jrplimited

Active member

- Messages

- 249

- Likes

- 1

Hi N and all,

Fantastic weekend weather wise, has summer started to arrive? Do politicians "distort" the truth? Enough of the dribble....

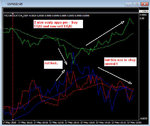

GU; First trade long entered at 44217 on open 08:05 bar, price started to climb rather reluctantly then collapsed in a heap taking out SL during 08:35 bar for 21 point loss. Second trade short entered at 43998 on open 08:40 bar, price shot down then went into a four bar range and wick of 09:05 bar caught TS for 15 point profit. Third trade buy stop at 44284 filled by 10:05 bar, price moved up after stalling then rolled over taking out SL during 10:50 bar for 21 point loss. Three trades (or rather two beatings!) and thats it for me on this pair.

EU; First trade buy stop at 23144 filled during 08:05 bar, price rose up slightly then collapsed in a heap taking out SL during 08:40 bar for 18 point loss. Second trade sell stop at 22694 filled during 08:45 bar, price jammed on the brakes, engaged reverse gear and ran over SL during 09:10 bar for 18 point loss. Two hits on the bounce and thats it for me pair wise.

EG; For first part of morning session chart was very confused so had to wait until past 09:30 for things to sort themselves out. First trade entered long at 85409 on open 10:40 bar, price started to drift downwards for five bars threatening SL but then large 11:10 up bar came to rescue and pushed price upwards to new 11:20 local high, price went sideways for three bars challenging last high print then it gave up the ghost and started to float downwards and trade exited on close of 11:40 bar for 8 points profit.

A real bad case of the chop monster raging around and eating up everything in its sight, talk about more chop suey this morning than in a chinese resturant! Goodness knows whats really going on, maybe you afternoon traders will see a bit of stability returning - trade well and regards,

Simon.

Fantastic weekend weather wise, has summer started to arrive? Do politicians "distort" the truth? Enough of the dribble....

GU; First trade long entered at 44217 on open 08:05 bar, price started to climb rather reluctantly then collapsed in a heap taking out SL during 08:35 bar for 21 point loss. Second trade short entered at 43998 on open 08:40 bar, price shot down then went into a four bar range and wick of 09:05 bar caught TS for 15 point profit. Third trade buy stop at 44284 filled by 10:05 bar, price moved up after stalling then rolled over taking out SL during 10:50 bar for 21 point loss. Three trades (or rather two beatings!) and thats it for me on this pair.

EU; First trade buy stop at 23144 filled during 08:05 bar, price rose up slightly then collapsed in a heap taking out SL during 08:40 bar for 18 point loss. Second trade sell stop at 22694 filled during 08:45 bar, price jammed on the brakes, engaged reverse gear and ran over SL during 09:10 bar for 18 point loss. Two hits on the bounce and thats it for me pair wise.

EG; For first part of morning session chart was very confused so had to wait until past 09:30 for things to sort themselves out. First trade entered long at 85409 on open 10:40 bar, price started to drift downwards for five bars threatening SL but then large 11:10 up bar came to rescue and pushed price upwards to new 11:20 local high, price went sideways for three bars challenging last high print then it gave up the ghost and started to float downwards and trade exited on close of 11:40 bar for 8 points profit.

A real bad case of the chop monster raging around and eating up everything in its sight, talk about more chop suey this morning than in a chinese resturant! Goodness knows whats really going on, maybe you afternoon traders will see a bit of stability returning - trade well and regards,

Simon.