Referring to the previous post, we offer the following comment

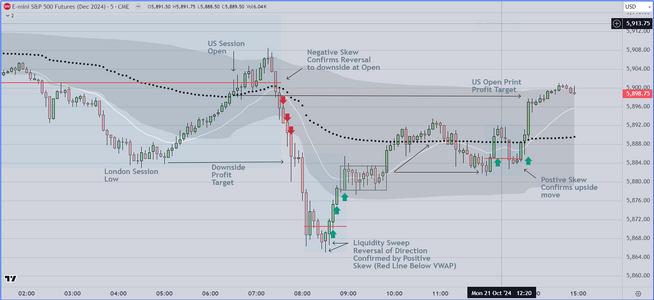

1) Overnight (US time) Asia drifted down from the open (as often happens)

and at the open of London Session, price reacted up briefly, but failed

and the distribution expanded to the downside. This is critical information

for the professional trader. Why? because it is counterintuitive. The initial

reaction up was five (5) points (a scalp). Normally that would have been

followed by another 5 point swing to the upside. What matters is the LOGIC

behind this behavior. I interpreted it as follows

Critical Importance of Understanding "Context" & Market Logic

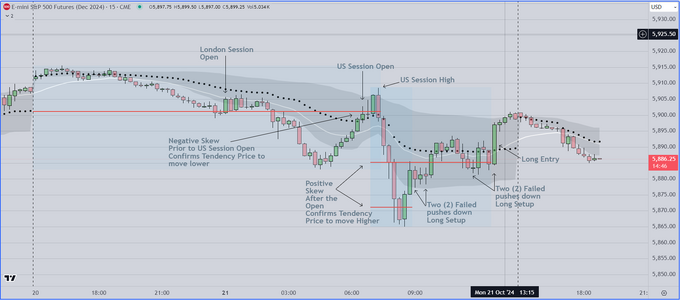

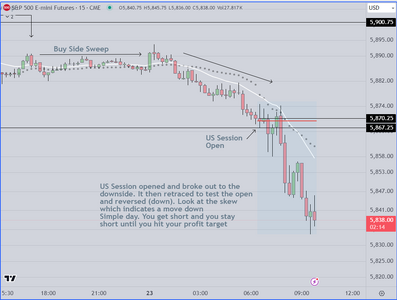

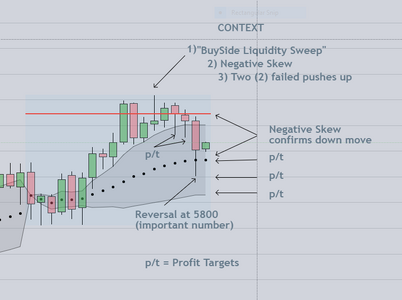

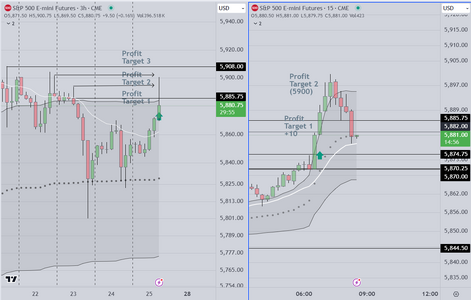

2) On a Monday, anticipating significant earnings reports, institutions will protect

profits using the London Session as a "Pivot". Notice that London opened and

moved down, followed by a late session reversal to the upside. Then at the open

of the US Session, price attempted to take out 5900 but could not. Notice that

the Skew was negative (above the VWAP) confirming the statistical tendency

to move down. Institutional computers calculate this and send sell orders. As

price closes BELOW each "Key Reference" (the Standard Deviation Band, and

the VWAP), it signals other institutions to "Go With" (Sell the Market Down)

and that is what they do....this short setup had very high odds of success, and once

the students heard the logic they took the trade. A solid early profit to start the session.

After this early move down, institutions slow down and wait for prices to stabilize

At the low, we see price RE-ENTER THE VWAP ENVELOPE FROM BELOW AND the skew

reverses (see the chart). This signals a) accumulation at discount prices, and b) a reversal back up

Prior to the US session open, during our review, students asked the obvious question

how can I know this, and aren't there other equally valid scenarios? The answer is yes,

of course there are other ways to interpret the data, however after more than fifteen (15)

years of experience and thousands of hours of screen time, I have a record that I can trust,

and so I take the trades (and hold my position) and if I am stopped out, (suggesting that I

am wrong) I make the appropriate adjustment. Today worked out as forecast.

The Markup chart shows the skew at various intervals throughout the session. I notice that

there are many YOUTUBE traders who suggest that they know how to do this, and explain

THEIR logic using all kinds of jargon. As far as I can tell, the skew is the only volume based

tool that works consistently, when used in a skillful way (anchored and interpreted properly)

I notice that there are no other "Internet traders" using it, and that is understandable. Early

in this and my other thread, I suggest that struggling traders take the time to learn basic

statistics. Interestingly the response was negative. I get it, but remind folks that the time is

going to go by anyway, and without the proper background, I don't see how a retail trader

can complete. In the long run, they will give back whatever they win using various indicators.

Good Luck