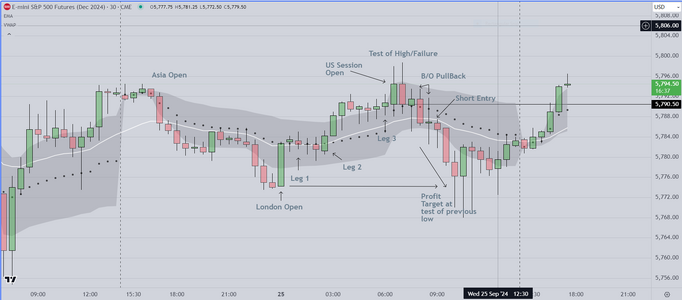

Here is my Markup Chart for Friday 20 Sept

This chart is based on the "Breakout Setup" that I suggest Retail Traders

use. It allows them to concentrate on a pattern that seems to display

a consistent edge. In my recent class, I show the students how to analyze

previous weekly performance to quantify whether the setup is working (it is)

and also to determine the percentage of setups that were successful (79%)

during the previous week.

For the coming week, we start by removing the red & green entry arrows

and we use the outline (horizontal lines) to create a framework.

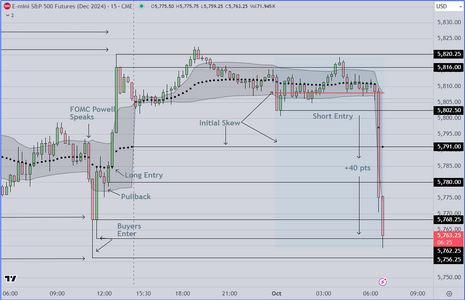

We also use the FRVP (fixed range volume profile) to identify the "initial skew"

which when used in combination with the VWAP, creates an accurate forecast

for the direction of price at/near the open.

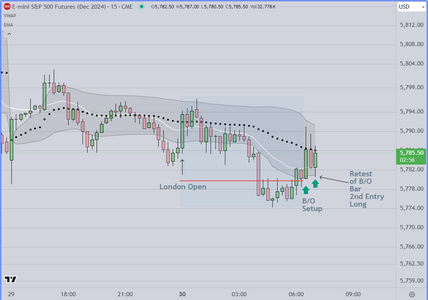

Notice that the display contains two (2) charts, a 15 min and a 5min chart. We

do this to show the extra granularity that the 5 min chart provides. This extra

detail allows skilled, experienced traders to find additional entries. Unfortunately

it seems to confuse retail traders and the result is that they tend to take bad

trades early in the session. We suggest newbies concentrate on the 15 chart

and focus on only the setups that are clear and present in that chart, while

reviewing the 5 min chart later, to learn to recognize those additional setups as

they develop.

Good Luck Everyone

This chart is based on the "Breakout Setup" that I suggest Retail Traders

use. It allows them to concentrate on a pattern that seems to display

a consistent edge. In my recent class, I show the students how to analyze

previous weekly performance to quantify whether the setup is working (it is)

and also to determine the percentage of setups that were successful (79%)

during the previous week.

For the coming week, we start by removing the red & green entry arrows

and we use the outline (horizontal lines) to create a framework.

We also use the FRVP (fixed range volume profile) to identify the "initial skew"

which when used in combination with the VWAP, creates an accurate forecast

for the direction of price at/near the open.

Notice that the display contains two (2) charts, a 15 min and a 5min chart. We

do this to show the extra granularity that the 5 min chart provides. This extra

detail allows skilled, experienced traders to find additional entries. Unfortunately

it seems to confuse retail traders and the result is that they tend to take bad

trades early in the session. We suggest newbies concentrate on the 15 chart

and focus on only the setups that are clear and present in that chart, while

reviewing the 5 min chart later, to learn to recognize those additional setups as

they develop.

Good Luck Everyone

Attachments

Last edited: