The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

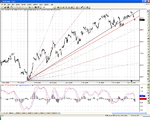

The next level down.

It’s not something that I expect to happen but to complete the picture as put together above the next Level down implicates an AEX close value at 473,25 today. Just so will know what the playing field looks like and it might not surprise you that our trailing stop-loss was hit yesterday and that the indicator status is Neutral, notice the lower boundary.

It’s not something that I expect to happen but to complete the picture as put together above the next Level down implicates an AEX close value at 473,25 today. Just so will know what the playing field looks like and it might not surprise you that our trailing stop-loss was hit yesterday and that the indicator status is Neutral, notice the lower boundary.