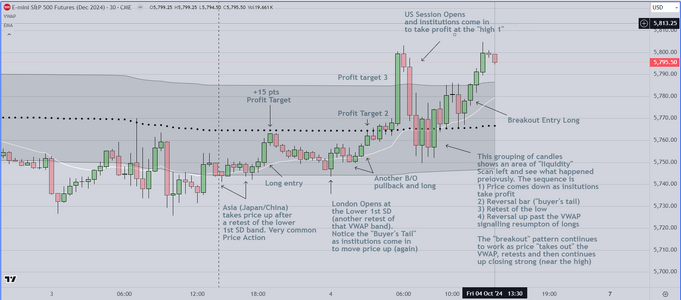

Chart Markup for Friday 10-4

ETH Markup (Left Side)

Left side shows hourly candles and ETH time frame

As can be seen plainly, the skew (red line relative to the

VWAP) is to the upside. Evaluation starts at London Open.

Price trends up, retests back down to the 20ema, then breaks

back up past the VWAP. Long entry at 2am PST US time would

have resulted in a significant winner

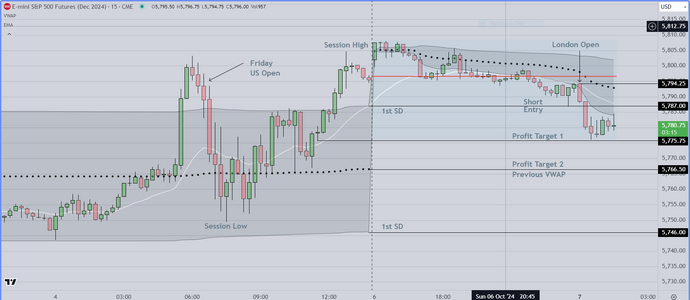

RTH Markup (Right Side)

On the right side, 15 min candles. Same premise, during ETH price

gaps up. Traders interpret this as a single wide range bar (WRB)

They wait for a pullback to retest the 20 ema, and then buy every

retest. This pattern (repetitive tests of the 20ema) occurs about 20%

of the time, once traders identify it, they will continue to trade it from the long

side, until it fails. On this occasion it was successful to the end of

the session.

Final Note

The objective is to develop a system whose statistics can be known and

traded reliably. Today's price action was unusual. It is more common for

breakout setups to fail (about 75% failure rate is common) and so we

look first for the short side. If as seen on today's chart, we see a trend

from the first pullback, AND the skew is in agreement, traders will assume

that this may be a trend day (only about 20% of days consistently trend)

They will monitor the first trade, then continue to take longs until they

fail.

ETH Markup (Left Side)

Left side shows hourly candles and ETH time frame

As can be seen plainly, the skew (red line relative to the

VWAP) is to the upside. Evaluation starts at London Open.

Price trends up, retests back down to the 20ema, then breaks

back up past the VWAP. Long entry at 2am PST US time would

have resulted in a significant winner

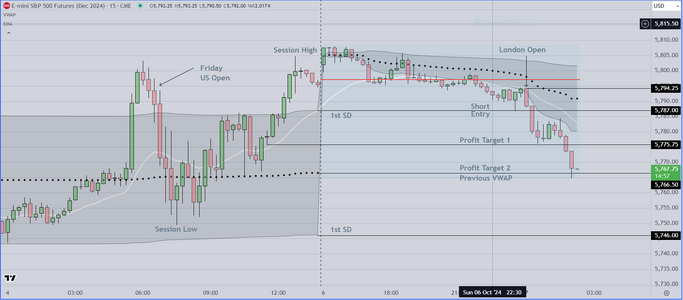

RTH Markup (Right Side)

On the right side, 15 min candles. Same premise, during ETH price

gaps up. Traders interpret this as a single wide range bar (WRB)

They wait for a pullback to retest the 20 ema, and then buy every

retest. This pattern (repetitive tests of the 20ema) occurs about 20%

of the time, once traders identify it, they will continue to trade it from the long

side, until it fails. On this occasion it was successful to the end of

the session.

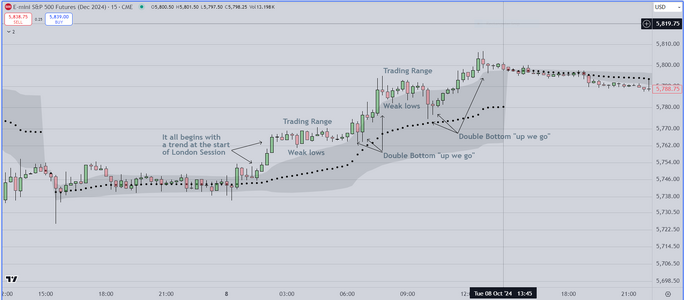

Final Note

The objective is to develop a system whose statistics can be known and

traded reliably. Today's price action was unusual. It is more common for

breakout setups to fail (about 75% failure rate is common) and so we

look first for the short side. If as seen on today's chart, we see a trend

from the first pullback, AND the skew is in agreement, traders will assume

that this may be a trend day (only about 20% of days consistently trend)

They will monitor the first trade, then continue to take longs until they

fail.

Attachments

Last edited: