Topje op?

This is my contribution of what I think will happen the first half year.....

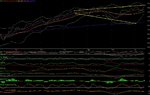

I've adjusted some lines in my chart. If my interpretation of the theory is right the first goal on Monday is 505,45 in the fti. Chart 1

Wave 2 has two closes at the 50% and a spike at the 61,8 retracement. From bottom 2 till the high at 3 (v) I measure 200%. In two extended waves till the 1,618% retracement. 2,618 gives an target at 505,45. Today we closed exactly at the 1,618 target of an other fibo. Look in the blue circle.

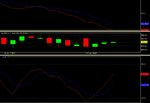

Chart two

Tja, and after that? We need to look at the bigger picture (day). My best guess is that this is the second five wave up from the low of 470. There is one problem I can't solve that is the bottom at last Wednesday. I count a little 5 wave. This can also be a wave A. Now the wave B and because if this is true, we get a wave C below A. The NR clown speaks of could then appear. Bottom 470 is A, The B wave is created as I wright this. A C wave will bottom at the

I don't have a PR in this time-frame. For that I look to other time frames. Chart four.

Chart three

If You count the complete 5 wave in December. This is a 400% fibo target. I have posted this in an other thread. The hourly has a target of 505,45. This one (240 min) has a target of 505,99 Sometimes the first target is at a 127,2% from top till bottom. Even so this is a 200% fibo of the fibo's I found in this chart.

Chart four

The weekly chart still has a PR of 514,24 We are now at the (red) 1,618 fibo target. The 200% is at 521,27

The yellow fibo is a complete bigger wave. The bottom of June is exactly at the 61,8 retracement. Targets are further away.....

Chart five

This is the monthly. 61,% retracement is 528,xx In time this will be a short one. In points the fit is ok. After that? What is Your own guess?

Resume

First target (Monday) is 505,45 After that a PR at 514.24 Two fibo's at 521,27 and 528,xx After the 5 in the month (march or april) we will go down.

These are mine targets and wave counts based upon what I've read and now (think) I know. If You all add the above mentioned together You'll get an other picture of the start of this year than Clown started in this thread. If anybody else sees other things I don't see in the charts, please let me know.

Now You know where I put my money........

There are people who make it happen and there are people who see it happen. The difference is the P.....

Groetjes,

Blinker