bbmac

Veteren member

- Messages

- 3,584

- Likes

- 789

Mon 30th Nov 09

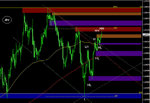

Last day of month and a generally bullish asian/overnight session see-ing a hi of 6590 (between 100 and 200 sma's on 1hr/4hr) before a pullback to Friday's Hi (=1hr prev swing hi=prev res=potential rbs zone) and further demand. London starting bullish too...no HH above that 6590 asian hi yet though..

Uk Data at 0930am

G/L

Last day of month and a generally bullish asian/overnight session see-ing a hi of 6590 (between 100 and 200 sma's on 1hr/4hr) before a pullback to Friday's Hi (=1hr prev swing hi=prev res=potential rbs zone) and further demand. London starting bullish too...no HH above that 6590 asian hi yet though..

Uk Data at 0930am

G/L