You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Pazienza

Senior member

- Messages

- 2,334

- Likes

- 442

I think it is the rejection of the close, the sudden change in momentum and volatility expansion at the same time. I know the bar itself is pretty average but there's quite a bit else going on too. Just thought you might have considered it.

Absolutely fair points, and yeah, I did think it over at the time (well, the YM one actually, but it's the same thing basically).

Personally, I have bad experience of trying to take that kind of thing. This is probably because back then I wasn't very discriminating. Part of my improvement process was to almost automatically ignore bars like that unless they were really, really obvious. The reason being that I lost so many times and ended up kicking myself because of it. I'd rather regret a lost profit than a loss outright.

But like I said, your case is fine in my opinion 👍.

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

So, in kind of the same light as I mentioned, 5min chart, reversal off the RTH Low from yesterday, change in momentum, increase in volatility, confirmation of the move and in.

Fidgeted whilst it consolidated, waiting for a close below the high (which didn't happen). Out on the cross at the top, end of day, move slowing down.

Fidgeted whilst it consolidated, waiting for a close below the high (which didn't happen). Out on the cross at the top, end of day, move slowing down.

Attachments

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

and obligatory bikini pic of mine and dash's favourite

Pazienza

Senior member

- Messages

- 2,334

- Likes

- 442

So, in kind of the same light as I mentioned, 5min chart, reversal off the RTH Low from yesterday, change in momentum, increase in volatility, confirmation of the move and in.

Fidgeted whilst it consolidated, waiting for a close below the high (which didn't happen). Out on the cross at the top, end of day, move slowing down.

I can see things to like there, and obviously you pretty well nailed it to the tick almost.

I don't watch ES M5 (although probably I should), but entering there I'd be worried about the strong drop, we're now retracing into a small block of consolidation, which I wouldn't be surprised to see turn us around and send us back down again.

If I was taking it, I'd enter on the pin at the bottom, although honestly that would be a bit aggressive for my tastes.

Nice trade though, played perfectly 👍.

Pazienza

Senior member

- Messages

- 2,334

- Likes

- 442

and obligatory bikini pic of mine and dash's favourite

Erm , it was actually one smutty pic per day, not per chart. But your way probably works better, now that I think about it.

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

I don't normally nail them that well on the exit but I was hot today.

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

Erm , it was actually one smutty pic per day, not per chart. But your way probably works better, now that I think about it.

Maybe a good policy, post a chart, post a bikini.

DashRiprock

Experienced member

- Messages

- 1,650

- Likes

- 482

Maybe a good policy, post a chart, post a bikini.

yes i was just going to say the same someone start a blog!

post a graph and post a pic

no munters or gayers or c0ck

someone start it!

👍

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

Jimmy has - it's here. No forex, just US indices and bikinis.

DashRiprock

Experienced member

- Messages

- 1,650

- Likes

- 482

or

bonds for bums

commodities and jubbly-titties

but no crack spreads!

🙂

bonds for bums

commodities and jubbly-titties

but no crack spreads!

🙂

Pazienza

Senior member

- Messages

- 2,334

- Likes

- 442

or

bonds for bums

commodities and jubbly-titties

but no crack spreads!

🙂

Post some charts you. If this thread just turns into an electronic version of Razzle, I'll get grief off the mods.

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

yes i was just going to say the same someone start a blog!

post a graph and post a pic

no munters or gayers or c0ck

someone start it!

👍

Come on Dash, post a chart of a trade you've taken today (unless you've been playing golf)

DashRiprock

Experienced member

- Messages

- 1,650

- Likes

- 482

Come on Dash, post a chart of a trade you've taken today (unless you've been playing golf)

i cant show fill ledger or for fun spreabdet trade, but I can try and say why thoday for me was a day where i had to work for my ticks.

fron the grey box you can see the 1st hour from trading range, and then a peak above it then retrade that is mostly chop.you can see from yellow line that this is right on high volume area with small opening range so i am thinking "ok could have a big move from here" so i am waiting for a nice orange light from ,my strategy but it was alot of chop until the first blue arrow from the top.

from there you can see a nice downmove with BLUE candles and ema going DOWN means is good for SHORTS... BUT of you look on my graph at the yellow lines you can see that it was turning in middle of nowhere and from all the chop from before i was douting.

it still was going down but towards the high volume area from before so i am still not agreed on a proper downtrend. i have in my mind the green line for at least a change from hh to ll but still after that there is more chop!

anyway my strategy is red for a bit cos of 2 UP candles with DOWN ema but then the BLUE and DOWN goes again and I am OK for shorts from the tape/dom again.

but look again from where it turned my strategy was still ok for shorts here because its not near high volume or other day high/low and turns arounf so i am looking for shrts when it turns on a 50p coin :/

it goes back towards yellow line (look todays yellow line is in same place as yestardays im not putting in afterwards) so i am think for more chop and soon after i am stopping trading.

anyway then are auctions results and everything and tnotes go all the way up to ydats high but iu am not trading then.

anyway i hope thats OK it looks dead easy for your strategy to work when you already have the answers, today for me it was looking like chop all day until i stopped then went to the races. there was nice downtrend when i was trading but i was taking profits too soon because my idea of chop then and got caught both times on a quick pullback.

Attachments

DashRiprock

Experienced member

- Messages

- 1,650

- Likes

- 482

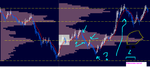

as well i can show the es trade you were talking about from my view

🙂

you can see top yellow line is on ydays high volume area. if its this close i dont put one in for the higs as well, but you can see big volumes in the end of es session as always so thats where the volumes come from even though is was closing on session highs :/

anyway from pink box you can see first 1:30 mins (which i think is IBR for es) and at the end its on the yellow line. and from then it is down a long way from an OPEN-TEST-DRIVE

its better of you look on your own graphs because the heikin ashi make it look like it opened at highs when it didnt.

because of the big balance range it would be hard to only take chorts from break below pink box but my strategy would have been ok for shorts from arnound the 3rd blue candle after testing.

this is a 3200 tick chart i think time charts are generally the worst for day trading :/

🙂

you can see top yellow line is on ydays high volume area. if its this close i dont put one in for the higs as well, but you can see big volumes in the end of es session as always so thats where the volumes come from even though is was closing on session highs :/

anyway from pink box you can see first 1:30 mins (which i think is IBR for es) and at the end its on the yellow line. and from then it is down a long way from an OPEN-TEST-DRIVE

its better of you look on your own graphs because the heikin ashi make it look like it opened at highs when it didnt.

because of the big balance range it would be hard to only take chorts from break below pink box but my strategy would have been ok for shorts from arnound the 3rd blue candle after testing.

this is a 3200 tick chart i think time charts are generally the worst for day trading :/

Attachments

Pazienza

Senior member

- Messages

- 2,334

- Likes

- 442

this is a 3200 tick chart i think time charts are generally the worst for day trading :/

Good to have a different perspective on the same thing. 🙂

I tried ticks, but couldn't get on with them as well and time charts give me better results. I think I used 4000 for ES.

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

I don't normally nail them that well on the exit but I was hot today.

Which one? The chic in the bikini you posted or your trade??

Peter

Last edited:

DashRiprock

Experienced member

- Messages

- 1,650

- Likes

- 482

Good to have a different perspective on the same thing. 🙂

I tried ticks, but couldn't get on with them as well and time charts give me better results. I think I used 4000 for ES.

🙂

well i dont do like candlestick analysis on intra day graphs i think cnadlesticks are good when the open and the close mean something tangible in the market instead of one hour to another or something.

so candlesticks trading is ok for daily (and specialy on exchanges) where the open and close mean something structural. on intra day it can be tick or volume or range they are better cos markets care about price and volume not about what time it is.

jusy in my mind anyway. can i post a picture now?

Similar threads

- Replies

- 1

- Views

- 2K