This week (10th June) we have high impact news that will affect price action

1) Wednesday CPI at 8:30 EST

2) Thursday Initial Jobless 8:30 EST & FOMC Statement 2:00 EST

with FOMC Press Conference 2:30 EST

Tier 1 Institutions have already positioned themselves and are trading around "core

positions". Commercial HFT and Retail will have their own process in place, with

some waiting for various time periods, then placing bets based on what they see the

big players doing. None of this is much of a secret

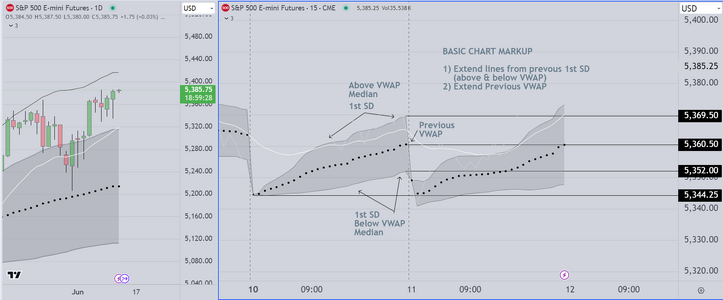

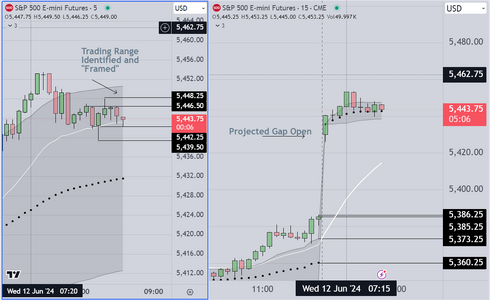

Typically we anticipate trading range activity, starting today, and will be marking high & low closes,

entering on retests. This is standard, and uses the basic VWAP framework. Absent a strong breakout,

we will likely trade using limit orders for both entry and exits.

Depending on the size of the range, we suggest retail traders stand aside until this plays out

beginning to trade again Friday 14th (using Market Orders)

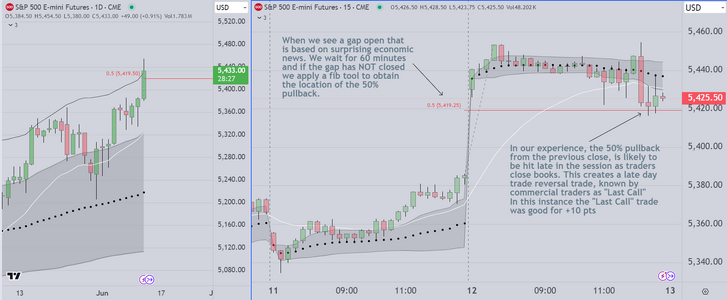

Since economic conditions have not changed, detailed examination of price action surrounding

the previous FOMC event is a critical part of our process.

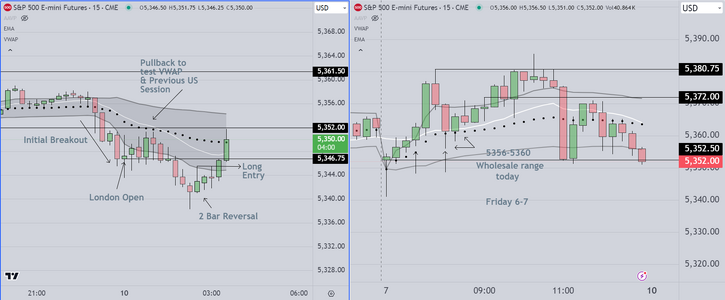

The attached chart shows price action as London Opens. We have been trading this open

because often it is the only trend we will see until the FOMC events conclude

We have amended the chart a couple of times, to show the initial breakout to the downside

followed by a two bar reversal back to the upside. Notice that the upside bars are "strong"

meaning that they are relatively wide range, closing near the extreme.

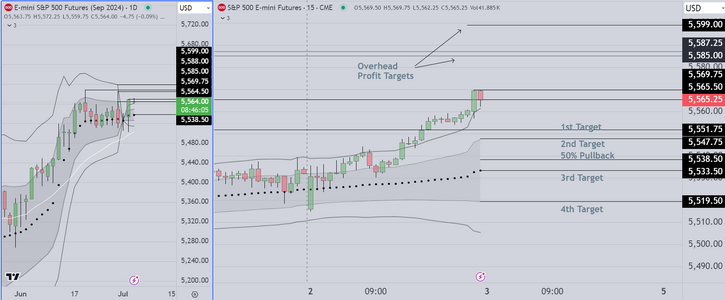

SETUPS

Breakout

The initial break to the down side follows our protocol and that is a) breakout, followed by

retest of a "Key" reference such as the VWAP or (in this instance) the previous US open

Short entry is made when the test fails, and price resumes its break to the downside.

2 Bar Reversal

After a reversal occurs, we mark the top or bottom of the 2nd bar as the point of

entry in the opposite direction. Odds of this trade being successful are increased

because of the context, so we took both entries, however it is considered good

practice to include "skew" as confirmation. Because the skew is a dynamic process

it is difficult to display properly in this context (not enough room on the chart to

display and include text explanation)

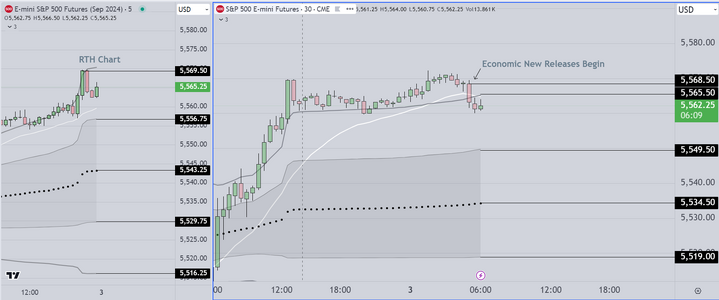

Final Comment

Notice if you will, that the breakout trade requires that price break either above

or below the darkened area that we call the VWAP envelope. That is after all, why

it is called a breakout. In contrast, the odds of success for a 2 bar reversal are greatly

increased if you pull the trigger as price enters INTO the darkened area, and your

initial profit target is at the VWAP line. This is understood by traders who have a

basic understanding of statistics.

Good Luck

1) Wednesday CPI at 8:30 EST

2) Thursday Initial Jobless 8:30 EST & FOMC Statement 2:00 EST

with FOMC Press Conference 2:30 EST

Tier 1 Institutions have already positioned themselves and are trading around "core

positions". Commercial HFT and Retail will have their own process in place, with

some waiting for various time periods, then placing bets based on what they see the

big players doing. None of this is much of a secret

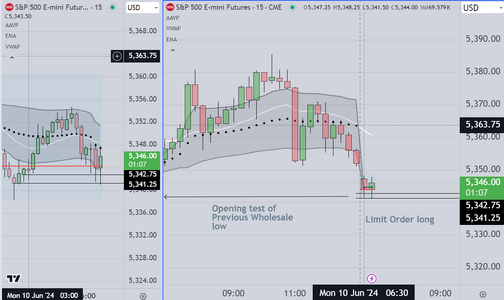

Typically we anticipate trading range activity, starting today, and will be marking high & low closes,

entering on retests. This is standard, and uses the basic VWAP framework. Absent a strong breakout,

we will likely trade using limit orders for both entry and exits.

Depending on the size of the range, we suggest retail traders stand aside until this plays out

beginning to trade again Friday 14th (using Market Orders)

Since economic conditions have not changed, detailed examination of price action surrounding

the previous FOMC event is a critical part of our process.

The attached chart shows price action as London Opens. We have been trading this open

because often it is the only trend we will see until the FOMC events conclude

We have amended the chart a couple of times, to show the initial breakout to the downside

followed by a two bar reversal back to the upside. Notice that the upside bars are "strong"

meaning that they are relatively wide range, closing near the extreme.

SETUPS

Breakout

The initial break to the down side follows our protocol and that is a) breakout, followed by

retest of a "Key" reference such as the VWAP or (in this instance) the previous US open

Short entry is made when the test fails, and price resumes its break to the downside.

2 Bar Reversal

After a reversal occurs, we mark the top or bottom of the 2nd bar as the point of

entry in the opposite direction. Odds of this trade being successful are increased

because of the context, so we took both entries, however it is considered good

practice to include "skew" as confirmation. Because the skew is a dynamic process

it is difficult to display properly in this context (not enough room on the chart to

display and include text explanation)

Final Comment

Notice if you will, that the breakout trade requires that price break either above

or below the darkened area that we call the VWAP envelope. That is after all, why

it is called a breakout. In contrast, the odds of success for a 2 bar reversal are greatly

increased if you pull the trigger as price enters INTO the darkened area, and your

initial profit target is at the VWAP line. This is understood by traders who have a

basic understanding of statistics.

Good Luck

Attachments

Last edited: