You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

alan5616

Established member

- Messages

- 934

- Likes

- 200

god and now eurozone fall under the tag hammer.....unbelievable action !

Hi N et al,

Certainly some action this afternoon. The CAD/JPY is selling off big time. Unfortunately, still feeling a bit groggy after the anaesthetic so, daren't partake in all this pip gathering ammo. I'm likely to press sell when I mean to buy and vice versa. I'll wait until Monday. Have a good weekend all.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

gotta go into meetings now but wanted to conclude the week with that U/J stuff

here it is....anyone who bought the Jason fielder correlation code stuff a while back (not the new stuff coming).....was this play on that system ?.....I only saw the Gbp aggressive trade into euro if Euro lead GBP into a usd trade on there....

all well worth the $2,000 cost i'm sure 😛

later

N

here it is....anyone who bought the Jason fielder correlation code stuff a while back (not the new stuff coming).....was this play on that system ?.....I only saw the Gbp aggressive trade into euro if Euro lead GBP into a usd trade on there....

all well worth the $2,000 cost i'm sure 😛

later

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hi N et al,

Certainly some action this afternoon. The CAD/JPY is selling off big time. Unfortunately, still feeling a bit groggy after the anaesthetic so, daren't partake in all this pip gathering ammo. I'm likely to press sell when I mean to buy and vice versa. I'll wait until Monday. Have a good weekend all.

Hey Alan

welcome back.......hope you are feeling ok

Save some of that juice for JRP......its cheaper than red wine 😆

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Nothing here, had a pretty bad trade at 16:00, indicator clearly signalled short and found myself caught in a rally upwards. S/L was taken out at 20 pips. With the single pair trading, my risk/reward ratio is pretty bad. Need to rethink my stops again.

hey mate....its all there in your head.....just let it flow and watch the distractions ....youre a cotton bailer like me so you cannot do it all at the same time 😴

N

alan5616

Established member

- Messages

- 934

- Likes

- 200

Hey Alan

welcome back.......hope you are feeling ok

Save some of that juice for JRP......its cheaper than red wine 😆

N

Thanks Neil. It's a lot more powerful than red wine too, no matter how much JRP drinks of it🙂

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

load the correlator (use tigloos's new one)

Are we talking MetaTrader only? I'm using NinjaTrader.

if you're serious about trading both GBPUSD and EURUSD then have a look at

http://www.google.com/finance?chdnp...046224&chddm=2291079&q=CURRENCY:EURGBP&ntsp=0

(the link will show a chart of the EURGBP price)

You can see that the pair was moving sideways in a narrow range, this means that in general EURUSD and GBPUSD are highly correlated. If you look for example at mataf.net, you will get a similar impression.

The GBP will probably move more independently from the Euro at the moment due to the financial stability of Greece and the crisis aftershock.

However, if you are trading both GBPUSD and EURUSD, you will usually increase your exposure to the USD. If correlation is meaningful to your system because the spikes in correlation are giving you better trading opportunities, then I would certainly factor it in. If correlation is not meaningful to you, I would restrict my trades to either GBPUSD or EURUSD, whichever pair will provide better opportunities for you.

My current nascent trading strategy has no notion of correlation, I wanted to be able to monitor it on the screen in the eventuality that I have simultaneous £$ and €$ trades on.

Excellent little widget for scaling the graph. Trust google to think up something nifty like that. The £€ looks like the Crude chart. Well, almost. A big injection of volatility. My main challenge currently is to find a mechanism that works at both levels of volatility.

I'm backtesting a trend-following system using hourly bars and trailing stops, so there is a likelihood that I'll have simultaneous trades on, and this will show up already in my backtesting in the combined portfolio results.

At some stage when I've got things up and running, the idea is to build in the correlation factor if it can boost my profits or reduce my drawdowns.

Thanks for the input, all you Correlados. It's difficult to get my head around the indicator without thinking about it slowly in monosyllables - so when a currency line is dropping on the correlator, that means that it is falling relative to all the other currencies on the chart?

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hi Adamus

Firstly can I apologise to you and the many many viewers that keep an eye on this thread or find it via a recommendation......and then come to see what the fuss us ....

I gotta be honest (hold my hand up :whistling) when I say that this thread is as user friendly as the Ghengis Khan (world conquest tour) complaints desk !

Its grown and evolved into a monster...and I forget that I created it nearly 9 months ago now - and I was playing solely with strengthmeters for easily a year or so before that I think

to me (like anyone who finds their trading path) Strengthmeters are the real world of charts and I think everyone else is familiar with it as well 🙄

anyway - yes we are metatrader....I have had requests for versions on other software but I am to programming what Mike Tyson is to flower arranging :innocent:....so its not happening.......happy to work with people who want to do it though.

I use ODL securities version.....in fact I will talk to them and get some kind of deal for people who mention the FXCorrelator....I had to drop 100 quid in the pot to keep the software up permanantly (alan didnt 😕)

the trial mt4 version is free anyway but you lose it after a month and have to reload.....

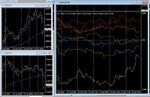

the FXcorrelator is a simple strengthmeter and the strength is based on each currencies relative position to the others (above / below)......you can get technical and play with the relative values of each line but I dont go there myself (techies welcome to).....the zero represents the average of the whole G8 basd on the MA setting being used.....above the Zero = stronger that average of G8 ....below = weaker than average of G8

I recomended the 1000/1 setting as at this very high level the ma has no distorting effect on the relativity of the prices to each other......divergence is true divergence and the same with convergence .....the vaues can be used as a true reading

not all corrie followers like this setting / aproach though and go for lower MA's...........all you have to remember though is that lower ma's mean much more relative strength distortion (as the whipsaw effect cuts in above below the zero line on lower ma)...........in programming / EA terms though tihs can be better as divergence between 2 currencies can be more esaily identified if one is simply above and one is simply below the line (which will be happening much more freqently at lower ma's)

so at the 1000/1 setting up is stronger and down is weaker...its that straightforward

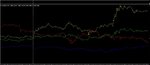

heres yesterday on 2 X 5min setting (4 currs on chart , G,E,Y,U)......youcan see the convergence and divergence relative clearly

1= 1000/1 where its straightforward and simple up is up and down is down

2= 20/1 setting where you could identify divergence/convergence more quickly by seeing which currencies are above or below the zero (20ma) line

both are useful in different ways

N

Firstly can I apologise to you and the many many viewers that keep an eye on this thread or find it via a recommendation......and then come to see what the fuss us ....

I gotta be honest (hold my hand up :whistling) when I say that this thread is as user friendly as the Ghengis Khan (world conquest tour) complaints desk !

Its grown and evolved into a monster...and I forget that I created it nearly 9 months ago now - and I was playing solely with strengthmeters for easily a year or so before that I think

to me (like anyone who finds their trading path) Strengthmeters are the real world of charts and I think everyone else is familiar with it as well 🙄

anyway - yes we are metatrader....I have had requests for versions on other software but I am to programming what Mike Tyson is to flower arranging :innocent:....so its not happening.......happy to work with people who want to do it though.

I use ODL securities version.....in fact I will talk to them and get some kind of deal for people who mention the FXCorrelator....I had to drop 100 quid in the pot to keep the software up permanantly (alan didnt 😕)

the trial mt4 version is free anyway but you lose it after a month and have to reload.....

the FXcorrelator is a simple strengthmeter and the strength is based on each currencies relative position to the others (above / below)......you can get technical and play with the relative values of each line but I dont go there myself (techies welcome to).....the zero represents the average of the whole G8 basd on the MA setting being used.....above the Zero = stronger that average of G8 ....below = weaker than average of G8

I recomended the 1000/1 setting as at this very high level the ma has no distorting effect on the relativity of the prices to each other......divergence is true divergence and the same with convergence .....the vaues can be used as a true reading

not all corrie followers like this setting / aproach though and go for lower MA's...........all you have to remember though is that lower ma's mean much more relative strength distortion (as the whipsaw effect cuts in above below the zero line on lower ma)...........in programming / EA terms though tihs can be better as divergence between 2 currencies can be more esaily identified if one is simply above and one is simply below the line (which will be happening much more freqently at lower ma's)

so at the 1000/1 setting up is stronger and down is weaker...its that straightforward

heres yesterday on 2 X 5min setting (4 currs on chart , G,E,Y,U)......youcan see the convergence and divergence relative clearly

1= 1000/1 where its straightforward and simple up is up and down is down

2= 20/1 setting where you could identify divergence/convergence more quickly by seeing which currencies are above or below the zero (20ma) line

both are useful in different ways

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

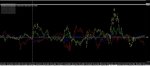

heres the week in focus on a 1 hr corrie 1000/1

See how the dj30 drove the yen up and down in the classic inverse relationship ?

I call the usd and the yen the tag team as they do tend to walk the same path as a small "tribe" unto themselves......even more prominently when Gold and DJ30 are relating as well

trade of the week was Tue/wed when dj30 got jiggy in northerly direction driving yen south.....usd was induced to fall in sympathy to its bosum buddy a little....but the stagnent gold price meant it was not going to move that much in response (correlator team note the classic buy u/J signal here re tag direction - and the opposite sell U/J signal later in week)

however in the markets its not just what is happening that is important ....its what is NOT happening that can be just as important in certain dynamics

on thursday yen starting coming north on not to much DJ30 bear action.....that meant yen wanted to be strong again regardless of the markets (profit taking?) ....the sure as eggs is eggs the market fell and yen went ballistic.....on friday it was the munchmaster on all the other G7 including the USD.....(witness my pathetic scalps yesterday on U/J whilst yen was destroying all in its path)

oh well....each week I learn a little more and hindsight is 20/20 vision !

have good weekends all....looks like a good one....

Neil

(NVP)

See how the dj30 drove the yen up and down in the classic inverse relationship ?

I call the usd and the yen the tag team as they do tend to walk the same path as a small "tribe" unto themselves......even more prominently when Gold and DJ30 are relating as well

trade of the week was Tue/wed when dj30 got jiggy in northerly direction driving yen south.....usd was induced to fall in sympathy to its bosum buddy a little....but the stagnent gold price meant it was not going to move that much in response (correlator team note the classic buy u/J signal here re tag direction - and the opposite sell U/J signal later in week)

however in the markets its not just what is happening that is important ....its what is NOT happening that can be just as important in certain dynamics

on thursday yen starting coming north on not to much DJ30 bear action.....that meant yen wanted to be strong again regardless of the markets (profit taking?) ....the sure as eggs is eggs the market fell and yen went ballistic.....on friday it was the munchmaster on all the other G7 including the USD.....(witness my pathetic scalps yesterday on U/J whilst yen was destroying all in its path)

oh well....each week I learn a little more and hindsight is 20/20 vision !

have good weekends all....looks like a good one....

Neil

(NVP)

Attachments

jrplimited

Active member

- Messages

- 249

- Likes

- 1

Hi N,

Nice explanation there, the 1000/1 setting is indeed a "raw" format for your corrie indy and will virtually replicate actual live underlying price feed - my favourite for real time intra day trading.

As we discussed a few times before, one of the very best methods to get to grips with what the corrie indy is actually "saying" is to use it with U, G and E (ie watching EU and GU pairs) and look for the whipping boy, so if both G and E are up then U is the dog or if G is up but E is down then there is no absolute dog (ie U is down against G but up against E) but you will often see some good opportunities on the EG chart to take advantage of G being up and E being down - ie in this case E is the dog!

It took me quite awhile to get my head around your corrie indy last year, but once I had the chance to follow price action and the corrie in real time it soon dawned upon my feeble grey matter exactly what was being literally shouted out to me. If you keep the currencies being watched down to a select few (better still, down to those you are more familar with) there are no end of strategies you can employ to take advantage of the corrie indy's output.

If you are scalping then bear in mind your broker's spread and limitations upon where (if using pending orders) a TP or SL can be placed in relation to current price quote. I use simple scripts within MT4 to fire orders into the market via "hot" keys and you can find these on forums such as the Forex Factory / Programming Discussion one - dig around as there is some amazing stuff within that!

Enjoy the weekend and regards,

Simon.

Nice explanation there, the 1000/1 setting is indeed a "raw" format for your corrie indy and will virtually replicate actual live underlying price feed - my favourite for real time intra day trading.

As we discussed a few times before, one of the very best methods to get to grips with what the corrie indy is actually "saying" is to use it with U, G and E (ie watching EU and GU pairs) and look for the whipping boy, so if both G and E are up then U is the dog or if G is up but E is down then there is no absolute dog (ie U is down against G but up against E) but you will often see some good opportunities on the EG chart to take advantage of G being up and E being down - ie in this case E is the dog!

It took me quite awhile to get my head around your corrie indy last year, but once I had the chance to follow price action and the corrie in real time it soon dawned upon my feeble grey matter exactly what was being literally shouted out to me. If you keep the currencies being watched down to a select few (better still, down to those you are more familar with) there are no end of strategies you can employ to take advantage of the corrie indy's output.

If you are scalping then bear in mind your broker's spread and limitations upon where (if using pending orders) a TP or SL can be placed in relation to current price quote. I use simple scripts within MT4 to fire orders into the market via "hot" keys and you can find these on forums such as the Forex Factory / Programming Discussion one - dig around as there is some amazing stuff within that!

Enjoy the weekend and regards,

Simon.

Last edited:

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

I guess I could program it in NinjaScript - although I have only got a week's worth of experience with NinjaTrader so far - I'm still trying to migrate my trading strategy over from TradeStation where it was EOD into NinjaScript intra-day.

I'm not sure if you're doing arbitrage on the divergences or picking up directional signals. Both probably.

I'm not sure if you're doing arbitrage on the divergences or picking up directional signals. Both probably.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

I guess I could program it in NinjaScript - although I have only got a week's worth of experience with NinjaTrader so far - I'm still trying to migrate my trading strategy over from TradeStation where it was EOD into NinjaScript intra-day.

I'm not sure if you're doing arbitrage on the divergences or picking up directional signals. Both probably.

Hi Adamus

Strengthmeters are incredibly underated tools

about 2 years ago (umm Ithink :innocent: ) I started researching them seriously through all internet/trading sources - continually questioning anyone using them about their styles and techniques and strategies

The best stuff was actually EA based systems and although helpful those dudes are in a world of their own and I was looking at more practical, hands on ways of using them....and at worse...well lets not get me started on that area of marketeering etc etc again

so I just kept going , playing and playing till I got (to many !) decent ideas/variations together on both commonly held idea on strengthmeters...and thats when this thread appeared :-

so the simple stuff is

1) use a standard Ma system and watch the currencies move above/below the zero or crosses)

2) correlate these to other markets for confirmation of signals

and then another approach that I really like which is using an extreme ma value to create real time price movement analysis of the G8.....this is my bag and quite a few people like it as well 👍

I am developing this area more than the others currently (as I cannot find anything out there similar in the trading cosmos) and am happy to be contacted (see my home page here) regarding some developments/practical systems which I will be offering shortly

Arbitrage / divergence / convergence - every type of trading is possible on strengthmeters - once you embrace it as a primary indicator and not just a supporting tool....Strengthmeter trading is in its own niche world and cannot be tied to anything else out there in my opinion (but then i'm naturally bias 🙂 )

let us know anything else you want and we will try to help

Neil

Similar threads

- Replies

- 0

- Views

- 3K