BLS

Established member

- Messages

- 642

- Likes

- 229

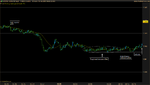

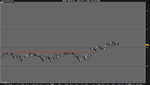

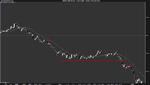

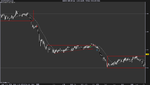

Here's my trades today.

Pretty nimble of you to take advantage of today's price action like that. I on the other hand seemed to be falling asleep at the wheel and had to give up on some possible trades because price action just seemed too fast for me.