mp6140

Established member

- Messages

- 742

- Likes

- 75

Mp -- About The "prior Close"

===================================================

I would imagine it was both, or the prior close would not have indicated a short --- unfortunately, I dont believe I receive a feed concerning the symbol, although Barclays does provide one of my feeds for forex, so i cant analyze what was going on at that moment !

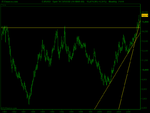

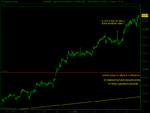

well, ive never called it a signal bar, but i guess thats what it is by golly --- it is simply the prior days closing price which represents strong resistance, obviously --- if the stock, currency or index breaks up at that point, its very strong medicine !

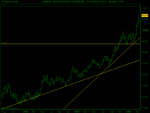

the "normal" run for a stock, forex or any others is 3 days, with the run usually ending about midday of the third day (here in the states its 12 noon, est --- watch the currency reverse, approach the "prior closing price", and one of two things happen --- either we break down thru it, or its left for the next market to break thru)

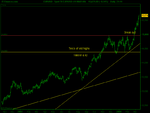

my exits (more than entries, as i may enter anywhere i see a trend has developed) are based COMPLETELY on support and resistance, with a look at the normal intraday, daily, weekly and monthly pivots, although one can do just fine with the normal chart overlays --- its only when you want to impress others, hit the EXACT tp before a major reversal and announce to the world that you are a master of the time/space continuam, that one needs the more esoteric overlays.

Not written in stone, but way above average situation.

markets move in reasonably predictable manners, because theyre being run by humans (who can be reasonable or not) and humans like their organization. Simply by watching how the charts move, focusing on the PATTERN and not the pips, one can pretty much lock into how it moves.

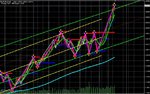

If one uses the LRC channel (an overlay for MT4 called SHI Real does the same thing), you can plot and predict with amazing accuracy, the movements of the index.

there are only a few things one really needs to know about forex to be reasonably successful, and not a lot of the hogwash I read on these sites deals with it because IT TAKES TIME AND EXPERIENCE before you can see the patterns and trends, and that requires a commitment and not a "get rich quick" mentality.

the same goes for most EA's, although I have found a very few that work on price movement and trends, and therefore are superior to the majority of stuff out there. I dont pay much attention because im a manual trader (otherwise I couldnt claim im a trader at all if some robot does my work for me)and so I had to learn the hard way and make the mistakes that had me on my knees, doing foxhole prayers to G-D to save me just this one time more.

But I learned and survived, and if i can do it anyone can do it cause its just not hard !

sorry for being longwinded, but often i just get tired of the hogwash I continuously read, and after many years of seeing the same old same old, I get a rather unpleasant taste in my mouth !

so trade well, learn much and enjoy all

mp

I've been going back to your post 212 and trying to get a grip on it. Yesterday I shorted BARC, a British bank, with success. I'm not sure whether it was because of Bear, Stearns or whether it it was that BARC was, what I considered as, a pullback in a bear stage. Anyway, I drew a horizontal line and used your post as a reason to short.

I'm a little uncertain as to what you consider a signal bar, though.

Split

===================================================

I would imagine it was both, or the prior close would not have indicated a short --- unfortunately, I dont believe I receive a feed concerning the symbol, although Barclays does provide one of my feeds for forex, so i cant analyze what was going on at that moment !

well, ive never called it a signal bar, but i guess thats what it is by golly --- it is simply the prior days closing price which represents strong resistance, obviously --- if the stock, currency or index breaks up at that point, its very strong medicine !

the "normal" run for a stock, forex or any others is 3 days, with the run usually ending about midday of the third day (here in the states its 12 noon, est --- watch the currency reverse, approach the "prior closing price", and one of two things happen --- either we break down thru it, or its left for the next market to break thru)

my exits (more than entries, as i may enter anywhere i see a trend has developed) are based COMPLETELY on support and resistance, with a look at the normal intraday, daily, weekly and monthly pivots, although one can do just fine with the normal chart overlays --- its only when you want to impress others, hit the EXACT tp before a major reversal and announce to the world that you are a master of the time/space continuam, that one needs the more esoteric overlays.

Not written in stone, but way above average situation.

markets move in reasonably predictable manners, because theyre being run by humans (who can be reasonable or not) and humans like their organization. Simply by watching how the charts move, focusing on the PATTERN and not the pips, one can pretty much lock into how it moves.

If one uses the LRC channel (an overlay for MT4 called SHI Real does the same thing), you can plot and predict with amazing accuracy, the movements of the index.

there are only a few things one really needs to know about forex to be reasonably successful, and not a lot of the hogwash I read on these sites deals with it because IT TAKES TIME AND EXPERIENCE before you can see the patterns and trends, and that requires a commitment and not a "get rich quick" mentality.

the same goes for most EA's, although I have found a very few that work on price movement and trends, and therefore are superior to the majority of stuff out there. I dont pay much attention because im a manual trader (otherwise I couldnt claim im a trader at all if some robot does my work for me)and so I had to learn the hard way and make the mistakes that had me on my knees, doing foxhole prayers to G-D to save me just this one time more.

But I learned and survived, and if i can do it anyone can do it cause its just not hard !

sorry for being longwinded, but often i just get tired of the hogwash I continuously read, and after many years of seeing the same old same old, I get a rather unpleasant taste in my mouth !

so trade well, learn much and enjoy all

mp