You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

hhiusa

Senior member

- Messages

- 2,687

- Likes

- 140

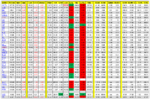

ok..to get back on track..done a few hours tonite on TwC..this is a new setup that is a work in progress..still a bit to do..but getting there

The color scheme makes my eyes hurt a little. Do you use all of the information there or is some of it just food for thought? For example, how important is the dividend yield to you? I noticed that you have it in your setup.

Lúidín

Established member

- Messages

- 818

- Likes

- 61

The color scheme makes my eyes hurt a little. Do you use all of the information there or is some of it just food for thought? For example, how important is the dividend yield to you? I noticed that you have it in your setup.

not that important..i just want to know which symbol is paying the highest div..i need to add the next div dates..the colors are also wip..will prob change before finished

i start off with most basic info..then..as i go along i will either hide or get rid of stuff that is not required..some is needed for the calcs..but can easily be hidden if not required for trading

as u know..this is just the screener..all i need do is click on the symbol and i am brought to the trading tab..which now has some charts..but i will be getting rid of them for this exercise..as the whole idea is to see if i can TwC as good as with charts..my gut feeling right now..is..YES

Lúidín

Established member

- Messages

- 818

- Likes

- 61

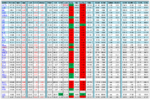

is this better..left some old color for comparison ?

you are correct..the colors are as important as the data..for..if you can not read the flow correctly..then you will not process the information correctly..and the colors play a big part creating the path for the eyes to follow

very astute observation..many would not even think of it

you are correct..the colors are as important as the data..for..if you can not read the flow correctly..then you will not process the information correctly..and the colors play a big part creating the path for the eyes to follow

very astute observation..many would not even think of it

Attachments

hhiusa

Senior member

- Messages

- 2,687

- Likes

- 140

is this better..left some old color for comparison ?

you are correct..the colors are as important as the data..for..if you can not read the flow correctly..then you will not process the information correctly..and the colors play a big part creating the path for the eyes to follow

very astute observation..many would not even think of it

That is much more pleasing to the eye.

Lúidín

Established member

- Messages

- 818

- Likes

- 61

hh..have you noticed anything bout pre market movement in index ftrs..it is a regular occurence..and can help identify possible moves when the market opens..this is not about predicting the future..it is about how certain people with deep pockets trade

it is very interesting

it is very interesting

hhiusa

Senior member

- Messages

- 2,687

- Likes

- 140

hh..have you noticed anything bout pre market movement in index ftrs..it is a regular occurence..and can help identify possible moves when the market opens..this is not about predicting the future..it is about how certain people with deep pockets trade

it is very interesting

I have not been watching the futures market. What has been going on?

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

Today's global selloff is caused by Shanghai. Their market tumbled 7%. This is a great swing trade opportunity.

As Warren Buffett said "Be fearful when people are greedy, and be greedy when people are fearful".

Does Warren Buffett trade martingale like you do and does he closes his stocks just for +1-3% ?

Last edited:

hhiusa

Senior member

- Messages

- 2,687

- Likes

- 140

Does Warren buffet trade martingale like you do and does he closes his stocks just for +1-3% ?

Do you know what he does?

Maybe we should cowboy leveragers like Lehman. Since you do not close 1-3% up. Is it also true that your stops are 1-3% below?

Stops are like training wheels, sooner or later you need to ride without them.

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

Do you know what he does?

Maybe we should cowboy leveragers like Lehman. Since you do not close 1-3% up. Is it also true that your stops are 1-3% below?

Stops are like training wheels, sooner or later you need to ride without them.

You are not aware that Mr Buffett invests in options ?! Which are nearly the most leveraged markets ! . And you think he buys and holds just in the downside but in the upside he closes prematurely for a mere +1% ... !

hhiusa

Senior member

- Messages

- 2,687

- Likes

- 140

You are not aware that Mr Buffet invests in options ?! Which are nearly the most leveraged markets ! . And you think he buys and holds just in the downside but in the upside he closes prematurely for a mere +1% ... !

Now you are showing your cluelessness. Stop equivocating. leveraged products are not the same as leveraging yourself. You are leveraging in the sense you are buying with money you do not have. That is definitely not the case with Warren Buffett.

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

Now you are showing your cluelessness. Stop equivocating. leveraged products are not the same as leveraging yourself. You are leveraging in the sense you are buying with money you do not have. That is definitely not the case with Warren Buffett.

He sells leap options for institutions at a huge size ...

hhiusa

Senior member

- Messages

- 2,687

- Likes

- 140

He sells leap options for institutions at a huge size ...

Wow! Clueless statement number 100 today. 😆

Yes, because he has the money. How do you not follow that. Buying a leveraged product is not the same as leveraging yourself. If you have the physical cash to back up the premiums, then you have not leveraged.

Apparently, you have equivocated all scenarios of leveraging into one. You think a leveraged product is the same as leveraging your account.

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

Wow! Clueless statement number 100 today. 😆

Yes, because he has the money. How do you not follow that. Buying a leveraged product is not the same as leveraging yourself. If you have the physical cash to back up the premiums, then you have not leveraged.

Apparently, you have equivocated all scenarios of leveraging into one. You think a leveraged product is the same as leveraging your account.

You are clu@less selling an option is not like buying one , certainly he has alot of money but its nothing compared to the market ... Lehman and other banks surely had alot of money but ... !

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

You shouldn't open your mouth after yesterday's exchange you thought futures contracts are "locked in" and cant be closed b4 expiration date same goes for European options positions , and one can buy and short the same stock simultaneously in the same account and options exercising is the same as closing an option no difference ! Who is the clueless exactly .

hhiusa

Senior member

- Messages

- 2,687

- Likes

- 140

You shouldn't open your mouth after yesterday's exchange you thought futures contracts are "locked in" and cant be closed b4 expiration date same goes for European options positions , and one can buy and short the same stock simultaneously in the same account and options exercising is the same as closing an option no difference ! Who is the clueless exactly .

Broken record! 😆

(133.80-133.75)/133.80 = 0.03% gain << 1-3%

(134.50-133.75)/133.80 = 0.56% gain << 1-3% 😆