Glad to see some more of Bob's charts, last week's set got me to pay a lot more attention to trend continuation and larger pullbacks. I think they are extremely helpful, really appreciate his time and input. I was really glad to see his take on those big moves on Friday. I wondered if I was missing setups on moves 2 and 3, but I didn't see an entry that looked safe.

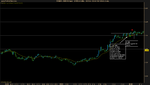

3 looked like it could have been a bear flag but it broke too early to be valid. Not in the average, not a long enough pullback, no good BB entry. It was a good place to watch for a setup, but nothing tradeable appeared.

I skipped #4. Looking at it after, that was an obvious trade. I don't know why I didn't take it. Strong downtrend, retest of the 70 level, price is pushed back under the EMA... I took a similar setup earlier in the week that failed, but it was in a much weaker trend. That was me not evaluating and thinking too much about patterns. But overall, I feel like I'm starting to consciously shift more towards overall conditions. Still need a lot of "repetitions" so that it comes naturally though. Right now I'm consciously watching 00 and 50 levels, watching pullbacks and looking for trend continuation opportunities. I still don't pay hardly any attention to 20 levels, so I will try to add that to my focus for this week, especially after reading Bob's comments on last week's charts. I need to shift to where I'm aware of what levels are nearby at all times. I think I was able to spot about half of the setups that Bob showed us, but I was bummed at myself for only taking 2 setups this week. I am starting to get a feel for spotting valid setups and throwing out bad ones, so here's to hoping this week I can make myself get in on every valid setup that I can spot in time. However, during my backtest, I still took 2 or 3 of the aggressive setups because I wasn't paying enough attention to price action near the 20 level, so I definitely need to start being more aware of that.

I have found that I manage all of my trades the same way, but I think some trades require tighter trailing. One thing that I'm going to try to do this week is know going into a trade whether or not I need to trail tight or leave it more room to work. Seems like RBs that have weak followthrough require close trailing. Setups in a significant pullback often don't require as strict of management, depending on where they show up on the chart.