does the Correlator come in? Top v. bottom?

I only had an entry on this after the data release at 9.35 which I thought initially was going to be too late, but fortunately I trusted my charts over my woeful judgment!

jrplimited

Active member

- Messages

- 249

- Likes

- 1

Hi N and anyone else,

Finished a bit earlier than usual so straight into this morning's bun fight....

GU; First trade entered long at 49102 on open 08:15 bar, price went into immediate reverse and took out SL during 08:25 bar for 21 point loss. Second trade entered short at 48814 (bit of slippage here) on open 08:40 bar, price shot down then went into nine bar range phase, 09:30 bar kicked price back onto southbound freeway again and made new 10:05 local low print, small weak rally followed then price moved down to challenge last low print, rallied feebly again and moved down to new 10:55 local low print then rallied once more with some force and took out TS during 11:20 bar for 102 points profit.

EU; Had to wait until 08:40 bar for signal, short entered at 26441 on open 08:45 bar, price went down slightly then retraced for five bars then momentum rode to rescue and pushed price back down without any real pauses to 10:00 new local low, weak rally followed and price moved down again to about match last low print then 10:40 bar popped up talking out TS for 57 points profit.

EG; Chart was complete mess for first part of session so left this pair alone this morning. With both Great British peso and Euro rouble in decline in tandem up until around elevenish, there wasnt really much prominent price action missed out on here.

So, who upset G and E this morning? Obviously U is a "safe" haven with their massive trillion Dollar plus defecit.... Hmmm, that doesnt seem to add up! Trade well and regards,

Simon.

Finished a bit earlier than usual so straight into this morning's bun fight....

GU; First trade entered long at 49102 on open 08:15 bar, price went into immediate reverse and took out SL during 08:25 bar for 21 point loss. Second trade entered short at 48814 (bit of slippage here) on open 08:40 bar, price shot down then went into nine bar range phase, 09:30 bar kicked price back onto southbound freeway again and made new 10:05 local low print, small weak rally followed then price moved down to challenge last low print, rallied feebly again and moved down to new 10:55 local low print then rallied once more with some force and took out TS during 11:20 bar for 102 points profit.

EU; Had to wait until 08:40 bar for signal, short entered at 26441 on open 08:45 bar, price went down slightly then retraced for five bars then momentum rode to rescue and pushed price back down without any real pauses to 10:00 new local low, weak rally followed and price moved down again to about match last low print then 10:40 bar popped up talking out TS for 57 points profit.

EG; Chart was complete mess for first part of session so left this pair alone this morning. With both Great British peso and Euro rouble in decline in tandem up until around elevenish, there wasnt really much prominent price action missed out on here.

So, who upset G and E this morning? Obviously U is a "safe" haven with their massive trillion Dollar plus defecit.... Hmmm, that doesnt seem to add up! Trade well and regards,

Simon.

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hi N and anyone else,

GU; First trade entered long at 49102 on open 08:15 bar, took out SL during 08:25 bar for 21 point loss. Second trade entered short at 48814 (bit of slippage here) on open 08:40 bar, and took out TS during 11:20 bar for 102 points profit.

EU; Had to wait until 08:40 bar for signal, short entered at 26441 on open 08:45 bar, then 10:40 bar popped up talking out TS for 57 points profit.

EG; Chart was complete mess for first part of session so left this pair alone this morning. With both Great British peso and Euro rouble in decline in tandem up until around elevenish, there wasnt really much prominent price action missed out on here.

So, who upset G and E this morning? Obviously U is a "safe" haven with their massive trillion Dollar plus defecit.... Hmmm, that doesnt seem to add up! Trade well and regards,

Simon.

hey mate ...a ton on G/U....been a while here since seeing that...nice going 👍

ladies and gentlemen...our very own JRP :smart:

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Before we become a mutual appreciation society 🙂whistling), as a big fan of JRP heres a 5 min Hybrid corrie showing just how good those trades were this morning by our resident gunslinger....

My correlation and system approach is different to JRP's.....but boy oh boy do I like what he does

day in and day out :smart:

virtually impossible to squeese any more out this morning if you look at the chart below, and JRP demonstrated how to stay in till the bitter end in case they all went again 👍

This customised hybrid chart (alongside a lot of others 🙄) will be in my corrie pack available soon :smart:

later.......

N

My correlation and system approach is different to JRP's.....but boy oh boy do I like what he does

day in and day out :smart:

virtually impossible to squeese any more out this morning if you look at the chart below, and JRP demonstrated how to stay in till the bitter end in case they all went again 👍

This customised hybrid chart (alongside a lot of others 🙄) will be in my corrie pack available soon :smart:

later.......

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Before we become a mutual appreciation society 🙂whistling), as a big fan of JRP heres a 5 min Hybrid corrie showing just how good those trades were this morning by our resident gunslinger....

My correlation and system approach is different to JRP's.....but boy oh boy do I like what he does

day in and day out :smart:

virtually impossible to squeese any more out this morning if you look at the chart below 👍

This customised hybrid chart (alongside a lot of others 🙄) will be in my corrie pack available soon :smart:

later.......

N

perhaps i will call it a Takeaway Corrie..........😢

N

Hi N and anyone else,

Finished a bit earlier than usual so straight into this morning's bun fight....

GU; First trade entered long at 49102 on open 08:15 bar, price went into immediate reverse and took out SL during 08:25 bar for 21 point loss. Second trade entered short at 48814 (bit of slippage here) on open 08:40 bar, price shot down then went into nine bar range phase, 09:30 bar kicked price back onto southbound freeway again and made new 10:05 local low print, small weak rally followed then price moved down to challenge last low print, rallied feebly again and moved down to new 10:55 local low print then rallied once more with some force and took out TS during 11:20 bar for 102 points profit.

EU; Had to wait until 08:40 bar for signal, short entered at 26441 on open 08:45 bar, price went down slightly then retraced for five bars then momentum rode to rescue and pushed price back down without any real pauses to 10:00 new local low, weak rally followed and price moved down again to about match last low print then 10:40 bar popped up talking out TS for 57 points profit.

EG; Chart was complete mess for first part of session so left this pair alone this morning. With both Great British peso and Euro rouble in decline in tandem up until around elevenish, there wasnt really much prominent price action missed out on here.

So, who upset G and E this morning? Obviously U is a "safe" haven with their massive trillion Dollar plus defecit.... Hmmm, that doesnt seem to add up! Trade well and regards,

Simon.

Hi Simon

Interestingly I got some similar results on the $ pairs this morning, 82 from one trade on cable, 50 from €$... if my system is beginning to resemble your trades, it must finally be on the right lines :clap:

I also took a leaf out of your book and took the rest of the day off; sat in the sun, planted some spuds (not very pirate-like I know) - it's great! I could get used to this... shame it won't last.

- Gavin

P.S. Maybe if I bought that great-looking Delphi system I could do this every day!

jrplimited

Active member

- Messages

- 249

- Likes

- 1

Hi Simon

Interestingly I got some similar results on the $ pairs this morning, 82 from one trade on cable, 50 from €$... if my system is beginning to resemble your trades, it must finally be on the right lines :clap:

I also took a leaf out of your book and took the rest of the day off; sat in the sun, planted some spuds (not very pirate-like I know) - it's great! I could get used to this... shame it won't last.

- Gavin

P.S. Maybe if I bought that great-looking Delphi system I could do this every day!

Hi Gavin,

Sounds like you too had a great morning session so congrats there, I think tomorrow is going to be a classic case of fighting to keep today's profits protected! Being a tad gung-ho thats gouing to be hard for me....

It would be interesting for you to do a quick back of fag packet check on all your PM trades results to see whether or not trading during that session warrants the tremendous effort required. Personally speaking, the mucho chango trousers during morning sessions doesnt really inspire me to stock up wardrobe for afternoon sessions!

Saw a comment you made on your excellent thread re exits and I'll mail you with a couple of ideas over next few days - best regards,

Simon.

Hi Gavin,

Sounds like you too had a great morning session so congrats there, I think tomorrow is going to be a classic case of fighting to keep today's profits protected! Being a tad gung-ho thats gouing to be hard for me....

It would be interesting for you to do a quick back of fag packet check on all your PM trades results to see whether or not trading during that session warrants the tremendous effort required. Personally speaking, the mucho chango trousers during morning sessions doesnt really inspire me to stock up wardrobe for afternoon sessions!

Saw a comment you made on your excellent thread re exits and I'll mail you with a couple of ideas over next few days - best regards,

Simon.

Great, thanks Simon, I'll look forward to that with interest. Fine line between keeping your profits & getting knocked out too early.

Good idea on the PM check. I should have marked them seperately on my EOD lists. Be good to confirm the suspicion as fact, as it is tough keeping the concentration levels up.

- Gavin

EOD report: http://www.trade2win.com/boards/trading-journals/91616-icc-forex-system-testing.html#post1126888

Last edited:

Before we become a mutual appreciation society 🙂whistling), as a big fan of JRP heres a 5 min Hybrid corrie showing just how good those trades were this morning by our resident gunslinger....

My correlation and system approach is different to JRP's.....but boy oh boy do I like what he does

day in and day out :smart:

virtually impossible to squeese any more out this morning if you look at the chart below, and JRP demonstrated how to stay in till the bitter end in case they all went again 👍

This customised hybrid chart (alongside a lot of others 🙄) will be in my corrie pack available soon :smar

Similar threads

- Replies

- 0

- Views

- 3K