Hi jacinto,

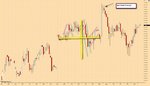

Currently see price as oscillating about a RN 9300 axis, and am waiting for a resolution of a triangle. I have attached a 5 min chart of the overnight as well, which is quite interesting. I am trying to stop thinking in terms in terms of buyers and sellers. For every buyer there is a seller, and vice versa. What matters, is which way is the crowd moving. What is their impulse? And the “smart” money, what do they think the crowds impulse is? What signs are they looking at?

Zagreb,

Good post indeed. It took me a long time to figure out there is no point in prediction. The name f the game is to follow price in its twists and turns. It was a William O'Neill thing "Don't ask where the market is going..ask what it is doing right now"

BTW, I found a good quote this morning,whilst trying to alleviate the tedium.

Dbp quoting Wykcoff

Currently see price as oscillating about a RN 9300 axis, and am waiting for a resolution of a triangle. I have attached a 5 min chart of the overnight as well, which is quite interesting. I am trying to stop thinking in terms in terms of buyers and sellers. For every buyer there is a seller, and vice versa. What matters, is which way is the crowd moving. What is their impulse? And the “smart” money, what do they think the crowds impulse is? What signs are they looking at?

Zagreb,

Good post indeed. It took me a long time to figure out there is no point in prediction. The name f the game is to follow price in its twists and turns. It was a William O'Neill thing "Don't ask where the market is going..ask what it is doing right now"

BTW, I found a good quote this morning,whilst trying to alleviate the tedium.

Dbp quoting Wykcoff

dbphoenix said:In a certain sense, reading charts is like reading music, in which you endeavor to interpret correctly the composer's ideas and the expression of his art. Just so a chart of the averages, or of a single stock, reflects the ideas, hopes, ambitions and purposes of the mass mind operating in the market, or of a manipulator handling a single stock.

The study of charts is not as some people claim, the mere identification of certain labeled patterns made by the actions of stocks. That sort of thing borders on the mechanical and does little to aid in the development of one's judgment. But when a student undertakes to read from his charts the purposes and objective of those who are responsible for a stock's action in the market, he is beginning to see, in a true light, the meaning of scientific stock speculation.

RW

RW