You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

It's still going, hope some of you guys are still in that... nice move on a Monday 🙂

Damn it!

I knew I shoulda gone shopping 😀 😀 😀

😀

SuddenDeath

Legendary member

- Messages

- 14,063

- Likes

- 143

u got the 5610 low to the point

u got the 5610 low to the point

Not me, it was Soaquan. He's taking the micky out of me 🙂 But, seriously, he could have gone shopping!

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

Still thinking about this dow ratio...... ftse now 5649 x 2.25 = 12710 currently quoted at sell 12750 buy 12755 so the ftse is weak?

HW

I just use a straight 2:1 - it doesn't matter if you're precise since you are looking for a change in the ratio.

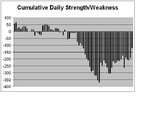

The thumbnail chart is the cumulative position of FTSE compared to DOW this year building up day by day. You'll see that FTSE started off a bit above where it would have been had it followed the DOW (ie: traded strongish) but then became weaker and weaker until, at one stage it was some 350 below where it would have been had it matched DOW (ie: it traded very weak overall). Since then it has got back to only 120 below where it should have been so has traded strong overall to get there.

This is a cumulative chart though (and it's not entirely pure because there's a lot of days bunched together in single bars when I've been away) and you'll see within it the day to day fluctuations weak and strong - it's those day to day (or hour to hour) fluctuations that you play with a pair trade.

Attachments

SuddenDeath

Legendary member

- Messages

- 14,063

- Likes

- 143

Not me, it was Soaquan. He's taking the micky out of me 🙂 But, seriously, he could have gone shopping!

where is the "global moderator" when u need him

Dick Lexic

Veteren member

- Messages

- 4,954

- Likes

- 124

interesting new thead started under futures......follow the smart money COT analysis

SuddenDeath

Legendary member

- Messages

- 14,063

- Likes

- 143

interesting new thead started under futures......follow the smart money COT analysis

thats great Dick Lexic,

Dick did u watch the trader meeting?

Dick Lexic

Veteren member

- Messages

- 4,954

- Likes

- 124

do you mean the power trading radio video?

Dick Lexic

Veteren member

- Messages

- 4,954

- Likes

- 124

sd thats a good find...think you should post this on a new thread so others on the boards can view ....lots of people suspect this sort of thing is going on but some keep saying it's not possible.

you could also stick it on here and creat a riot ha ha

http://www.trade2win.com/boards/spread-betting/16595-capital-spreads.html

Last edited:

SuddenDeath

Legendary member

- Messages

- 14,063

- Likes

- 143

sd thats a good find...think you should post this on a new thread so others on the boards can view ....lots of people suspect this sort of thing is going on but some keep saying it's not possible.

you could also stick it on here and creat a riot ha ha

http://www.trade2win.com/boards/spread-betting/16595-capital-spreads.html

at the beginning Merlin rothfeld (man on the left) calls spread betting a ponzi scheme. and dislikes the fact that they do not allow you to place buy and stops where u like. these guys are associated with the online trading academy.

the lesson is place stops where they cannot be spiked out. or go direct access, trade real futures.

SD, I am not going into another of those SB vs. DA arguments at my time of life because everyone should know what he wants to do with his money and the subject has been done to death over the years and all over this site but, as an example, this very morning, I was trading Euro/GBP and saw the price go down to less than a point away from my stop, when it turned and the trade went into profit,

If, as that guy on the video says, someone clears out all the stops, why wasn't I closed out this morning?

If, as that guy on the video says, someone clears out all the stops, why wasn't I closed out this morning?

SD, I am not going into another of those SB vs. DA arguments at my time of life because everyone should know what he wants to do with his money and the subject has been done to death over the years and all over this site but, as an example, this very morning, I was trading Euro/GBP and saw the price go down to less than a point away from my stop, when it turned and the trade went into profit,

If, as that guy on the video says, someone clears out all the stops, why wasn't I closed out this morning?

Done 2 years on DMA and the last 5 years on SB.

At the end of the day you can make and loose money on both.

Morning All

BHP -1.10%

RIO -1.20%

30 to go

China imports missed forecast and drop in new export orders(Eurozone is my guess)

Imports 6.3% in June Y/Y vs 12.7% in May Y/Y

Exports 11.3% in June Y/Y vs 15.3% in May Y/Y

Trade Balance $31.73B in June vs $18.70B in May

Aussie dollar and Dow Futures under pressure since the China release.

Not a great lead for the FTSE bulls, 5580 to 5610 strong support area.

BHP -1.10%

RIO -1.20%

30 to go

China imports missed forecast and drop in new export orders(Eurozone is my guess)

Imports 6.3% in June Y/Y vs 12.7% in May Y/Y

Exports 11.3% in June Y/Y vs 15.3% in May Y/Y

Trade Balance $31.73B in June vs $18.70B in May

Aussie dollar and Dow Futures under pressure since the China release.

Not a great lead for the FTSE bulls, 5580 to 5610 strong support area.

SuddenDeath

Legendary member

- Messages

- 14,063

- Likes

- 143

morning bustech

so more weakness in ftse

so more weakness in ftse

hereward the wake

Senior member

- Messages

- 3,154

- Likes

- 124

Thank you for that ... very usefulHW

I just use a straight 2:1 - it doesn't matter if you're precise since you are looking for a change in the ratio.

The thumbnail chart is the cumulative position of FTSE compared to DOW this year building up day by day. You'll see that FTSE started off a bit above where it would have been had it followed the DOW (ie: traded strongish) but then became weaker and weaker until, at one stage it was some 350 below where it would have been had it matched DOW (ie: it traded very weak overall). Since then it has got back to only 120 below where it should have been so has traded strong overall to get there.

This is a cumulative chart though (and it's not entirely pure because there's a lot of days bunched together in single bars when I've been away) and you'll see within it the day to day fluctuations weak and strong - it's those day to day (or hour to hour) fluctuations that you play with a pair trade.

hereward the wake

Senior member

- Messages

- 3,154

- Likes

- 124

Morning chaps

SuddenDeath

Legendary member

- Messages

- 14,063

- Likes

- 143

looking at current dow/sp500 ftse should be about minus 4pts on open

SuddenDeath

Legendary member

- Messages

- 14,063

- Likes

- 143

Biderman's Daily Edge 7/9/2012: Next QE Not Until Stocks Drop Another 15% but Unlikely to Work

Biderman's Daily Edge 7/9/2012: Next QE Not Until Stocks Drop Another 15% but Unlikely to Work - YouTube

Biderman's Daily Edge 7/9/2012: Next QE Not Until Stocks Drop Another 15% but Unlikely to Work - YouTube

SuddenDeath

Legendary member

- Messages

- 14,063

- Likes

- 143

Pivots

Buy 5637

Sell 5627

Dow 9pm close = ftse level 5635

Buy 5637

Sell 5627

Dow 9pm close = ftse level 5635

Similar threads

- Replies

- 1

- Views

- 2K