Someone asks:

What is the point in using “targets”?

“I see many use "targets" as exit rules. Like sell when price rises 10 points from where I bought; or sell if price drops 2 points from where I bought.

But the market price does not depend on where you bought! So WTF?”

Jack Hershey responds:

Targets are inventions of traders. And the market does not put targets up on a screen.

Targets could be thought of as parts of trading approaches. The reason they are there is to complete a trading approach.

So targets originate some time in the process of creating or refining a trading approach because they fulfill a trader’s need.

What need does the trader express when he invents a target as part of a trading strategy?

There may be many ways the target satisfies a need or needs. Any trader can go back over his notes on where he introduced the target and, there, he will find out why he did it.

He will notice it has something to do with his entry. This can be deduced by looking at the equation that was made to get the value of the target. The equation says “Target equals entry, and some arithmetic follows and then a numeric value appears". This has nothing to do with the market and everything to do with what the trader was inventing at the time.

This step in creating an approach has the most to do with limiting the profits a trader will make, more than any other feature of his final approach.

Most of the time it is an afterthought and it is a replacement for the trader’s original exit approach. The original exit approach didn’t work, probably.

Looking at the seasoning process a trader goes through on the way to failure or success, the target is a critical step along the way.

Let’s look at the path to failure first. Targets are created along this path.

Let’s look at the path to success. Targets are removed somewhere along this path if they were ever instituted.

Adding or deleting targets is more important than the creation of most other single aspects of the trader’s methods or approach. It is the place in time where the trader either lets the market talk to him or not talk to him.

A trader who gets to understand his partnership with the market does not use targets. It is the market’s job to determine some things. Included in these are two important things: entries and exits at first, then, later when they are not used anymore, holds and reversals.

Why do targets for exits go away? It is mostly because exits go away. Exits are replaced with reversals when the trader understands his partnership with the markets.

As has been said, “It is obvious to everyone that an exit signal is an entry signal in the opposite direction”. Actually, it was said last week after the person read the statement which he was reviewing while he looked for something he wanted to criticize.

Seriously, when a person has determined his partnership with the markets and when he lets any market do the job of giving him segments of profits one after another, what has led him to that place?

It may be the realization that the market talks to traders and says things that are always correct and at the correct time.

These messages may not be seen by many simply because they are not on display. Displaying the markets is part of the creative process. If a trader is creating an approach and he cannot see the markets nor the roles the market plays, he is going to have to go to great lengths to make up for these shortcomings. Well, isn’t he? More precisely, aren’t you?

Is it arrogant and condescending of me, the writer, to ask? Maybe not. I am in support of a person going up a path to excellence. Let’s tip the path upward first.

The markets unfold. They do this over time. It may take years for them to display themselves.

Markets: show me the partnership and show me what you have to say. Either do it from details building into concepts or do it by showing me the concepts and break them up into pieces that I can collect and make use of.

The market will tell you both. Groups of pieces are needed to see conclusions which are related to the principles of the market.

This is so difficult to do for traders because they feel, want and desire to make decisions most of all. The market makes the decisions, however. The trader hears what leads to decisions as the market talks to him all the while.

How does a trader really create a trading approach? Read about it. It is done by paying tuition and waiting a long time to find out. The Holy Grail is the name of something that is sought after. None of these things is a very good idea at all. They lead to limitations that may turn out to be overpowering and, if this path is used, it leads away from success.

People aren’t built, naturally, to be traders. So, most people cannot go through the adjustments to become traders. Naturally, nature takes care of most people by simply conducting them, as effectively as possible, away from trading. Most of the time it comes down to taking their money away or not letting them make enough to make it worthwhile (compared to other survival missions they ultimately accept as their life experience).

The way down to the exit is filed with the emotions nature provides as gravity: fear, anxiety and anger. These turn out to be the three gauges a trader on the path uses to test his progress. The trader going upwards to success enjoys support, comfort and confidence. If a tinge of fear, anxiety or anger becomes present, it is an immediate caution that something is awry in what the trader is sensing. In other words, the market is not talking to him or, more important; he is preventing the market from talking to him.

The markets do not do targets.

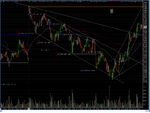

Clean geometry on YM today, for the archive....a technical day. Once I'd seen two impulses down and two retacements, shorting the top of the second one i.e wave 4 (16:30ish) at the channel top boundary seemed like a good idea. Exit near bottom of consolidation at the 45 pt target. Once we broke out upwards from this channel at 20:00 there were two decent Ross Hook style pullback trades (buy penetration of the high of up to 4 pullback bars i.e 20:04 and 20:18)

So, a target was used in the first case to measure the likely retracement length (for entry) and to project a symmetrical run down of x points (for exit: wv 5 might and did equal wvs 1 &3) [exit also near a gap fill]. But not in the second: in the case of the RH trades moved stop up with proprietary Kiwi trailing stop line (dark grey) and exit on close. In an ideal world lol ... actually I took some off at VWAP (20:14) like a coward.