Just trying to help LM

Yeah, its all going pete tong, what with laptops trigger bands looking shot to bits, pigsys non ma strat, what's going on in the kitchen 😱

ok so we need a benchmark timeframe to follow, difficult one that as I'm actually on several timeframes, whichever gives a signal I go with, I'm all for an hour with 0.075 % trigger bands , although 15 min can give an early signal 😕

I have to admit the thread is running out of puff, I'm suprised its managed this much to be honest, after all not much to debate really is there ...price and one MA 😴

Anyway up to the thread contributers how the whole thing pans out method wise. I feel ok with which ever way it goes, take it where you want 😀

LM

Morning Rule Breach😱 because I like to answer a post if I have started something/sorry joined in with a valid concern

😀

Sorry, I thought you wanted to see what others saw regards your entry LM :?:

I thought

😱 it was a method / system in progress,

I am concerned regards whipped entries thats all.

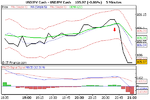

You started on the Ftse, you said you would kick its butt, we are looking at a Dow chart :?:

Ftse I am sure would have done your brains in over the last couple of weeks, if I am wrong then post the good trades and bad and show how method held up

(no discrection)

Just trying to help with filters if you want any help that is LM :?:

Ftse, I just popped a plain 5 ma on and I can see you would have had a monster trade from a conservative entry useing manual S&R pts from 6160 Fut - 5950 approx 15th &16th Jan

but 9th & 10th

😡 and in fact the period up to that trade

😡 not really sure LM

😕

Looks like a lot of small razor wounds to me that add up

😡😢

I watch the hours form if I am trading (screen time excess/ mornings only

😱) and they are very whippy LM, the bars not done untill the turn on the hour and it very often goes up and down multiple times, I am sure others will back me up on this.

Whats the proposed method going to do with what appear to be multi entries on the same bar:?:

I just think its a little early to be getting excited thats all

I posted my charts which just show a bog standard method as old as the hills being employed, which would just have easy caught the same move with IMO a more valid Stop and in fact if the trade was split into 2 lots one for the 15 min timeframe and one for the hour timeframe (the runner) a trader would be sat very nice this morning LM

Rule: exit on breach of High by 5 pts or the average tail in the hour candles = whatever you want =

Simple , eazy peezy

Good luck with method and trading LM :clover: