DAX30DayTrader

Well-known member

- Messages

- 474

- Likes

- 51

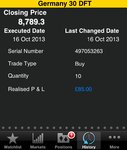

Today's line in the sand is 8745 for retracements (last line of defense), they must hold above here to keep the current intraday trend intact. Below this line a deeper correction should then take place under 8700 to the low to mid 8600's.

So 8745 is the line today that keeps the current trend, or breaks it.

In my opinion.

So 8745 is the line today that keeps the current trend, or breaks it.

In my opinion.