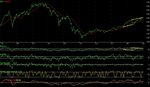

The stochastic

Good evening,

The two studies..... They are hard to read. She uses it with a trend. The spread she plots in a histogram. I really don't know how to create such a chart (balen). I will look in to it a bit further, because she get nice results. Not only with the trend but also with the averages she uses. I think you look for the same.

The standard is the one never to use. Default club, remember? Nice to see we uses the same stoch. Same teacher perhaps 😉 ? Further more I see a PR in the stoch (AEX). The same is happening on the other side of the ocean (S&P).

But we use a different KVKD system. Mine didn't broke jet. Not saying it couldn't be broken. Together with both PR's in the stoch. and RSI (508,xx) Monday can be positive. If not, you know my exit now..... 503 will be the first target.

In the intra-day I have a target of 513,30 and the weekly PR is still open..... Probably not in a straight line!

Heb nog twee plaatjes voor de liefhebbers....

Good evening,

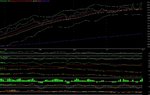

The two studies..... They are hard to read. She uses it with a trend. The spread she plots in a histogram. I really don't know how to create such a chart (balen). I will look in to it a bit further, because she get nice results. Not only with the trend but also with the averages she uses. I think you look for the same.

The standard is the one never to use. Default club, remember? Nice to see we uses the same stoch. Same teacher perhaps 😉 ? Further more I see a PR in the stoch (AEX). The same is happening on the other side of the ocean (S&P).

But we use a different KVKD system. Mine didn't broke jet. Not saying it couldn't be broken. Together with both PR's in the stoch. and RSI (508,xx) Monday can be positive. If not, you know my exit now..... 503 will be the first target.

In the intra-day I have a target of 513,30 and the weekly PR is still open..... Probably not in a straight line!

Heb nog twee plaatjes voor de liefhebbers....

Attachments

Last edited: