You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ok G1,

now getting the Iraj N Minute built into the strat. (a few error 000000000' still to be fixed)

It seems like the daily "MACCI" and the daily "Iraj N Minute" are working against one another

ie. the MACCI O/S stocks are the stocks that are showing weakness compared to the market on the Iraj N Change???????????????

so what should i be looking for?

Glen

Hi Glen,

I do not see INDU on the list-or is it my eyes....

That is what you are meant to compare the stock against....

Raj

hi Raj

number 9

that'll be the eyes then.lol

cheers

glen

So it is....😆 (one more thing to look after now apart from Macci 😆 )

Jokes apart- now the Daily indu shows -8.5 and heading down.. there is still some juice left I think in the downward motion.. did not close my swings yet..

So it is....😆 (one more thing to look after now apart from Macci 😆 )

no worries, i got my eyes tested about a year ago, was told i need to get glasses

still havn't done anything about it tho

cheers

glen

didn't get the job i interviewed for this week..

now going out to get pissed. drown sorrows.. etc..

cheers all

glen

running total = $3,495

as it turns out, i did get this job (i thought i'd no chance)

should allow me to intra day in the future (when the times correct)

Glen

Ok G1,

now getting the Iraj N Minute built into the strat. (a few error 000000000' still to be fixed)

It seems like the daily "MACCI" and the daily "Iraj N Minute" are working against one another

ie. the MACCI O/S stocks are the stocks that are showing weakness compared to the market on the Iraj N Change???????????????

so what should i be looking for?

Glen

Not sure if G1 will answer this,

does anyone else use these two indcators on daily radar,

Glen

Ultramarine

Junior member

- Messages

- 41

- Likes

- 4

thanks for your post

the list is G1's latest weak list that on this thread, these are not open positions, just a list to pick from

cheers

glen

Thanks Glen, I see what you've done - taken the stocks on the target price list that Grey1 posted a while ago. That made me go back and look at it again as I'd only used it so far to check the target prices on the stocks on my own list. I see now that it contained a few stocks that were not on his original list -I hadn't checked. However, in his post he referred to producing targets for the remainder of the stocks, so I presumed that the final list would be longer. As it stands now, getting 10 or 12 stocks O/B from a list of 40 is going to be trickier than working with a list of 100 or so stocks. Any clarification on this anybody? (Iraj??)

Al

Last edited:

Thanks Glen, I see what you've done - taken the stocks on the target price list that Grey1 posted a while ago. That made me go back and look at it again as I'd only used it so far to check the target prices on the stocks on my own list. I see now that it contained a few stocks that were not on his original list -I hadn't checked. However, in his post he referred to producing targets for the remainder of the stocks, so I presumed that the final list would be longer. As it stands now, getting 10 or 12 stocks O/B from a list of 40 is going to be trickier than working with a list of 100 or so stocks. Any clarification on this anybody? (Iraj??)

Al

yes, i see what you mean i will put all the stocks for the original weak list on to mine again

I think its important to realise which stocks have already fallen apart (MBI, TMA)

I would still like Grey1 to comment on the possible conflicts between the “MACCI” and the “Iraj N Minute” on the stock daily time frame, before I introduce this into the this strat. (Because if I get conflicting signals I won’t no what to do)

So for now I’ll stick with the MACCI only.

Glen

Grey1

Senior member

- Messages

- 2,190

- Likes

- 210

Thanks Glen, I see what you've done - taken the stocks on the target price list that Grey1 posted a while ago. That made me go back and look at it again as I'd only used it so far to check the target prices on the stocks on my own list. I see now that it contained a few stocks that were not on his original list -I hadn't checked. However, in his post he referred to producing targets for the remainder of the stocks, so I presumed that the final list would be longer. As it stands now, getting 10 or 12 stocks O/B from a list of 40 is going to be trickier than working with a list of 100 or so stocks. Any clarification on this anybody? (Iraj??)

Al

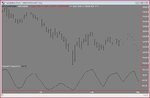

In my seminar i clearly mentioned that you can also use the same methodology ( IRAJ N MINUTE ) to short list those stocks that are weaker than the INDU with the highest MACCI for swing ..

I have also said that you short those stocks when the marke is spiking and NOT when the market is down 200 points ,, This methodoogy applies in all time frames ( 1 min to 1 month 1 year) .. Always short weak stock when every body is buying them if you have a longer bearish view toward a market ( which we do ) .

grey1

In my seminar i clearly mentioned that you can also use the same methodology ( IRAJ N MINUTE ) to short list those stocks that are weaker than the INDU with the highest MACCI for swing ..

I have also said that you short those stocks when the marke is spiking and NOT when the market is down 200 points ,, This methodoogy applies in all time frames ( 1 min to 1 month 1 year) .. Always short weak stock when every body is buying them if you have a longer bearish view toward a market ( which we do ) .

grey1

Ok that’s that cleared up, (thanks Grey1)

Will introduce this into this forward test.

Will be looking for the following set up now

1.Market showing a good set up (good spike up, MACCI daily at O/B or at previous turn level high)

2.Look for all weak list stocks that have O/B MACCI’s

3.Filter these stocks for there strength/weakness in relation to the market (using the Iraj N Minute indicator)

4.Pick 10 stocks (diversify across sectors as best as possible)

5.Enter using position sizing indicator for size

Glen

Glenn

Experienced member

- Messages

- 1,040

- Likes

- 118

Ok that’s that cleared up, (thanks Grey1)

Will introduce this into this forward test.

Will be looking for the following set up now

1.Market showing a good set up (good spike up, MACCI daily at O/B or at previous turn level high)

2.Look for all weak list stocks that have O/B MACCI’s

3.Filter these stocks for there strength/weakness in relation to the market (using the Iraj N Minute indicator)

4.Pick 10 stocks (diversify across sectors as best as possible)

5.Enter using position sizing indicator for size

Glen

Hi Glen

I have just confirmed the method below via e-mail with Grey1, in trying to be precise about all the details.

For a portfolio for a Short swing trade:-

1. Use the Weak List

2. Use N-Minute Change with Daily compression to select stocks from the Weak list with lowest ATR Change compared to Indu.

3. Use Daily Macci on the selection to find stocks which have high Macci values,

4. Wait for 10-minute INDU Macci to be OB, and then go short using correct position size from new code.

5. Position size from new code will use Daily compression for this Swing portfolio.

I am about to post the new code for Position Size in another thread called TT Toobox.

It will have ELS and ELA versions.

Glenn

Glenn

Experienced member

- Messages

- 1,040

- Likes

- 118

When you say downloading do you mean historical or live data ?still having problems downloading data from IB to TS2

Glen

For live data :-

Is IB TWS showing the quotes changing ?

If yes then go into Globalserver

Click File - Work Offline and then

Click File - Work Online

This usually kicks it back into action.

Glenn

When you say downloading do you mean historical or live data ?

For live data :-

Is IB TWS showing the quotes changing ?

If yes then go into Globalserver

Click File - Work Offline and then

Click File - Work Online

This usually kicks it back into action.

Glenn

yes almost all prob's i've had have been when TWS quotes are working fine.

thanks Glenn

will try this

Glen

rightly pissed off tonight.

I've to go to Dublin tomorrow, then fly from Dublin to London, back late Friday

no trading next few days!!! 😡🙁😡role on new job!!

glen

trading weather intra day or swing, surely must be a full time business!!!!!!!!!!!!

Glen

Glenyes almost all prob's i've had have been when TWS quotes are working fine.

thanks Glenn

will try this

Glen

You might be interested in the fact that Tradestation are about to bring out a new version that includes simulated trading. I was particularly annoyed yesterday or was it the day before when IB data was not available at all for quite some time. Luckily I'm running a long-term portfolio on that account and using Tradestation for intraday.

Charlton

Similar threads

- Replies

- 309

- Views

- 114K