05-oct-15 - crude oil

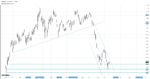

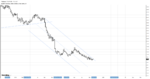

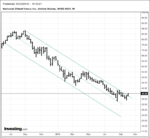

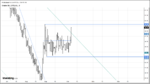

Oil price has been falling for over a year. First weekly chart shows price hitting lows of 2009. Second weekly is just zoomed in on the last year or so. There appears to be a wedge forming but on smaller timeframes it looks more like a range so I haven't drawn it on.

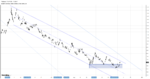

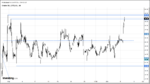

On the daily price has been in a range since the end of august. This range was traded twice before this year. As per blue box.

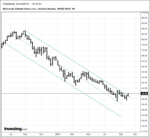

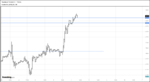

The hourly shows price behaviour around the support/resistance and mean of the range. I see a lot of spikes in the price throughout the range. I assume this is because of news reports on the plethora of political and commercial variables that have an effect on the price of oil.

Oil price has been falling for over a year. First weekly chart shows price hitting lows of 2009. Second weekly is just zoomed in on the last year or so. There appears to be a wedge forming but on smaller timeframes it looks more like a range so I haven't drawn it on.

On the daily price has been in a range since the end of august. This range was traded twice before this year. As per blue box.

The hourly shows price behaviour around the support/resistance and mean of the range. I see a lot of spikes in the price throughout the range. I assume this is because of news reports on the plethora of political and commercial variables that have an effect on the price of oil.