Strugglingtrader

Active member

- Messages

- 147

- Likes

- 9

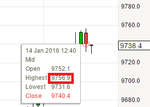

Same to you. I currently only trade FTSE but key an eye on a host of other markets as well.

Do you trade other instruments as well?

Went for a run...didn't miss much it looks like. Ahhh trader being asked about his book, this could be long 😉

Not trying to impress the postman here but I make a couple of thousand a day on the ftse which I'm happy to talk about, but my largest trades are actually cable, if I tell you I'm short $2m you will think I am an outright liar :cheesy: so I'll keep you guessing on that. I also love the nasdaq/S&P have been trading NDX since Juniper Networks was $200+ and of course Oil which I am getting ready for a life time trade 🙄

How long are your runs?