You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

the_winner_11

Junior member

- Messages

- 32

- Likes

- 0

Well, in my opinion one can't be right or lucky all the time, so probably you really need more time for testing and examining the information

There are only two outcomes: a losing or a winning trade. A good system (and the money management) should be there to avoid a big loss: a trader should know before entering a trade how much is at risk. Personally I don't feel comfortable if the loss is more than 2% of my equity, so by knowing where my stop loss is I can calculate what size I can trade - that is the only thing I can control (size of the loss).

Once in a trade I wait either for the stop or the target to get hit. IMO there is no point in looking too much at what happened afterwards (once I'm out of the trade).

So far as the system is statistically viable there is no need to despair. Also if reward risk ratio is a nice one, a system can have less than 50% strike rate and still be profitable. Important thing is to follow the system and be prepared to take losses when they come. It took me some time, but nowadays I'm not that much affected by outcome of a single trade. It's all part of a bigger picture.

the quote in red made me :-0. how do i calculate the risk. do you guys have any info, webiste, books etc that will help me understand things better becuase i am looking at some charts etc and getting a headache 😕

sorry to ask for the basic things but i just need to be pointed in the right direction and it would be greatly appreciated 🙂

Regards,

SNL - It's a key question, maybe the most important in trading. How much can you lose?

In essence, every trade needs three prices - Entry, Target and Stop. It's good if the pattern that gives you Entry has a high win rate. It's good if Target is at least as far from Entry as Stop is. Stop is where you will get out of the trade, no matter what, and Stop is never moved further out from Entry. If you can't see both exits, don't enter.

If your account is £5,000 you might be prepared to risk just 2% loss per trade. This will allow you a string of consecutive losses of 2% each, still without wiping you out. 2% of 5000 is 100, so that is the maximum you should be prepared to lose on any one trade. If your charts suggest your Stop will best be placed at a certain level 30 pips from Entry, ensure that your position size is such that a 30 pip move equals 2% of your account.

Sometimes it's easier to do than to tell, which is why it can seem confusing to read about. You can always post a trade and ask people here to look at your numbers or your charts and shoot you down in flames - sorry, I mean comment helpfully. We've all been where you are now - nobody is born with innate knowledge of trading.

In essence, every trade needs three prices - Entry, Target and Stop. It's good if the pattern that gives you Entry has a high win rate. It's good if Target is at least as far from Entry as Stop is. Stop is where you will get out of the trade, no matter what, and Stop is never moved further out from Entry. If you can't see both exits, don't enter.

If your account is £5,000 you might be prepared to risk just 2% loss per trade. This will allow you a string of consecutive losses of 2% each, still without wiping you out. 2% of 5000 is 100, so that is the maximum you should be prepared to lose on any one trade. If your charts suggest your Stop will best be placed at a certain level 30 pips from Entry, ensure that your position size is such that a 30 pip move equals 2% of your account.

Sometimes it's easier to do than to tell, which is why it can seem confusing to read about. You can always post a trade and ask people here to look at your numbers or your charts and shoot you down in flames - sorry, I mean comment helpfully. We've all been where you are now - nobody is born with innate knowledge of trading.

the quote in red made me :-0. how do i calculate the risk. do you guys have any info, webiste, books etc that will help me understand things better becuase i am looking at some charts etc and getting a headache 😕

sorry to ask for the basic things but i just need to be pointed in the right direction and it would be greatly appreciated 🙂

Regards,

It's quite simple SNL.

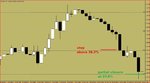

First you need some sort of trading system - in the example attached I traded rejection of 61.8% of Fibonacci level. Idea behind it that when price is trending one way or the other it never goes straight down or up. There are always some pull backs and it seems like 61.8% is good level to enter after a pull back - it works more often than not.

So based on that (also I added some conditions there like waiting for 2 closes below the level etc.) I plan where should enter the trade, where should I put the stop and where my potential target or targets may be.

From the calculations I can see that my risk is 29 pips and potential reward is 34 pips. I like the idea and there is only one more thing to do - I have to find the size of the stake. Personally I don't like risking more than 2% of my account per trade. Sometimes I risk only 1% of the account.

For example: Account is £10,000

1% is £100

Stake = amount at risk/number of pips =

£100/29 = £3.45 per pip

This calculations and analysis I can do in short time and get ready to enter immediately after second close bellow the level. So if the price hits the stop - there is £100 loss for me (that's the known part). About the future price moves - I can only guess based on what happened before under similar circumstances.

If you are lucky and the trade goes your way, you may start taking some of the profit. Also it's a good idea to move your stop, so you can lower the risk on the remaining stake.

If the price hits the stop, good to take a break and look for some other opportunity. Losses are inevitable part of trading unfortunately.

Attachments

Thank you for the advise guys, i am going to have to read your post a couple of times to get a real understanding to what the hell you are talking about :whistling but il get there eventually. Thank you bedsit for the images they do really help me (i work better with visuals than text).

once i understand what is going on ill will proberly come back with some more stupid questions 😛

Thank again guys...

once i understand what is going on ill will proberly come back with some more stupid questions 😛

Thank again guys...

OK her come the stupid questions...

i am assuming the "61.8% of Fibonacci level" is a system?

What is a PullBack?

i am also assuming pips is points!!!

plus what is that Chart? and do you know of a site which explains it?

"also I added some conditions there like waiting for 2 closes below the level etc."

does closes mean day closes and i am unsure of what below the level mean?

sorry for hurting your forehead with you slapping it in disbelief but that chart game a slight headache.

Cheers for all the help so far...

i am assuming the "61.8% of Fibonacci level" is a system?

What is a PullBack?

i am also assuming pips is points!!!

plus what is that Chart? and do you know of a site which explains it?

"also I added some conditions there like waiting for 2 closes below the level etc."

does closes mean day closes and i am unsure of what below the level mean?

sorry for hurting your forehead with you slapping it in disbelief but that chart game a slight headache.

Cheers for all the help so far...

OK her come the stupid questions...

i am assuming the "61.8% of Fibonacci level" is a system?

What is a PullBack?

i am also assuming pips is points!!!

plus what is that Chart? and do you know of a site which explains it?

"also I added some conditions there like waiting for 2 closes below the level etc."

does closes mean day closes and i am unsure of what below the level mean?

sorry for hurting your forehead with you slapping it in disbelief but that chart game a slight headache.

Cheers for all the help so far...

SNL

There are 2 good and relatively cheap books: Trading For Dummies and Currency Trading For Dummies.

I should think you are better off by reading through a good book than spending long time trying to find useful information on the internet.

Before that maybe you should think about trading (if you want to be a trader) - more than 90% of people who try it fail. Try to take it seriously and spend long hours studying and researching. In the meantime forget about trading with real money - open a demo account instead. Once you've been consistently profitable for 6 months trading on a demo account, try with the smallest possible stakes.

PS Hope you don't mind my instructions - just trying to help you avoid different sort of problems that can be caused by lack of trading success.

PPS Just remembered a good book on psychology: Trading In The Zone (M Douglas)

Good luck

PS Hope you don't mind my instructions - just trying to help you avoid different sort of problems that can be caused by lack of trading success.

It is 100% alright mate, i got thick skin 😛

appreciate the honesty if im gona be honest 🙂, i have purchased the book and i will read it throu and start on a Demo account.

I have been trading for about 1 month with real money, i kinda just go into the deep end with things, i know i cant do this with trading thou.

so i think im gona take my time with it and open a demo account for about 3 months starting from March and see how things go.

All my trading so far has been guess work and some i was right and some i was wrong, more often that not wrong.

I would like to ask you something in regards to trading, How much capital do you think is a good amount to start with?

Thank you for all your help so far.

Regards,

It is 100% alright mate, i got thick skin 😛

appreciate the honesty if im gona be honest 🙂, i have purchased the book and i will read it throu and start on a Demo account.

I have been trading for about 1 month with real money, i kinda just go into the deep end with things, i know i cant do this with trading thou.

so i think im gona take my time with it and open a demo account for about 3 months starting from March and see how things go.

If you can afford to lose £10,000 without major disruptions to your life style that would be a reasonable amount to start with, but I wouldn't do that (trade real money) before achieving consistent profitability on a demo account.

A demo account trading would give you an idea about your learning progress. If happy only then I would consider trading with real money which is a bit more challenging - apart from good analytical skills one needs good discipline (control over greed and fear).

If you come to that stage may be a good idea to start risking the smallest possible amount - the amount you are comfortable with (if a loss affects your heart rate, sleeping, gives you indigestion, makes you sweaty etc. you are obviously risking too much). Also I wouldn't do scalping and day trading at the beginning.

PS A trader needs lots of patience - trading is more like a marathon, not a sprint.

Regards

i have been seeing it as a sprint at the moment and i have been doing scalping not even day trading. seen like i have been barking up the wrong tree.

to be honest i dont have 10k to lose. i have 10k plus but thats all my savings.

i am taking your advise and opening a play account after i have read the book you recommended. i was plaing on using £500 per month to trade with after i have further knowledge.

Why wouldnt i do scalping or day trading? just out of curiousity.

also what demo account would you recommend.

to be honest i dont have 10k to lose. i have 10k plus but thats all my savings.

i am taking your advise and opening a play account after i have read the book you recommended. i was plaing on using £500 per month to trade with after i have further knowledge.

Why wouldnt i do scalping or day trading? just out of curiousity.

also what demo account would you recommend.

i have been seeing it as a sprint at the moment and i have been doing scalping not even day trading. seen like i have been barking up the wrong tree.

to be honest i dont have 10k to lose. i have 10k plus but thats all my savings.

i am taking your advise and opening a play account after i have read the book you recommended. i was plaing on using £500 per month to trade with after i have further knowledge.

Why wouldnt i do scalping or day trading? just out of curiousity.

also what demo account would you recommend.

If I were you, I would close the real account immediately. What's the point of giving your hard earned money away? After all trading should be about making money.

Scalping and day trading require fast decisions and extreme discipline. Apart from that you need good analytical skills in order to achieve high success rate.

With scalping there is added difficulty regarding spreads. For example if the mid price for GDPUSD is 16230.0 and you want to buy it you can do it only at 16231.5 (dealer wants his bit). Lets say you want to take profit at 16240.0 mid price (10 points). You can't sell it at the mid price, only at the bid price which is 16238.5 - so if you are lucky you made 7 points(pips). If you are unlucky and your stop gets hit at 16220.0 (10 points) you can get out only at 16218.5 which is 13 points.

This way you are risking 13 points to make 7 points, so to break even you need to be right 13 times out of 20, or to have 65% success rate. This is in an ideal world where there are no slippages, slow trader's reactions, no crooked dealers etc.

IMO if somebody is losing money trading, they will only speed up the process with day trading and scalping.

About demo accounts - for FX you can open demo account with IBFX. They provide you with free MT4 charts. I don't know about commodities, shares etc. If you do some research - maybe CMC markets (I'm not sure about their charting package though).

Once you managed to get some success on a demo, you should spend some time researching the forums to find where is good to open a real account.

I've read some horror stories on this forum - like one trader got stopped 300 points from the real market price😱. You can imagine -the brutality of the market combined with unscrupulous dealer. No wonder more than 90% fail.

PS Avoid trading trainers, coaches, systems like the plague. Most of them are not successful traders and that's their way to make money. Nobody in their right mind would sell you profitable trading system.

Similar threads

- Replies

- 16

- Views

- 5K

- Replies

- 22

- Views

- 6K