snowrider

Well-known member

- Messages

- 423

- Likes

- 3

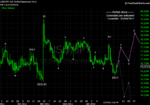

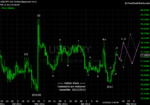

I am starting a new thread for 2012's first half year (Jan - Jun), including EUR, SP, Gold, and JPY. My previous wave counts can be found from:

http://www.trade2win.com/boards/us-indices/136478-perfect-wave-2011-q4.html

Elliott Wave reference can be found from:

Elliott Wave Principle - Wikipedia, the free encyclopedia

My labeling for wave degrees in different time frames:

Monthly - [[]], [[[II]]], [[[III]]], [[[IV]]], [[[V]]], [[[A]]], [[]], [[[C]]]

Monthly - [], [[II]], [[III]], [[IV]], [[V]], [[A]], [], [[C]]

Weekly - , [II], [III], [IV], [V], [A], , [C]

Weekly - I, II, III, IV, V, A, B, C

Daily - 1, 2, 3, 4, 5, a, b, c

Daily - _1, _2, _3, _4, _5, _a, _b, _c

Hourly - __1, __2, __3, __4, __5, __a, __b, __c

My labeling for wave formation in a segment = Wave Name + Wave Formation

For example, [A3] = 3 segments in a wave [A]

For example, [A3][B3][C5] = 3-3-5 formation for waves [A][C]

My labeling for zigzag is the combination of R.N. Elliott's classical labeling and my wave formation labeling. DO NOT USE R.P.'s W-X-Y(-X-Z) labeling because it creates confusion and lacks the flexibility of changing wave counts.

I am getting lazy on updating the counts because I don't know how many people are following. I might stop writing this at anytime. If you are an audience of my threds, please PM me to let me know so that I won't forget to keep you updated if I stop writing.

http://www.trade2win.com/boards/us-indices/136478-perfect-wave-2011-q4.html

Elliott Wave reference can be found from:

Elliott Wave Principle - Wikipedia, the free encyclopedia

My labeling for wave degrees in different time frames:

Monthly - [[]], [[[II]]], [[[III]]], [[[IV]]], [[[V]]], [[[A]]], [[]], [[[C]]]

Monthly - [], [[II]], [[III]], [[IV]], [[V]], [[A]], [], [[C]]

Weekly - , [II], [III], [IV], [V], [A], , [C]

Weekly - I, II, III, IV, V, A, B, C

Daily - 1, 2, 3, 4, 5, a, b, c

Daily - _1, _2, _3, _4, _5, _a, _b, _c

Hourly - __1, __2, __3, __4, __5, __a, __b, __c

My labeling for wave formation in a segment = Wave Name + Wave Formation

For example, [A3] = 3 segments in a wave [A]

For example, [A3][B3][C5] = 3-3-5 formation for waves [A][C]

My labeling for zigzag is the combination of R.N. Elliott's classical labeling and my wave formation labeling. DO NOT USE R.P.'s W-X-Y(-X-Z) labeling because it creates confusion and lacks the flexibility of changing wave counts.

I am getting lazy on updating the counts because I don't know how many people are following. I might stop writing this at anytime. If you are an audience of my threds, please PM me to let me know so that I won't forget to keep you updated if I stop writing.