samich1262

Well-known member

- Messages

- 293

- Likes

- 3

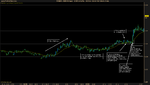

Now what does that mean price technically? Is the barrier significance strengthened and should we look for continuation (withtrend) setup, or is the return below the barrier sign of bearish strength?

Hmm. My first thought is that we either need a longer sideways setup, or a significant pullback. My guess is bulls are starting to run out of steam, but bears are still unable to gather enough strength to push price below that line of 5. So I think we should still be looking for a bullish setup here, it just needs to have a more buildup than something we would have taken during the trend. A nice head and shoulders pattern in a BB would be good here. Personally I wouldn't take a bearish trade right there, I would expect that the bulls are still hanging around for better prices. I would either look for a bullish BB/IRB with a nice squeeze, or price might start ranging. Hard to say completely without knowing what levels this formed at. If 5 were right above a round #, I would be more bullish, but if that line of 5 formed right below a round # I'd be a lot more cautious.