You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

anyone trading cable 2013 - lets roll

- Thread starter cablemonster

- Start date

- Watchers 11

bbmac

Veteren member

- Messages

- 3,584

- Likes

- 789

yeh,,,offers touted 4740-50, 5780 and 5800

G/L

G/L

This morning cable trading very bullish, lots of talk pushing it up, UK growth is improving, shadow MPC votes for a hike , no more QE etc etc, all rubbish but today GBP getting a bid long at 15 , target 1.58 initially

Talbs!

Experienced member

- Messages

- 1,180

- Likes

- 24

yeh,,,offers touted 4740-50, 5780 and 5800

G/L

/sure looks like one of those days thats just grinds up all day, gets thorugh 53 then thats a bullish sign for me !

bbmac

Veteren member

- Messages

- 3,584

- Likes

- 789

could be - but I like to think I scored a prefect short entry on the technicals (lol) - some pip gain and out...Eurusd on slide too on spanish govt stability worries - bond yields rising as a result

G/L

G/L

(BN) Gieve Sees ‘Substantial Chance’ BOE

rsday

above story is grabbing some attention

This hitting cable !

BeginnerJoe

Senior member

- Messages

- 3,329

- Likes

- 351

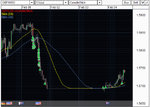

Here's my position profile. On the latest swing high, I am averaging 20 pips down, not too terrible. Most of the fractional positions at the top, although out of money by a lot, are probes and have minimum effect. My bias remains long and will be adding on swing lows.

Attachments

Last edited:

bbmac

Veteren member

- Messages

- 3,584

- Likes

- 789

Joe, On what basis is your bias in this pairing remaining long, the only t/f (of 1hr +) exhibiting signs of strength is 1hr and 4hr/daily are in opa downtrends, and weekly/monthly look bearish too ? Thanks,

G/L

-----------------------------------------

38.2% 5845-5687/weekly pivot see-iung some supply at today's current daily hi.

G/L

-----------------------------------------

38.2% 5845-5687/weekly pivot see-iung some supply at today's current daily hi.

Here's my position profile. On the latest swing high, I am averaging 20 pips down, not too terrible. Most of the fractional positions at the top, although out of money by a lot, are probes and have minimum effect. My bias remains long and will be adding on swing lows.

Last edited:

BeginnerJoe

Senior member

- Messages

- 3,329

- Likes

- 351

I am long based on market action, and the manipulator's intention.

C

cablemonster

short 28.6

C

cablemonster

out for -22.6 grr

bbmac

Veteren member

- Messages

- 3,584

- Likes

- 789

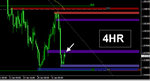

1 x HL on 4hr and 4 x HL's (well 3 fractal but likely to be 4 when current 1hr candle closes) on 1hr, price reaaching 38.2% of Friday's hi-lo at today's current hi-so 1hr exhibiting signs of strength now - course this is exactly what happened on 1hr and 4hr before the drop on Friday lol !

Daily candle today likely to result in a fractal HL on that t/f - so that would be bearish-rangy then re opa on that t/f if it does.

G/L

Daily candle today likely to result in a fractal HL on that t/f - so that would be bearish-rangy then re opa on that t/f if it does.

G/L

Attachments

Last edited:

BeginnerJoe

Senior member

- Messages

- 3,329

- Likes

- 351

Hope it collapses soon. It really didn't swing low enough for me to buy in. At the current price, my position is -7 pips down.

bbmac

Veteren member

- Messages

- 3,584

- Likes

- 789

Price pulled back off yesterdayt's 5771 hi and found support in the previous 1hr swing lo zone pictured/circled below...strong buying from there with the last leg up helped by the Uk data react at 0928/0930am gmt....better than expected Services Pmi....and price finds more demand - finding it's way up to 61.8% of Friday's move (circled) and in the 1st 1/2 of a previous 4hr swing lo zone (potential rbs) where some supply comes in.

G/L

G/L

Attachments

C

cablemonster

CABLE: MNI Cable: Fundamental levels (orders, options, technicals),

$1.5895/900 Strong offers/$1.5892 200-dma

$1.5870/80 Medium offers

$1.5840/50 Medium offers/Stops

$1.5830/35 Medium offers/$1.5833 76.4% $1.5879-1.5683

$1.5805 Int.Day high Europe, Asia $1.5767

$1.5768 **Current market rate 1102GMT Tuesday

$1.5768 Pullback low off $1.5805

$1.5755/50 Medium demand/$1.5755 76.4% $1.5727-1.5805

$1.5728 Int.Day low Europe, Asia $1.5745

$1.5710/00 Medium demand

$1.5683 Mon Feb4 low

$1.5680 Strong demand on approach/Stops

$1.5650/40 Medium demand

$1.5610/00 Strong demand

$1.5895/900 Strong offers/$1.5892 200-dma

$1.5870/80 Medium offers

$1.5840/50 Medium offers/Stops

$1.5830/35 Medium offers/$1.5833 76.4% $1.5879-1.5683

$1.5805 Int.Day high Europe, Asia $1.5767

$1.5768 **Current market rate 1102GMT Tuesday

$1.5768 Pullback low off $1.5805

$1.5755/50 Medium demand/$1.5755 76.4% $1.5727-1.5805

$1.5728 Int.Day low Europe, Asia $1.5745

$1.5710/00 Medium demand

$1.5683 Mon Feb4 low

$1.5680 Strong demand on approach/Stops

$1.5650/40 Medium demand

$1.5610/00 Strong demand

C

cablemonster

C

cablemonster

we see cable bust out of the overnight channel south take out the weak shorts and bust north, now in that 'awkward' phase coming up to London lunch.

Similar threads

- Replies

- 21

- Views

- 16K

- Replies

- 0

- Views

- 4K

- Replies

- 708

- Views

- 218K

- Locked

- Replies

- 2K

- Views

- 218K