lurkerlurker

Senior member

- Messages

- 2,482

- Likes

- 150

Drawdown

-997 on the month. This represents a large chunk of my profits given back to the markets.

In short, I lost this due to unstructured and undisciplined trading on various instruments and timeframes. Some of these losses were due to "fat finger", including an accidental gold trade which I immediately covered for a large loss (why my deal ticket was pre filled to such a large size, I'll never know).

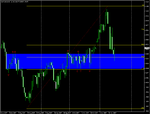

I am entering a new stage in trading, where I will only take trades based on daily bars. I'm following trader_dante's "How to Make Money Trading" thread with some interest, and have already made a profit from my first trade in this style.

I will post all of my new trades in this journal as they happen, complete with before and after annotated charts.

I know I have tried the patience of quite a few traders who have tried helping me - I hope I will turn a corner soon. Intra day trading no longer suits my lifestyle, and I don't think it was a method of trading I was ever very good at, especially paying high costs to access the market through spreadbetting. Longer term positions should provide better results.

Interestingly, my twitchiness and discipline issues don't seem to manifest themselves as much when trading daily bars - I don't usually try to exit early for example.

I've also recently tried out binary betting - I seemed to do okay initially, however my average win was so much smaller than my average loss, so it was like picking up pennies in front of a steamroller. Not something I will try again in a hurry. I paid £100 to learn that it was not for me. That was my last attempt at short term "trading". I've now sworn off intra day trading, and would prefer the forex to indices in the future.

Finally, size kills. I did quite well selling the Dow up to £10pp in August, however with my limited account size and trading experience, I have no business being in the market in size greater than £1pp. I intend to use my IG account for the daily forex trades, and will be trading at £0.50pp in some of the more volatile crosses. I'm taking money management more seriously now, and when evaluating a (pin bar) trade I will take into account my equity and pass up trades which require a wide stop. I can't reduce my position size as £1pp (or £0.50pp) in some cases is the minimum, so some trades will have to be passed up. I might still post the charts, and the hypothetical trade in this journal.

-997 on the month. This represents a large chunk of my profits given back to the markets.

In short, I lost this due to unstructured and undisciplined trading on various instruments and timeframes. Some of these losses were due to "fat finger", including an accidental gold trade which I immediately covered for a large loss (why my deal ticket was pre filled to such a large size, I'll never know).

I am entering a new stage in trading, where I will only take trades based on daily bars. I'm following trader_dante's "How to Make Money Trading" thread with some interest, and have already made a profit from my first trade in this style.

I will post all of my new trades in this journal as they happen, complete with before and after annotated charts.

I know I have tried the patience of quite a few traders who have tried helping me - I hope I will turn a corner soon. Intra day trading no longer suits my lifestyle, and I don't think it was a method of trading I was ever very good at, especially paying high costs to access the market through spreadbetting. Longer term positions should provide better results.

Interestingly, my twitchiness and discipline issues don't seem to manifest themselves as much when trading daily bars - I don't usually try to exit early for example.

I've also recently tried out binary betting - I seemed to do okay initially, however my average win was so much smaller than my average loss, so it was like picking up pennies in front of a steamroller. Not something I will try again in a hurry. I paid £100 to learn that it was not for me. That was my last attempt at short term "trading". I've now sworn off intra day trading, and would prefer the forex to indices in the future.

Finally, size kills. I did quite well selling the Dow up to £10pp in August, however with my limited account size and trading experience, I have no business being in the market in size greater than £1pp. I intend to use my IG account for the daily forex trades, and will be trading at £0.50pp in some of the more volatile crosses. I'm taking money management more seriously now, and when evaluating a (pin bar) trade I will take into account my equity and pass up trades which require a wide stop. I can't reduce my position size as £1pp (or £0.50pp) in some cases is the minimum, so some trades will have to be passed up. I might still post the charts, and the hypothetical trade in this journal.