spartakden

Newbie

- Messages

- 6

- Likes

- 0

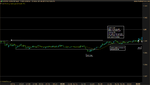

Hello good people of t2w forums. I have also bought this book and been reading it. Its great but then I got kind of confused about what chart to use since none of the brokers I know provide 70 tick charts. I am sure you have already discussed here and probably figured out an answer so I will just come out and ask: Which broker/platform is the best to use with this system so I can have nice 70 tick charts? Thanks in advance!