lurkerlurker

Senior member

- Messages

- 2,482

- Likes

- 150

YM Paper Trading Results

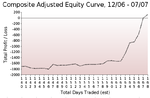

Thanks to firewalkers great post above, I've done some paper trading over the last few weeks. I'm posting results from Monday 9 July 2007 going forward on the YM in a spreadsheet.

The system does have positive expectancy, but needs some work. I am happy to keep paper trading it going forward as these results cover an unusual period of activity in the Dow. This system works better when the Dow is range bound, and does not do well on +/- 200 pip trend days if it misses the entry. Even if it gets the entry, conservative profits are taken. I have worked in three stoploss policies in the example - target of 60 pips with BE at +20 and +20 at +40 works better than either 40 pip target, whether straight -20/40 stop/limit or BE at +20. Again, I will need to test this over different market phases, and use filters for the system, perhaps the previous days range or something.

Anyway, spreadsheets follow as ODS format (OpenOffice), XLS format (MS Excel), SYLK (Open Standard), and HTML (for browser viewing only). Comments greatly appreciated.

Firewalker - thanks for setting me this challenge. As you may have noticed, my P&L has improved dramatically, and I am slightly more confident about holding positions (although discipline is still an issue).

* - Sorry, it won't take these formats. Looks like HTML for viewing and XLS for editing. I did this in O😵rg, so other OpenOffice users should be able to convert the file back in I hope. Let me know if there are any problems.

Being "in tune" is something that can happen from time to time. But as you've found out for yourself being "not in tune" will cause you much more pain (emotionally and financially) than being in tune. So why not stick to "the" (or "a") plan and forget about trying to understand let alone act on instinct.

Also, you started to make daily analysis, but you quit after 3?

"YM Paper Trading, 14 June 2007"

"YM Paper Trading, 21 June 2007"

"YM Paper Trading, 27 June 2007"

is all I can find of?

Unless you make 20 consecutive posts from 20 consecutive days where you followed your plan to the letter, you will keep on going round without making progress.

Sorry to be blunt, but there's really no other way of putting it.

I will challenge you to do the following exercise: papertrade the YM for 2 weeks. 2 week onlys, by using the very simple rules below. Make daily stats of your win%, net points profit, etc as you did before. This isn't about the system, this is about you and the discipline.

Rules

1) Before the day opens review the previous day and note lowest price of the previous day (=PDL) and the highest price of the previous day (=PDH)

2) In case price opens above the PDH (so not inside yesterday's range), then put in:

- a BUY limit order at the PDH

3) In case price opens below the PDL (so not inside yesterday's range), then put in:

- a SELL limit order at the lowest price of the previous day (PDH)

4) In case price opens within yesterday's range, then put in:

- a BUY limit order at the lowest price of the previous day (PDL) and

-a SELL limit order at the highest price of the previous day (PDH)

Your stop is 20 points, your target 40.

This is very basic, very easy, and you don't need to watch the screen during the day, only at the open. At the EOD you'll see if you made profit or not. No stress, no thinking, no second-guessing. Very straightforward, very easy.

I just made up this system and backtested it on the last two weeks and unless I've made an error on this nightly hour I've counted 4 profitable and 8 losing trades. Not deducting commissions that would mean 4 x 40 - 8 x 20 = 0 points. Basically no profit. But that's still better than what you are doing now, which is losing money, right?

Even with commissions from 12 trades in 2 weeks time you still would only be down about 50 USD.

I hope you get my point.

Thanks to firewalkers great post above, I've done some paper trading over the last few weeks. I'm posting results from Monday 9 July 2007 going forward on the YM in a spreadsheet.

The system does have positive expectancy, but needs some work. I am happy to keep paper trading it going forward as these results cover an unusual period of activity in the Dow. This system works better when the Dow is range bound, and does not do well on +/- 200 pip trend days if it misses the entry. Even if it gets the entry, conservative profits are taken. I have worked in three stoploss policies in the example - target of 60 pips with BE at +20 and +20 at +40 works better than either 40 pip target, whether straight -20/40 stop/limit or BE at +20. Again, I will need to test this over different market phases, and use filters for the system, perhaps the previous days range or something.

Anyway, spreadsheets follow as ODS format (OpenOffice), XLS format (MS Excel), SYLK (Open Standard), and HTML (for browser viewing only). Comments greatly appreciated.

Firewalker - thanks for setting me this challenge. As you may have noticed, my P&L has improved dramatically, and I am slightly more confident about holding positions (although discipline is still an issue).

* - Sorry, it won't take these formats. Looks like HTML for viewing and XLS for editing. I did this in O😵rg, so other OpenOffice users should be able to convert the file back in I hope. Let me know if there are any problems.

Attachments

Last edited: