jrplimited

Active member

- Messages

- 249

- Likes

- 1

Hi N and all,

Its a murky Monday outside, must be the ash from Iceland burning all their folding stuff! Onto this morning's bun fight....

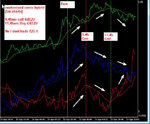

GU; First trade entered long at 52304 on open 08:10 bar, price went up then retraced to a few points below entry then staggered slowly upwards printing 09:30 new local high and fell over taking out TS on 09:40 sharp down bar for 8 point profit. Second trade sell stop at 52154 filled during 10:15 bar, price moved down a few points then retraced to around entry point, stalled for three bars then moved down again and made 11:10 new local low (below 1.52 level) but couldnt seem to hold it, tried again two bars later and failed miserably, rose up slowly and took out TS during 11:45 strong up bar for 9 point profit.

EU; Had to wait until 10:00 bar for sell stop fill at 34442, price moved lower on some momentum, printed new 10:20 local low, made shallow retrace and went sideways for ten bars edging slightly lower, 11:20 bar printed new local low then price decided to march back up the hill again and after 11:40 up bar trade exited for 10 point profit.

EG; Watched chart for first two hours then gave up as narrow range bars were not providing any setups.

Eeek! What a morning, during the latter half it seemed that both GU and EU wanted to drop but there just wasnt any follow through momentum. Also noticed that EU managed to fill the notorious Sunday gap, but GU failed to do this so that might be worth watching this afternoon - trade well and regards,

Simon.

Its a murky Monday outside, must be the ash from Iceland burning all their folding stuff! Onto this morning's bun fight....

GU; First trade entered long at 52304 on open 08:10 bar, price went up then retraced to a few points below entry then staggered slowly upwards printing 09:30 new local high and fell over taking out TS on 09:40 sharp down bar for 8 point profit. Second trade sell stop at 52154 filled during 10:15 bar, price moved down a few points then retraced to around entry point, stalled for three bars then moved down again and made 11:10 new local low (below 1.52 level) but couldnt seem to hold it, tried again two bars later and failed miserably, rose up slowly and took out TS during 11:45 strong up bar for 9 point profit.

EU; Had to wait until 10:00 bar for sell stop fill at 34442, price moved lower on some momentum, printed new 10:20 local low, made shallow retrace and went sideways for ten bars edging slightly lower, 11:20 bar printed new local low then price decided to march back up the hill again and after 11:40 up bar trade exited for 10 point profit.

EG; Watched chart for first two hours then gave up as narrow range bars were not providing any setups.

Eeek! What a morning, during the latter half it seemed that both GU and EU wanted to drop but there just wasnt any follow through momentum. Also noticed that EU managed to fill the notorious Sunday gap, but GU failed to do this so that might be worth watching this afternoon - trade well and regards,

Simon.