I agree there are many methods of trading and some in each ‘school of thought’ inevitably reject the others as nonsense, but generally add ‘if it works for you, then use it’. I kept my mind open to all possibilities for as long as possible. I tried all I could find and even developed a method of my own based on diagonal lines. After a long time I noticed that there was a strong link with Fibonacci levels, which was encouraging. But additionally the price followed my lines between levels and you could say corresponded with support and resistance levels. Do I want to patent my method (if it were possible)? Of course not, it’s nonsense. Intriguing and compelling certainly, but all the same nonsense. Why? Because you can draw random lines through any price chart and find significance wherever they cross the price. Try it. If traders are making money using the methods they claim, then I respectfully believe that something else is happening i.e. intuition and judgement based on experience. I’m not trying to be controversial, just honest with myself.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Jimi, i'm not sure you'll find many people with the required motivation to disagree with your points and explain their whole belief system about the markets, as it's just a waste of energy and time for anyone who makes money. I refute many of your 'facts', as accepting them would lead me to being a net loser. However, from reading what you've said, it seems like your beliefs and premises about trading are completely misaligned, which will make disciplined, profitable trading practically impossible. You say you're a full-time trader of 2 years...are you profitable? Do you make a living from trading?

I'd also add that thousand of hours of watching screens and testing countless indicators & EA's doesn't add up to squat if you start with an incorrect premise.

You imply that I am a loser, rubbish my beliefs and premises without saying which or why and ask for my results without publishing yours. If you can’t say anything useful, why say anything at all? Nevertheless, thanks for my new motto.

"Thousands of hours watching charts" in two years. There are maybe 12k waking hours in two years, so you've spent, what, 25% of your waking time looking at charts? Did you never get bored or think that maybe you were barking up the wrong tree?

I don't trade technical patterns but of all of them, head and shoulders for me has always seemed the best one.

What's your conclusion anyway.. you're going to persevere or give up?

I’ve barked up very many trees, continued through the wood with determination, revisited the same trees after rejecting them and barked again. Inevitably most of the trees were the wrong trees.

No I don’t get bored, In fact, I find the subject endlessly fascinating and look forward to the next day, which answers your question.

Cycles within cycles.Very often five waves up.In organized markets chart patterns show supply and demand breakouts. Flags definitely fly at half-mast.How did they do it before computers. Same buyers and sellers in all markets.Thousands more trade but do not sit in front of there screens all day and are successful.It sounds like you are listing to the news. This can be a real problem.Until I get in.Bent trend lines.To low. But when they come back, they trade a few seasonal spreads a year and earn back there losses.Pullback is a test of support. Big money wants to see support before it goes whole hog.Reveals accumulation and distrubution of securities.Elliot waves (five waves up off of the second low of a double bottom) can be clearly seen on seasonal charts. No guessing needed.

Good of you to take the time and trouble to reply in detail, which I found to be enigmatic and amusing, particularly your answer to point 8). However, I don’t know why you think I listen to the news – nothing could be further from the truth as I don’t want to be influenced that way. If I have it on good authority (maybe not the news) that something will happen, then it can subconsciously affect me, which I don’t want. I believe that everything I need to know is on the chart.

Point 3) “Flags definitely fly at half mast”. Great phrase, but I didn’t get it.

Point 5) Before computers they probably didn’t line up, I don’t know. In the old days I believe that some people made fortunes by noticing where moving averages crossed over.

() A few seasonal spreads – must look into that.

No-one else has to-date picked up on my hints at Elliot Wave Theory, which was where I was going with this line of thought.

What? S&R lines are where lots of people place entry orders, TPs & SLs, therefore they are significant levels to trade off. Grab the H1 GBPUSD chart for the past 2 weeks and now tell me you think that a support line is just a "fanciful creation of the mind"...

The reason that Fibs and the like work is due to people using them; again people setting pending orders and stop losses etc at these levels. So, they do work.

I take your point. In fact, I sent a chart to an independent, verifiable and responsible trader, who by his own admission is very successful. I annotated the chart of the UK100 with my expectations for that same afternoon using Fibs & S/R. Guess what? I was exactly right. But, of course, on other occasions I’ve been exactly wrong.

I’ve been a member of several live trading forums and predictive services of fair repute and found that their success is no better than mine. Extraordinary. In fact, I was amazed, I often did the opposite to their advice using my system and they lost money not me.

The key is consistency and that’s what I’m striving for.

I agree with some of your points and disagree with others.

I sometimes have the thought that a lot of TA under some market conditions is just somewhere to hang your hat.

What I mean by this is a lot of the time the market seems to be a fluid swirling randomness with no particular tidal flow.

I sometimes think that traders who can make money under these circumstances, all using differing TA are just drawing a line in the sand as a way of creating a reference point they believe in, to trade from, to create form in the market and to use money and trade management within it.

For me though I am in need of a trend and or my perception of S/R but I am always striving to find a way to successfully trade randomness.

I sometimes have the thought that a lot of TA under some market conditions is just somewhere to hang your hat.

What I mean by this is a lot of the time the market seems to be a fluid swirling randomness with no particular tidal flow.

I sometimes think that traders who can make money under these circumstances, all using differing TA are just drawing a line in the sand as a way of creating a reference point they believe in, to trade from, to create form in the market and to use money and trade management within it.

For me though I am in need of a trend and or my perception of S/R but I am always striving to find a way to successfully trade randomness.

For what reason are the "pullback" and "head and shoulders" "shapes" the only ones that work when the Market "might as well be random"?

A genuine question, I'm not having a dig.

It’s very difficult to be unambiguous when describing charts in words (a picture/1,000 words), however, that’s what I’m going to do because it forces me to think more about what I see.

For my convenience, I distinguish between a ‘PATTERN' which is ‘imposed/added/drawn’ after it has been recognised

e.g. a wedge or trend line ...

and a ‘shape’ which is ‘traced’ or left behind like a snail’s trail

e.g. a pullback or head and shoulders (H&S).

A pullback can be seen very clearly when using candlesticks, and a short term EMA certainly provides increased visibility - the EMA ‘traces the shape’ without the need for pattern recognising software, which I use for identifying H&S, which are not totally obvious, but follow the same principle i.e. they are traced rather than being imposed.

Does this matter? I hear people say: A pattern is a shape, a shape is a pattern, a word is a word. How does one prove the distinction is important or it does not matter? The only way I can think of is to use an ‘Expert Advisor’/’Strategy Tester’, which I’ve used to test various ideas, but not this one. Of course, whilst one can say with absolute certainty that over a past period an idea has worked a percentage of the time (given the accuracy of the data etc), there is no guarantee that it will work again, ever! However, as sure as the sun will rise, pullbacks will reoccur. It is the nature of price action.

To cut to the chase ... If ‘My facts’ 1 & 2 are universal (3 to 7 were more my opinion, belonging to me i.e. “My facts”), then it might be useful to examine the process that produces pullbacks more closely and extend it. Pullbacks are ‘shapes’ not ‘patterns’ (“My definition”, for use by me, take it or leave it, there’s no point in people attacking me again).

H&S are shapes also, albeit slightly more ‘involved’, which I prefer to the word ‘complex’ since the same process is involved. I deliberately used the word ‘ripple’ in universal fact (2) as a clue to where this might go. I was hoping that someone would pick up the ‘Elliot Wave’ idea I finished with and run with it.

I’m put off Elliot Waves because they are so darn complex, but just a minute, is it the same process on a grander scale? Or why not a very small scale? Certainly the ‘shape’ is more complex.

I believe that ‘My fact’ (8) is also a ‘universal fact’, which would surely be simple to prove and I would have to disagree with -ooO(GoldTrader) who said “Bollinger Bands” are “Bent Trend Lines” (although it might a joke) if my distinction between patterns and shapes has any validity i.e. they are traced not drawn.

If you’re still with me, then congratulations. Any constructive comments or genuine questions are welcome.

nunrgguy

Established member

- Messages

- 683

- Likes

- 126

Consistency: I've noticed the word consistency cropping up and I can't bl00dy spell it.

To me that is the crux of where people go 'wrong' because it implies having no losses or not taking a loss. It tends to imply the bullsh1t fantasy land of internet traders that on a daily (or weekly) basis want to see a profit on the bottom line, implying both that they are closing trades out and booking profits when there's perhaps more to be had and also trading a small(er) account for regular income rather than capital growth.

All in the name of 'consistency'. It's looking for the wrong things in the wrong place.

To me that is the crux of where people go 'wrong' because it implies having no losses or not taking a loss. It tends to imply the bullsh1t fantasy land of internet traders that on a daily (or weekly) basis want to see a profit on the bottom line, implying both that they are closing trades out and booking profits when there's perhaps more to be had and also trading a small(er) account for regular income rather than capital growth.

All in the name of 'consistency'. It's looking for the wrong things in the wrong place.

All in the name of 'consistency'. It's looking for the wrong things in the wrong place.

It's not looking for the wrong things in the wrong place, it's trying to find the right thing in the only place that I am looking ,so I suppose that consistency isn't in my dictionary!

Blaiserboy

Well-known member

- Messages

- 391

- Likes

- 24

trading with graphs and charts has become easy with the help of indicator....if anyone wants test my indicator just contact me at [email protected]

does this mean you are selling an indicator........?

Did you register as a vendor with Trade2 Win............. or are you just advertising looking for people to buy your junk without being registered.?

Blaiserboy

Well-known member

- Messages

- 391

- Likes

- 24

no friend i am just helping others to earn profit easily...

In other words you are marketing an indicator which was my original question. other than that, you would post it in here..

sighthound

Well-known member

- Messages

- 437

- Likes

- 124

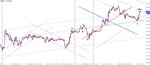

Not taken any sides just took a quick snapshot of usd/chf M15 and put a few lines on etc to see how it plays out ,if someone more experienced wants to add a chart all the better,will post another chart tomorrow,M15 picked at random.Would like to see varying opinions on what happens.

Attachments

Not taken any sides just took a quick snapshot of usd/chf M15 and put a few lines on etc to see how it plays out ,if someone more experienced wants to add a chart all the better,will post another chart tomorrow,M15 picked at random.Would like to see varying opinions on what happens.

I drew three lines on your graph with my eyes shut and subsequently coloured them red, green and blue. I did not adjust lines to make my point, but they are rather good.

Notice how the green line acts as resistance at A, support at B and support at C, right before the price races up!

The red line clearly identifies an upwards trend from X to Y to Z.

The blue line .... Hasn’t revealed it’s secrets yet so I copied it into a dashed line and quite obviously it’s another trend line! And, and ... (now it’s getting really exciting) -

- where the green crosses the blue line the price leaps up!!! Wow, really Wow!

If I read this post I’d doubt, really doubt that those lines were drawn by chance. It’s a fake, right? No, it’s genuine. Try it.

So what’s the price going to do next? I don’t know, how could I? It will do what it will do. Only AFTER it's done what it's done can I explain it using Fibonacci, Gann, Bollinger, Elliot or better still my eyes shut method.

Please tell me what’s going to happen any time forwards, I can do past time by myself.

There are hundreds, even thousands or videos on Youtube describing the past to me - even by members of this forum. But why not be different and describe what's going to happen?

Attachments

B

Black Swan

Not contributed to this thread, wanted to watch it *evolve*..so..as you now accept that 'the game' is all about probabilities could these patterns/indicators/trend lines help you predict (with a reasonable amount of historical precedent) what happens next, or do you think every trade is simply a 50:50 crap shoot..? And if it is a random 50:50 shoot can you figure a way of making money from it? 🙂

When analysing a situation we need a list of points, which can be stated positively as in “My facts” or as questions i.e.

Either

8) 'It is' more likely that a trend will continue than reverse.

Or

8) 'Is it' more likely that a trend will continue than reverse?

We can then challenge these statements, quantify them, provide evidence and even test them.

I invited people to challenge them, suggested one test and hoped people would add to the list.

Yours are the first new questions:

11) “Could these patterns/indicators/trend lines help you predict

(with a reasonable amount of historical precedent) what happens next?”

12) “If it is a random 50:50 shoot can you figure a way of making money from it?”

In order to answer any of these questions, we have to be specific and find ways to test them.

I said “I know of no study that has proved that the price is more likely to go up or down following any chart pattern”. Now favouring the question format I ask:”Does anyone know of a study ... etc?”

Books, articles, blogs etc are full of unsubstantiated, vague opinion. Read this thread. (Yes, that was sharp, but necessary) i.e. if this dialogue is to be of any value to anyone we have to state clearly not only what we believe but in addition either 'why it works' (which is an opinion) or more usefully 'what percentage of the time it works', and must exclude “because it works for me”. If it does that’s great, but if others cannot reproduce your results then you are just talking about how lucky you are.

Some of the people are right some of the time. When I am right, I ask myself – was it luck? Because of the criteria I set myself, I am always forced to answer: “Yes, drat”. However, I do make money by trying all kinds of stuff. I don’t mind making losses, although I prefer the wins, which is why I added the word “consistency”. Nevertheless, I like the point so nicely made by nunrgguy “"Place an order son” ..."Then let's see how price reacts”, which is more or less my current strategy.

I have a good exit strategy and reasons for entering. However, all of those reasons can be invalidated by what the price does next.

Either

8) 'It is' more likely that a trend will continue than reverse.

Or

8) 'Is it' more likely that a trend will continue than reverse?

We can then challenge these statements, quantify them, provide evidence and even test them.

I invited people to challenge them, suggested one test and hoped people would add to the list.

Yours are the first new questions:

11) “Could these patterns/indicators/trend lines help you predict

(with a reasonable amount of historical precedent) what happens next?”

12) “If it is a random 50:50 shoot can you figure a way of making money from it?”

In order to answer any of these questions, we have to be specific and find ways to test them.

I said “I know of no study that has proved that the price is more likely to go up or down following any chart pattern”. Now favouring the question format I ask:”Does anyone know of a study ... etc?”

Books, articles, blogs etc are full of unsubstantiated, vague opinion. Read this thread. (Yes, that was sharp, but necessary) i.e. if this dialogue is to be of any value to anyone we have to state clearly not only what we believe but in addition either 'why it works' (which is an opinion) or more usefully 'what percentage of the time it works', and must exclude “because it works for me”. If it does that’s great, but if others cannot reproduce your results then you are just talking about how lucky you are.

Some of the people are right some of the time. When I am right, I ask myself – was it luck? Because of the criteria I set myself, I am always forced to answer: “Yes, drat”. However, I do make money by trying all kinds of stuff. I don’t mind making losses, although I prefer the wins, which is why I added the word “consistency”. Nevertheless, I like the point so nicely made by nunrgguy “"Place an order son” ..."Then let's see how price reacts”, which is more or less my current strategy.

I have a good exit strategy and reasons for entering. However, all of those reasons can be invalidated by what the price does next.

-oo0(GoldTrader)

Well-known member

- Messages

- 345

- Likes

- 5

There are systems that attempt to pull profits from a 50:50 probability.*And if it is a random 50:50 shoot can you figure a way of making money from it? 🙂

See: http://en.wikipedia.org/wiki/Martingale_(betting_system)

When analysing a situation we need a list of points, which can be stated positively as in “My facts” or as questions i.e.

Either

8) 'It is' more likely that a trend will continue than reverse.

Or

8) 'Is it' more likely that a trend will continue than reverse?

We can then challenge these statements, quantify them, provide evidence and even test them.

I invited people to challenge them, suggested one test and hoped people would add to the list.

Yours are the first new questions:

11) “Could these patterns/indicators/trend lines help you predict

(with a reasonable amount of historical precedent) what happens next?”

12) “If it is a random 50:50 shoot can you figure a way of making money from it?”

In order to answer any of these questions, we have to be specific and find ways to test them.

I said “I know of no study that has proved that the price is more likely to go up or down following any chart pattern”. Now favouring the question format I ask:”Does anyone know of a study ... etc?”

Books, articles, blogs etc are full of unsubstantiated, vague opinion. Read this thread. (Yes, that was sharp, but necessary) i.e. if this dialogue is to be of any value to anyone we have to state clearly not only what we believe but in addition either 'why it works' (which is an opinion) or more usefully 'what percentage of the time it works', and must exclude “because it works for me”. If it does that’s great, but if others cannot reproduce your results then you are just talking about how lucky you are.

Some of the people are right some of the time. When I am right, I ask myself – was it luck? Because of the criteria I set myself, I am always forced to answer: “Yes, drat”. However, I do make money by trying all kinds of stuff. I don’t mind making losses, although I prefer the wins, which is why I added the word “consistency”. Nevertheless, I like the point so nicely made by nunrgguy “"Place an order son” ..."Then let's see how price reacts”, which is more or less my current strategy.

I have a good exit strategy and reasons for entering. However, all of those reasons can be invalidated by what the price does next.

You're right about most things, and to be honest I only believe that trades work off S and R because everyone is doing the same thing, and trading in the same way, but then you would think you would have a reasonable chance of the price reverting after 100 point move. There's alot of BS going on, but what you gotta remember is like audusd has for example has hit 1.0200 a few times and bounced off it, and alot will remember this, so when the price got down to 1.0205 today, there would have been a number of poeple thinking this is definitely a buy down here. It will definitely bounce off that support line, which was such a huge resistence in the past.

S and R does work. You just have to be patient and pick the right moments. If the price has reverted a long way that day to find that 1.0200 then theres a good chance it will bounce off that.

I have to be honest and say: whilst my point 3) IS correct: S&R lines “can be found in randomly generated data” and whilst, as I demonstrated, randomly drawn lines can act as S&R lines’, I actually agree with cuddykid and you that double/triple top/bottom ‘patterns’ (ouch that hurt!) have significance. And, perhaps for the reason you give, which if true would mean that the other popular ‘patterns’ such as Fibonacci have equal validity. Does this mean I would buy an ‘Expert Advisor’ based on these criteria? No, absolutely not, which means one of two things 1) using an EA as a test of whether an event has greater than 50% predictability is not valid, which I don’t believe for a moment, or 2) whether the price bounces or goes through is 50/50 unless other judgement comes into play.

I have to be honest and say: whilst my point 3) IS correct: S&R lines “can be found in randomly generated data” and whilst, as I demonstrated, randomly drawn lines can act as S&R lines’, I actually agree with cuddykid and you that double/triple top/bottom ‘patterns’ (ouch that hurt!) have significance. And, perhaps for the reason you give, which if true would mean that the other popular ‘patterns’ such as Fibonacci have equal validity. Does this mean I would buy an ‘Expert Advisor’ based on these criteria? No, absolutely not, which means one of two things 1) using an EA as a test of whether an event has greater than 50% predictability is not valid, which I don’t believe for a moment, or 2) whether the price bounces or goes through is 50/50 unless other judgement comes into play.

If you look at a chart and you see squiggly lines and shapes, you're screwed. If you look at a chart and see trading psychology, volatility and patterns, you're getting somewhere.

Similar threads

- Replies

- 135

- Views

- 34K

- Replies

- 1

- Views

- 5K

F

- Replies

- 2

- Views

- 9K